Emerson Electric Co. EMR has entered into a definitive agreement to acquire FLEXIM Flexible Industriemesstechnik GmbH. Headquartered in Berlin, Germany, FLEXIM is involved in clamp-on ultrasonic flow measurement for liquids, gases and steam. Financial terms of the acquisition were kept under wraps.

The acquisition will add to Emerson’s existing flow measurement positions in coriolis, differential pressure, magmeter and vortex flow measurement, and expand its automation portfolio and measurement capabilities.

Given that the global ultrasonic clamp-on flowmeter market is expected to grow in the high-single digits annually over the long term, the acquisition will bolster Emerson’s growth.

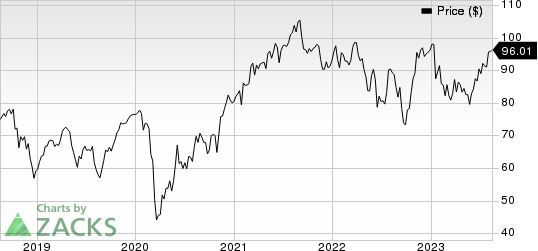

Emerson Electric Co. Price

Emerson Electric Co. price | Emerson Electric Co. Quote

Subject to customary closing conditions, the transaction is expected to close by the end of Emerson’s fiscal 2023, following which, Flexim’s Berlin headquarter is anticipated to become the former’s Ultrasonic Flow Measurement Center of Excellence.

Emerson expects the buyout to be accretive to its sales, gross margins and adjusted EBITA margins. Flexim will be part of EMR’s Measurement & Analytical sub-segment within Intelligent Devices.

Emerson’s inorganic activities to expand operations hold promise. Earlier this year, the company entered into a deal to acquire National Instruments for $8.2 billion. The move is aligned with the company’s focus on global automation to drive growth and profitability. The acquisition, expected to be completed in the first half of fiscal 2024, will strengthen EMR’s global automation foothold, helping the company expand into high-growth end markets, including semiconductor and electronics, transportation and electric vehicles and aerospace and defense.

Zacks Rank & Key Picks

Emerson presently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks within the Industrial Products sector are as follows:

A. O. Smith Corporation AOS presently carries a Zacks Rank #2 (Buy). The company pulled off a trailing four-quarter earnings surprise of 10.5%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks.

A. O. Smith has an estimated earnings growth rate of 13.7% for the current year. The stock has rallied 22.8% in the year-to-date period.

Eaton Corporation plc ETN currently carries a Zacks Rank #2. The company delivered a trailing four-quarter earnings surprise of approximately 3%, on average.

Eaton has an estimated earnings growth rate of 16.3% for the current year. The stock has soared 37.7% in the year-to-date period.

Enersys ENS presently carries a Zacks Rank #2. The company delivered a trailing four-quarter earnings surprise of 10.3%, on average.

Enersys has an estimated earnings growth rate of 45.7% for the current fiscal year (ending March 2024). The stock has gained 34.5% in the year-to-date period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Enersys (ENS) : Free Stock Analysis Report