SHANGHAI/TAIPEI, Sept 8 (Reuters) – China’s widening curbs on iPhone use by government staff intensified a sell-off in global tech stocks on Friday, fanning fears that Apple (AAPL.O) and its suppliers could take a hit from rising Sino-U.S. tensions and growing competition from Huawei.

Apple shares tumbled 6.4% over the last two days, wiping $190 billion from its market capitalisation, following news that Beijing ordered some central government employees in recent weeks to stop using iPhones at work.

Adding pressure for Apple in one of its biggest markets, Huawei launched two new smartphones – a foldable, the Mate X5, and the Mate 60 Pro+, a new addition to the line that drew global attention for showcasing resilience to U.S. sanctions.

In Taipei, Apple supplier Largan Precision (3008.TW), which makes camera lenses, dropped more than 4%, while contract chipmaker TSMC (2330.TW) fell 0.6% on Friday.

China’s Luxshare Precision Industry (002475.SZ), maker of connector cables for the iPhone and MacBook, as well as AirPods, and owner of factories capable of making iPhones, fell 2%. Its shares were also hit last week by the Huawei launch.

Some analysts feel the Huawei moves could be a first step in comeback efforts by China’s “national champion” to rival Apple.

“We believe Huawei’s activity this time was well-prepared and not sudden,” said Ivan Lam, an analyst at Counterpoint, whose outlook for the new products exceeds previous estimation.

“It can manage the psychological expectations of the target consumer group before Apple’s press conference.”

