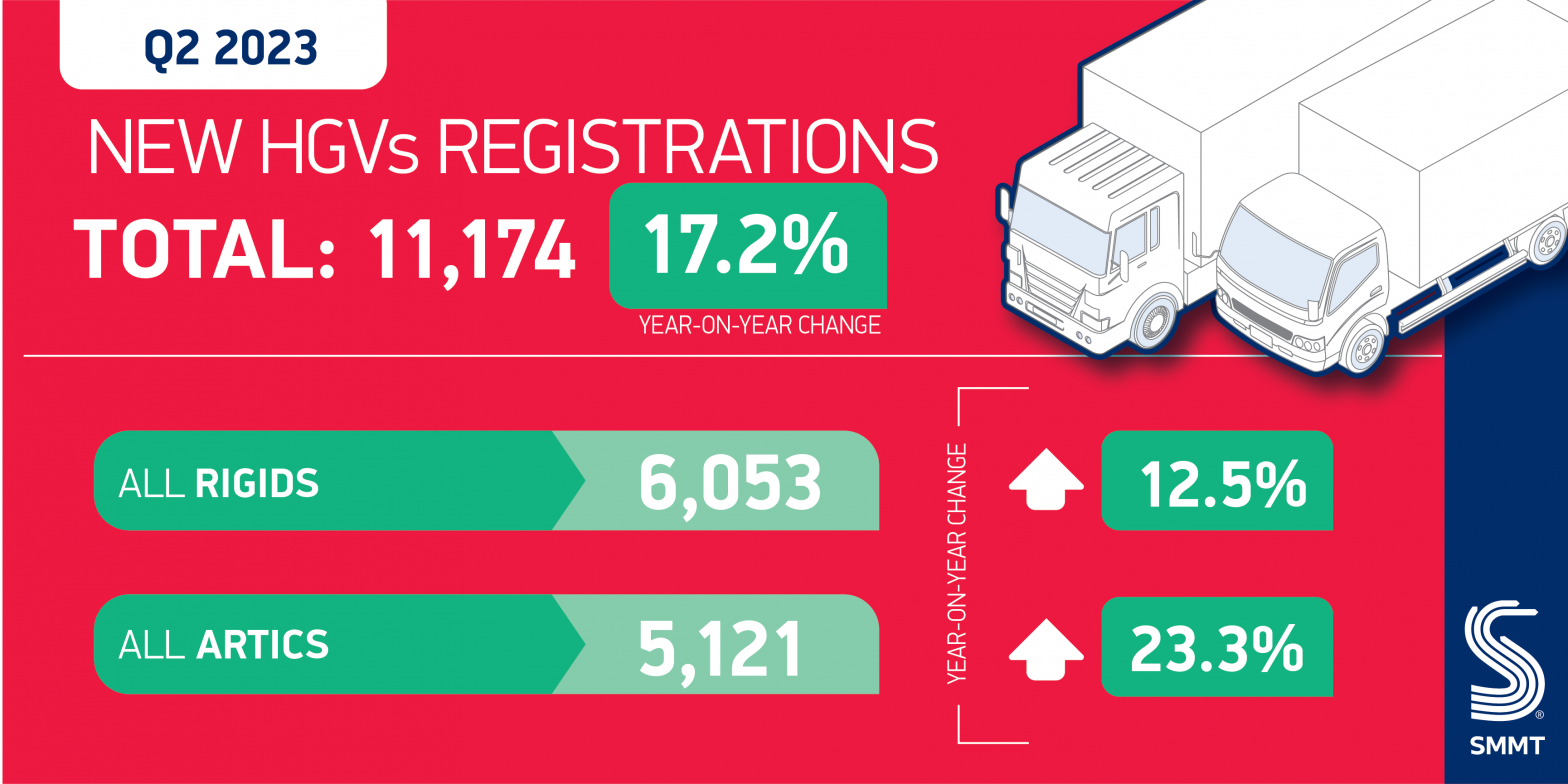

- New HGV market rises by 17.2% in Q2 2023 as fleet renewal returns to pre-pandemic levels.

- Double-digit growth for rigid and articulated trucks, with volumes up 12.5% and 23.3% respectively.

- Sector seeks sustainable strategy to spur depot investment and green fleet transition.

SEE HGV REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

The UK market for new heavy goods vehicles (HGVs) grew by 17.2% to 11,174 units in the second quarter of 2023, the fifth consecutive quarter of growth, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT).1

Growth was driven primarily by registrations of articulated trucks, up 23.3% to 5,121 units, while deliveries of rigid trucks rose by 12.5% to 6,053. That reflects increased demand across the majority of truck segments, with tractors continuing to be the most popular by some distance, up by 23.7% to 5,047 units and a 45.2% market share. Registrations of box vans grew 14.2% to 1,153 units, while deliveries of curtain sided and dropside trucks rose by 23.6% and 7.6%. Tippers were the only segment in the top five to record a decline, with registrations down -12.5%.

Uptake grew in three of the four Home Nations, with registrations in England up 17.3% to account for more than eight in 10 (86.6%) UK deliveries. Demand in Scotland and Northern Ireland also rose, with registrations up 34.9% and 5.0% respectively, while deliveries in Wales fell by -7.5% following a strong period of fleet renewal in Q1 this year. By region, operators in South East England registered the most new trucks (20.6% of the total), followed by those in the North West (13.5%) and Yorkshire & Humberside (11.9%).

Rising demand and easing supply chain restrictions helped HGV registrations grow by 17.1% in the first half of 2023 to 22,691 units – surpassing typical pre-pandemic levels.2 Five successive quarters of market growth demonstrates the confidence of HGV operators in renewing their fleets with the latest fuel efficient trucks. This includes zero emission models, with electric and hydrogen HGVs representing 0.4% of the market, up from 0.3% in Q1 this year.

Zero emission uptake must accelerate more quickly, however, with the sale of new non-zero emission HGVs weighing under 26 tonnes due to be phased out in 2035 – the same date as cars and vans. With just one full cycle of fleet renewal remaining before 2035, urgent action is needed to deliver HGV-dedicated public charging and hydrogen refuelling infrastructure – which is currently absent on UK roads – alongside support for depot infrastructure installation that matches Britain’s zero emission ambitions.

Mike Hawes, SMMT Chief Executive, said,

HGV fleet renewal has flourished, finally beating pre-pandemic levels with five straight quarters of growth. Growing confidence for fleet investment is also translating into new zero emission truck demand, demand which must grow still faster if the UK’s green goals are to be achieved. Accelerating this transition, however, requires dedicated HGV charging and refuelling infrastructure and incentives to encourage uptake and depot upgrades. Doing so can help Britain become the world’s first decarbonised truck sector. There is no time to delay.

Notes to Editors

1 Q2 2018 registrations: 10,670 units. Some 15,605 units were registered in Q2 2019, a particularly strong period of fleet renewal due to the upcoming introduction of smart tachograph regulation.

2 Q1-Q2 2018 registrations: 20,453 units.