Paychex, Inc. PAYX boasts a robust position in the outsourcing market, driven by strong revenue growth. The company is actively pursuing opportunities in the professional employer organization sector. Its steadfast dividend payouts and share buybacks enhance investor confidence and positively influence earnings per share.

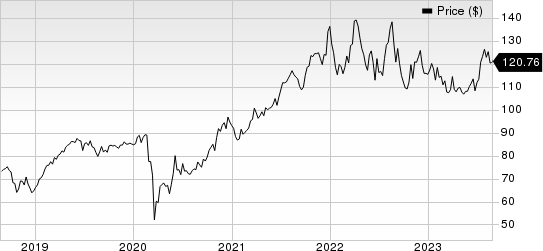

PAYX has gained 4.5% year to date compared with the outsourcing market industry’s 7% rise.

Paychex, Inc. Price

Paychex, Inc. price | Paychex, Inc. Quote

Factors in Favor

As of May 31,2023, Paychex served more than 730,000 payroll clients. The company has been reporting its revenues broadly under two categories, which are service revenues and interest on funds held for clients. Service revenues contributed 98% to total revenues in fiscal 2023. 76% of the service revenues were from Management Solutions while 24% were from professional employer organization (PEO) and insurance services. Interest on funds held for clients accounted for the remaining 2% of fiscal 2023 revenues.

Revenue growth is crucial for a company since it drives growth plans and justifies expenses. Paychex has achieved revenue growth through its services, tech, and acquisitions, with an 8.2% five-year CAGR from 2018 to 2023, enhancing margins, and ensuring long-term profitability. Management Solutions revenues are expected to indicate year-over-year growth of 5.5% in 2024 while revenues from PEO and Insurance Solutions are expected to grow 6.2% from the year-ago reported quarter. We expect total revenues to be $5.32 billion, up 6.3% from the year-ago figure.

Paychex consistently focuses on benefiting its shareholders by distributing dividends and conducting share buybacks. In fiscal years 2023, 2022 and 2021, the company allocated $1.17 billion, $999.6 million, and $908.7 million for dividends and invested $145.2 million, $155.7 million, and $171.9 million in share repurchases, respectively. The company did not repurchase any shares in fiscal 2023. These actions bolster investor trust and have a favorable influence on earnings per share.

Paychex’s current ratio was 1.30 at the end of fourth-quarter fiscal 2022, higher than the 1.25 at the end of the prior-year quarter. A current ratio of more than 1 implies that the company has enough liquid assets to cover its short-term liabilities.

Factors Against

Paychex’s expenses are climbing due to investments in various areas and PEO insurance costs. Strategic acquisitions also contribute to the expenses. In 2023, expenses reached $2.97 billion, up 7% year over year, following similar trends in previous years. This may continue to strain the company’s bottom line.

The outsourcing sector relies heavily on foreign talent and is labor intensive. Increasing competition for talent and strict immigration policies may hinder industry growth, impacting companies like Paychex.

Zacks Rank and Stocks to Consider

PAYX currently carries a Zacks Rank #3 (Hold).

Investors interested in Zacks Business Services sector can consider the following stocks:

Aptiv APTV holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings for 2023 are expected to grow 39% while revenues are anticipated to gain 14.8% from the year-ago figure. APTV has an impressive earnings surprise of 13.35% in the past four quarters, having beaten the Zacks Consensus Estimate in all four trailing quarters. APTV carries a VGM Score of A.

Clean Harbors CLH holds a Zacks Rank of 2. Earnings for 2023 are expected to be in-line with the year-ago quarter while revenues are anticipated go up 5.3% year over year. CLH has an impressive earnings surprise of 13% in the past four quarters, having beaten the Zacks Consensus Estimate in all four trailing quarters. CLH carries a VGM Score of B.

Verisk Analytics VRSK holds a Zacks Rank of 2. Earnings for 2023 are expected to grow 14% while revenues are anticipated to fall 8.3% from the year-ago figure. VRSK has an impressive earnings surprise of 9.85% in the past four quarters, having beaten the Zacks Consensus Estimate in three of the four trailing quarters and matching on one instance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Paychex, Inc. (PAYX) : Free Stock Analysis Report

Clean Harbors, Inc. (CLH) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report