Waste Connections Inc.’s WCN operational efficiency and acquisitions serve as pivotal growth drivers. Low liquidity and foreign currency risk are concerning.

WCN has an impressive Growth Score of B. This style score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth.

Waste Connections reported solid second-quarter 2023 results, wherein both earnings and revenues surpassed the respective Zacks Consensus Estimate. Adjusted earnings (excluding 21 cents from non-recurring items) of $1.02 per share beat the consensus estimate by 1% and increased 2% year over year. Revenues of $2.02 billion topped the consensus estimate by 0.6% and rose 11.3% year over year. Acquisitions contributed $141.36 million to revenues in the reported quarter.

Factors That Augur Well

Waste Connections prioritizes secondary and rural markets for a strong local presence, reducing customer turnover and improving financial performance. The company focuses on niche markets, like E&P waste treatment, where early entry in rural regions is vital due to limited alternatives. It aims to expand market share, provide more services and leverage franchise platforms to reach customers beyond exclusive territories.

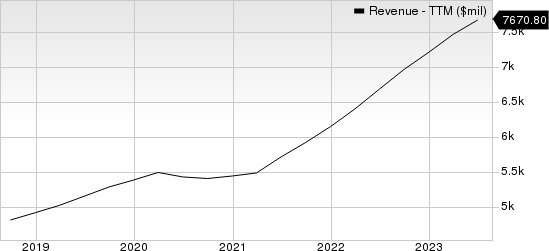

Waste Connections, Inc. Revenue (TTM)

Waste Connections, Inc. revenue-ttm | Waste Connections, Inc. Quote

Waste Connections offers end-to-end waste services, owning or operating landfills. Decentralized operations empower quick and cost-effective customer response. This efficiency enables expansion into neighboring markets and underserved communities.

Waste Connections actively pursues acquisitions, using a strategic approach based on financial, market, and management criteria. Initial acquisitions are leveraged as a foundation, which enhance the company’s presence by offering more services, gaining customers, and making additional “tuck-in” acquisitions in new or adjacent markets. In 2021, 2020, and 2019, the company completed 30, 21, and 21 acquisitions, respectively, contributing $215.39 million, $197.23 million, and $291.93 million to revenues. Notable acquisitions include American Disposal Services, Groot Industries, and Progressive Waste.

Waste Connections consistently rewards shareholders, paying dividends of $243 million, $220.2 million, and $199.9 million in 2022, 2021, and 2020, respectively, while also repurchasing shares valued at $425 million, $339 million, and $105.7 million. These actions underscore the commitment to shareholder value and confidence in the business.

Factors Against

Waste Connections’ current ratio at the end of second-quarter 2023 was pegged at 0.76, lower than the current ratio of 0.94 reported at the end of the prior-year quarter. It indicates that the company may have problems meeting its short-term debt obligations.

While providing environmental and waste management services, Waste Connections faces various operational risks, including accidents, equipment issues, and fueling station or landfill-related hazards. Additionally, its Canadian operations are susceptible to risks linked to currency exchange rate fluctuations and monetary devaluation uncertainty.

Zacks Rank and Stocks to Consider

WCN currently carries a Zacks Rank #3 (Hold).

Investors interested in Zacks Business Services sector can consider the following better-ranked stocks:

Aptiv APTV currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings for 2023 are expected to grow 39% while revenues are anticipated to gain 14.8% from the year-ago figure. APTV has an impressive earnings surprise of 13.35% in the past four quarters, having beaten the Zacks Consensus Estimate in all four trailing quarters. APTV carries a VGM Score of A.

Clean Harbors CLH carries a Zacks Rank of 2 at present. Earnings for 2023 are expected to be in-line with the year-ago quarter while revenues are anticipated go up 5.3% year over year. CLH has an impressive earnings surprise of 13% in the past four quarters, having beaten the Zacks Consensus Estimate in all four trailing quarters. CLH carries a VGM Score of B.

Verisk Analytics VRSK currently has a Zacks Rank of 2. Earnings for 2023 are expected to grow 14% while revenues are anticipated to fall 8.3% from the year-ago figure. VRSK has an impressive earnings surprise of 9.85% in the past four quarters, having beaten the Zacks Consensus Estimate in three of the four trailing quarters and matching on one instance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Clean Harbors, Inc. (CLH) : Free Stock Analysis Report

Waste Connections, Inc. (WCN) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report