Waste Management Inc., WM which belongs to the waste management industry, is surging due to environmental concerns, industrial growth, and rising non-hazardous waste from economic expansion. Companies adopt advanced waste solutions while government initiatives drive demand.

The global waste management market is expected to surge from $1,612.0 billion in 2020 to $2,483.0 billion by 2030, with a projected 3.4% annual growth rate from 2021 to 2030. This paints a bright future for the industry.

Factors in Favor

Waste Management holds a strong position in the market with substantial market capitalization and a consistent approach to dividends and share buybacks. In 2022, 2021, and 2020, the company repurchased shares totaling $1.5 billion, $1.35 billion, and $402 million, respectively.

Additionally, it distributed dividends of $1.1 billion, $970 million, and $927 million during 2022, 2021, and 2020, respectively. Waste Management intends to continue this practice of returning significant cash to its shareholders through both dividends and share repurchases in the future.

Waste Management remains committed to implementing core operational strategies centered on focused differentiation and ongoing improvement. These efforts aim to maintain price and cost discipline, ultimately leading to improved profit margins. Leveraging extensive assets for differentiation ensures sustainable growth and a competitive edge, while controlling costs and refining processes enhances service quality.

Factors Against

Waste Management’s current ratio at the end of second-quarter 2023 was pegged at 0.82, lower than the prior-year quarter’s current ratio of 1.07 and 0.87 reported at the end of the previous quarter. It indicates the company may have problems meeting its short-term debt obligations.

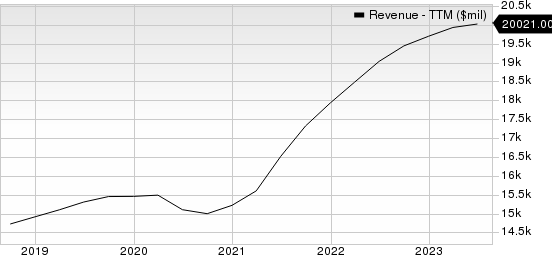

Waste Management, Inc. Revenue (TTM)

Waste Management, Inc. revenue-ttm | Waste Management, Inc. Quote

Waste Management faces intense competition from national, regional, and local companies. Countries and municipalities pose a threat due to in-house waste services, limiting price increases and impacting revenues.

Zacks Rank and Stocks to Consider

WM currently carries a Zacks Rank #3 (Hold).

Investors interested in Zacks Business Services sector can consider the following stocks:

Aptiv APTV holds a Zacks Rank #2(Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings for 2023 are expected to grow 39% while revenues are anticipated to gain 14.8% from the year-ago figure. APTV has an impressive earnings surprise of 13.35% in the past four quarters, having beaten the Zacks Consensus Estimate in all four trailing quarters. APTV carries a VGM Score of A.

Clean Harbors CLH holds a Zacks Rank of 2. Earnings for 2023 are expected to be in-line with the year-ago quarter while revenues are anticipated go up 5.3% year over year. CLH has an impressive earnings surprise of 13% in the past four quarters, having beaten the Zacks Consensus Estimate in all four trailing quarters. CLH carries a VGM Score of B.

Verisk Analytics VRSK holds a Zacks Rank of 2. Earnings for 2023 are expected to grow 14% while revenues are anticipated to fall 8.3% from the year-ago figure. VRSK has an impressive earnings surprise of 9.85% in the past four quarters, having beaten the Zacks Consensus Estimate in three of the four trailing quarters and matching on one instance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Waste Management, Inc. (WM) : Free Stock Analysis Report

Clean Harbors, Inc. (CLH) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report