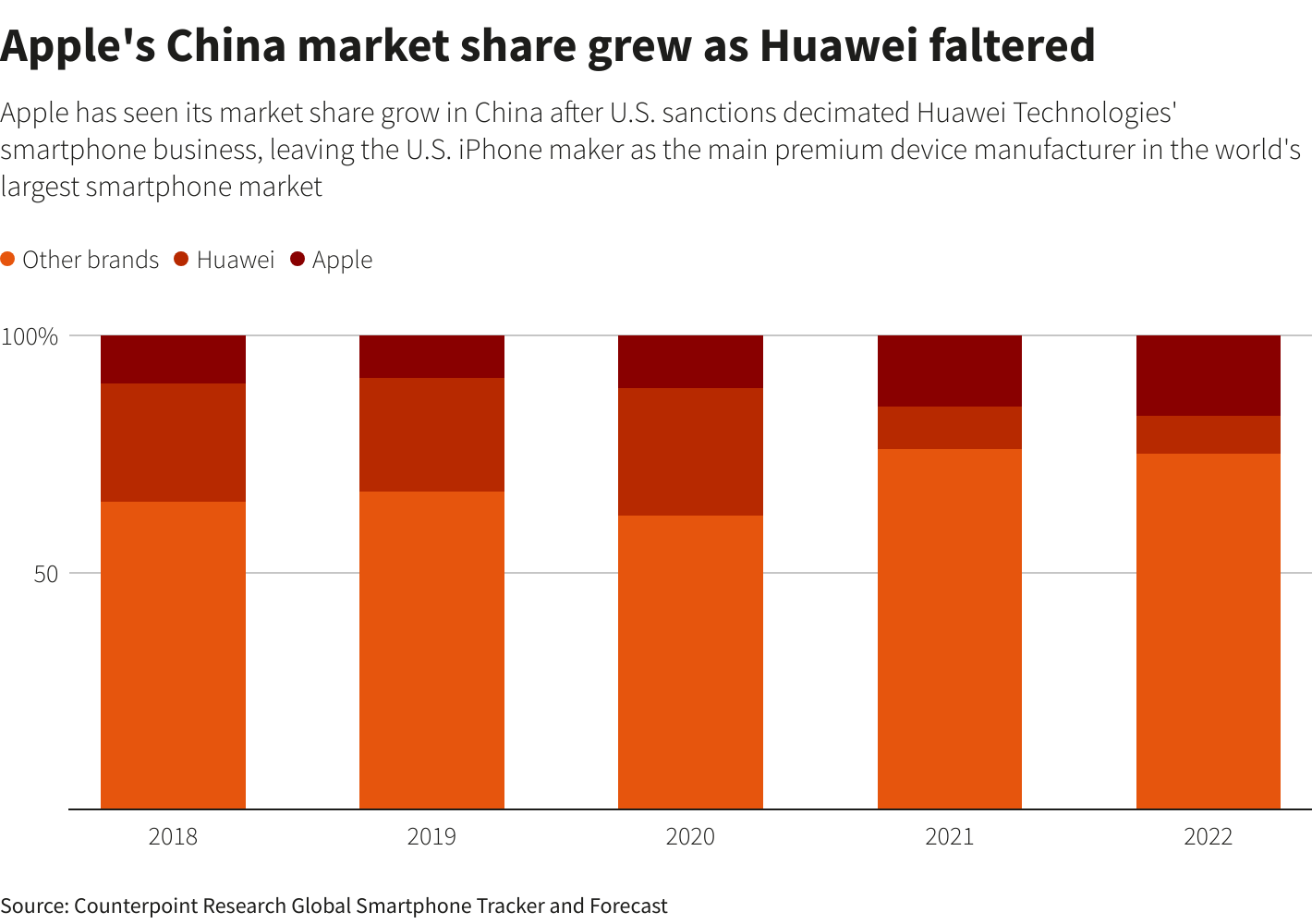

China has been a bright spot for Apple in an otherwise tough period for iPhone sales, as Huawei’s smartphone business was decimated after the U.S. curbed tech exports to it in 2019.

By contrast with the hit for Apple suppliers, Huawei’s extended recent gains.

Shares in Semiconductor Manufacturing International Corp (SMIC) , which is believed to have made the advanced chip in Huawei’s new smartphone, rose 1%, and China’s semiconductor sector (.CSIH30184) also gained 1%.

SCOPE OF CURBS UNCLEAR

It was not immediately clear how wide China’s iPhone curbs are, but one employee at an affected state-owned enterprise (SOEs) in the capital said they extended to visitors.

“Anyone, including business visitors, who enters our work area cannot bring in their iPhones,” said the source, one of two SOE employees who said they were told of the ban in recent weeks.

The source, who spoke on condition of anonymity, said the company was giving employees a subsidy of 100 yuan to 200 yuan ($13 to $26) to switch to local brands. Some staff at other SOEs, however, told Reuters they had not been banned from using iPhones.

While the number of central government employees is not public, Bank of America estimated such a ban could cut iPhone sales by 5 million to 10 million units a year from China’s annual total of up to 50 million.

By contrast, Huawei’s smartphone sales, driven by the new Mate 60 Pro, could jump 65% this year to 38 million, in the absence of some “non-commercial risks”, said Ming-Chi Kuo, an analyst at TF International Securities.

However, Canalys analyst Nicole Peng said Huawei could present a greater threat to domestic peers, such as Honor, which had benefited from Huawei’s woes.

Several Wall Street analysts said the curbs showed that even a company with good ties to the government and a large presence in the world’s second-biggest economy was not immune to rising tension between the two nations.

That friction has worsened in recent years as Washington tries to limit China’s access to key advances, including cutting-edge chip technology, and Beijing looks to cut reliance on American tech.

The U.S. Commerce Department is seeking more information on the “character and composition” of the new Huawei chip that may violate trade curbs, it said on Thursday.

“The restrictions … since 2019 have knocked Huawei down and forced it to reinvent itself – at a substantial cost to the (Chinese) government,” it added.

“We are continually working to assess and, when appropriate, update our controls based on the dynamic threat environment and we will not hesitate to take appropriate action to protect U.S. national security.”

A teardown by research firm TechInsights showed more China-made chip components in the Mate 60 Pro than previous models, a sign of Beijing’s progress.

($1=7.3482 Chinese yuan renminbi)

Additional reporting by Shanghai Newsroom, Jeanny Kao in Taipei, David Kirton in Shenzhen, Jason Xue in Shanghai, Yelin Mo and Ellen Zhang in Beijing and Sam Nussey in Tokyo; Writing by Miyoung Kim; Editing by Clarence Fernandez

Our Standards: The Thomson Reuters Trust Principles.