While the road to electric vehicle supremacy has had its fair share of bumps, one company is emerging from the challenges stronger than ever. NIO Inc (NYSE:NIO), the electric vehicle trailblazer, weathered the storm of supply chain constraints and COVID-19 disruptions, but now, it’s charging ahead with record-breaking deliveries.

With China reopening its economy, NIO Inc (NYSE:NIO) is revving up production and aiming for the electric highway at full throttle. Join us as we explore NIO Inc (NYSE:NIO)’s remarkable journey towards a greener, electrifying future.

Financial Challenges: NIO Inc (NYSE:NIO) Experiences Revenue Drop and Declining Vehicle Sales

In Q2 2023, NIO Inc (NYSE:NIO) experienced significant shifts in its financial performance. Total revenues amounted to RMB8.8 billion ($1,209.7 million), marking a 14.8% YoY decrease and a 17.8% decline QoQ. This drop was attributed to two main components: vehicle and other sales.

Vehicle sales in Q2 2023 reached RMB7.2 billion ($990.9 million), reflecting a substantial 24.9% YoY decrease and a 22.1% decrease compared to Q1. This decline was primarily due to a lower average selling price, influenced by a higher proportion of ET5 and 75-kilowatt-hour standard-range battery pack deliveries and a decrease in delivery volume. A reduction in delivery volume primarily drove QoQ, the dip in vehicle sales.

Delivery Numbers and Other Sales

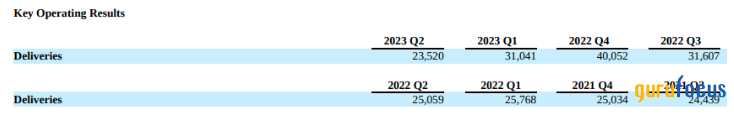

Notably, NIO Inc (NYSE:NIO) reported negative growth in delivery numbers in Q2 2023, delivering 23,520 EVs (10,492 premium smart electric SUVs and 13,028 premium smart electric sedans), a YoY decrease of 6.1% and a QoQ decrease of 24.2%.

Source: Form 6-K for NIO Inc (NYSE:NIO)

Other sales during the same period amounted to RMB1.6 billion, showcasing a remarkable 119.9% increase YoY and a 9.3% rise QoQ. This upswing in other sales was attributed to the surge in sales of used cars, accessories, and power solutions facilitated by the continued user base expansion. However, this positive trend was partially offset by a decrease in revenue generated from auto financing services.

Margin and Operational Loss

Further, the gross margin in Q2 2023 was 1.0%, contrasting with 13.0% in Q2 2022 and 1.5% in Q1 2023. Vehicle margins stood at 6.2%, significantly decreasing compared to 16.7% in Q2 2022 and 1.1% in Q1 2023. The YoY decline in vehicle margin could be attributed to shifts in the product mix, somewhat offset by lowered battery costs per unit. Conversely, the QoQ improvement in vehicle margin was driven by decreased promotion discounts for the previous generation of vehicle models.

At the bottom line, the loss from operations in Q2 amounted to RMB6.1 billion ($837.7 million), representing a substantial 113.5% YoY increase and an 18.8% QoQ increase. It is primarily based on a 55.6% YoY increase in research and development expenses and a 25% YoY increase in selling, general, and administrative expenses.

July 2023: A Turning Point for NIO Inc (NYSE:NIO)

Despite weak deliveries during Q2, July 2023 stood out as a significant month for NIO Inc (NYSE:NIO), with 20,462 units delivered, marking a YoY growth of 104%. The company became the best-selling brand in the premium EV segment in China, boasting a 59% market share for vehicles priced above RMB 300,000. This impressive performance can be attributed to NIO Inc (NYSE:NIO)’s strategic expansion and focus on delivering a high-quality user experience.

Product Development and User Experience

NIO Inc (NYSE:NIO)’s product development strategy is paying off with the launch and successful delivery of multiple new models, including the ET5 Touring, ES8, and the upcoming EC6. The company’s NT2 platform, featuring eight distinct models, covers 80% of the premium market’s requirements. NIO Inc (NYSE:NIO)’s focus on safety has also been recognized, with two of its models earning 5-star safety ratings from Euro NCAP.

Infrastructure and Strategic Investments

NIO Inc (NYSE:NIO)’s emphasis on assisted and intelligent driving features, exemplified by its Navigate on Pilot Plus system, has garnered significant user engagement, with over 100,000 users utilizing the feature. NIO Inc (NYSE:NIO)’s extensive charging and swapping network, comprising over 1,700 power swap stations and a substantial number of public chargers, solidifies its reputation as a leader in charging infrastructure.

The financial landscape for NIO Inc (NYSE:NIO) remains promising, as indicated by a strategic equity investment of $1.1 billion from CYVN Holdings, backed by the Abu Dhabi government. The company’s forward-looking approach involves strengthening its sales capabilities and increasing its personnel to accommodate the projected surge in demand, with a target of achieving 30,000 monthly unit orders.

Stock Price Considerations and Long-Term Positioning

NIO Inc (NYSE:NIO)’s stock price is currently at a pivot level, testing the change of polarity, where the downtrend is now near the oversold level (below 30) in the RSI. The stock can be gradually accumulated at the current price level to build a long position over the coming quarters. However, the stock can dive further to establish or retest a support level near the June 2023 lows.

Source: tradingview.com

Takeaway

In summary, NIO Inc (NYSE:NIO)’s journey in the electric vehicle market has seen its fair share of challenges, but it’s emerging stronger than ever. Despite a dip in financial performance in Q2 2023, the company is making significant strides with impressive deliveries and market leadership. July 2023 marked a turning point, showcasing NIO Inc (NYSE:NIO)’s potential to dominate the premium EV segment in China.

Finally, strategic investments and a focus on innovation and safety are positioning NIO Inc (NYSE:NIO) for long-term success. While its stock price faces uncertainty, NIO Inc (NYSE:NIO)’s story is one of resilience and determination in pursuing a greener, electrifying future.

This article first appeared on GuruFocus.