NIO Inc. NIO incurred a loss per American Depositary Share (ADS) of 51 cents in the second quarter of 2023, wider than the Zacks Consensus Estimate of a loss of 36 cents. The reported loss is also wider than the year-ago loss of 25 cents due to lower vehicle margins and higher operating expenses.

This China-based electric vehicle maker posted revenues of $1.2 billion, lagging the Zacks Consensus estimate of $1.35 billion and declining 14.8% year over year due to lower delivery volume.

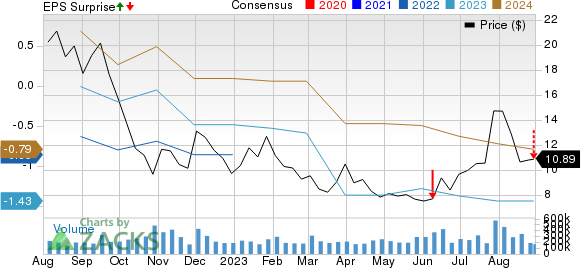

NIO Inc. Price, Consensus and EPS Surprise

NIO Inc. price-consensus-eps-surprise-chart | NIO Inc. Quote

Key Details

NIO delivered 23,520 vehicles in the second quarter, down 6.1% year over year, including 10,492 SUVs and 13,028 sedans.

Revenues generated from vehicle sales amounted to $990.9 million, plunging 24.9% year over year. The decrease mainly stemmed from a lower average selling price and a dip in delivery volume. Other sales of $218.8 million rose 119.9%. Strong sales of used cars, accessories and provision of power solution contributed to the increase.

Gross profit came in at $12 million, tumbling 93.5% year over year. Vehicle margin in the reported quarter fell to 6.2% from 16.7% in second-quarter 2022. Gross margin was 1%, down from 13% in the year-ago quarter.

Research & development, and selling, general & administrative costs were $461.2 million and $393.9 million, reflecting year-over-year growth of 55.6% and 25.2%, respectively.

As of Jun 30, 2023, cash and cash equivalents totaled $1,892.6 million, and long-term debt was $902.5 million.

For third-quarter 2023, NIO projects deliveries in the range of 55,000-57,000 vehicles, suggesting 74-80.3% surge year over year. Revenues are envisioned to be between $2,606 million and $2,692 million, indicating year-over-year improvement of 45.3-50.1%.

Zacks Rank & Key Picks

NIO currently carries a Zacks Rank #3 (Hold).

Some better-ranked players in the auto space include Oshkosh Corporation OSK, Allison Transmission Holdings, Inc. ALSN and Gentex Corporation GNTX, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for OSK’s 2023 sales and earnings implies year-over-year growth of 15% and 126.9%, respectively. The EPS estimate for 2023 and 2024 has moved north by $1.75 and $1.56, respectively, in the past 30 days.

The Zacks Consensus Estimate for ALSN’s 2023 sales and earnings suggests year-over-year increases of 9.4% and 25.3%, respectively. The EPS estimate for 2023 and 2024 has moved up by 14 cents and 15 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for GNTX’s 2023 sales and earnings indicates year-over-year rises of 17.3% and 29.4%, respectively. The EPS estimate for 2023 and 2024 has moved up by 7 cents and 9 cents, respectively, in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

Gentex Corporation (GNTX) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report