Wall Street has seen an impressive bull run in 2023 after a highly disappointing 2022. Year to date, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — are up 4.1%, 13.8% and 27%, respectively. However, volatility has shown its ugly face once again in August owing to both internal and external factors.

Consequently, month to date, the S&P 500 Index is down 4.8%. Last week, the S&P 500 fell 2.1%, marking its third-straight weekly loss, for the first time since February. The index’s last three-week loss of 4.6% is its biggest decline since the three weeks ended Mar 10.

Nevertheless, the long-term trend of U.S. stock markets remains bullish. The inflation rate is dwindling steadily since June 2022. Fundamentals of the economy remain strong with a resilient labor market and solid consumer spending. These developments have brightened the chance of the Fed’s so-called “soft landing” and reduces the possibility of a near-term recession.

At this stage, it will be prudent to invest in dividend-paying S&P 500 stocks with a favorable Zacks Rank that have provided positive returns in the past month with more upside left. If the index’s downturn continues, dividend will act as a regular income stream. If the benchmark resumes its northward journey, favorable Zacks Rank will capture the upsides.

Our Top Picks

We have narrowed our search to five such stocks with strong potential for the rest of 2023. These stocks have seen positive earnings estimate revisions in the last 30 days. Each of our pick sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

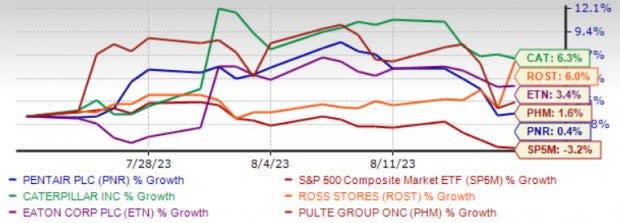

The chart below shows the price performance of our five picks in the past month.

Image Source: Zacks Investment Research

Caterpillar Inc. CAT has seen year-over-year revenue and earnings growth for nine straight quarters thanks to its cost-saving actions, strong end-market demand and pricing actions that offset the impact of supply-chain snarls and cost pressures. We expect CAT’s adjusted earnings per share for 2023 to grow 20% and revenues to rise 8%.

Caterpillar has an expected revenue and earnings growth rate of 12% and 40.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 5.2% over the last seven days. CAT has a current dividend yield of 1.9%.

Ross Stores Inc. ROST has benefited from positive customer response to its improved merchandise and strong value offerings. ROST has been benefiting from the execution of its store expansion plans over the years.

ROST operates a chain of off-price retail apparel and home accessories stores, which target value-conscious men and women, aged 25 to 54 in middle-to-upper middle-class households. ROST has a proven business model as the competitive bargains it offers continue to make its stores attractive destinations for customers in all economic scenarios.

Ross Stores has an expected revenue and earnings growth rate of 4.8% and 18.3%, respectively, for the current year (ending January 2023). The Zacks Consensus Estimate for current-year earnings has improved 4.6% over the last seven days. ROST has a current dividend yield of 1.1%.

PulteGroup Inc. PHM has been riding high since it reported solid second-quarter results. PHM’s solid operating model, which strategically aligns the production of build-to-order and quick-move-in homes with applicable demand across consumer groups, aided the result.

Backed by its disciplined and balanced business model, PHM witnessed solid gross closings, orders and margins in the reported quarter and posted a 12-month return on equity of 32%. PHM expects to close 7,000-7,400 homes in the third quarter and 29,500 homes this year. PHM expects its community count to grow by 5-10% in the third and fourth quarters.

PulteGroup has an expected revenue and earnings growth rate of 0.4% and 7.6%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 25.5% over the last 30 days. PHM has a current dividend yield of 0.8%.

Eaton Corp. plc ETN will benefit from improving end market conditions and contribution from its organic assets which will assist it in retaining a strong market position. ETN is expanding via strategic acquisitions and its rising backlog shows strong demand for its products.

The ongoing research and development are allowing ETN to develop products for efficient power management solutions. ETN’s strategy to manufacture in the zone of sale has helped it to cut costs.

Eaton has an expected revenue and earnings growth rate of 11.3% and 16.3%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.5% over the last seven days. ETN has a current dividend yield of 1.6%.

Pentair plc PNR anticipates volumes in the pool business to remain weak this year due to the ongoing inventory correction. However, the ongoing momentum in the Industrial and Flow Technologies and Water Solutions segments will offset the impact.

Pricing actions, gains from the Manitowoc Ice acquisition and savings from the Transformation program are expected to offset the impacts of inflated costs and supply-chain issues on PNR’s margins. Focus on digital initiatives, innovation and acquisitions will aid growth. PNR’s Transformation Program is expected to drive margin expansion of at least 400 basis points by 2025.

Pentair has an expected revenue and earnings growth rate of 0.3% and 1.6%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last seven days. PNR has a current dividend yield of 1.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Pentair plc (PNR) : Free Stock Analysis Report