Eaton Corporation plc ETN will benefit from the improving end market conditions and contribution from its organic assets will assist the company to retain a strong market position. ETN is expanding via acquisitions and its rising backlog shows demand for its products. Given its growth opportunities, the company makes for a solid investment option in the industrial products sector.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) company a strong investment pick at the moment.

Growth Projections & Surprise History

The Zacks Consensus Estimate for Eaton’s 2023 earnings per share (EPS) has increased 4.3% to $8.81 in the past 60 days.

ETN’s long-term (three- to five-year) earnings growth rate is 11.61%. It delivered an average earnings surprise of 3% in the last four quarters.

Return on Equity

Return on equity (ROE) indicates how efficiently a company has been utilizing its funds to generate higher returns. Currently, Eaton’s ROE is 19.06%, higher than the industry’s average of 12.07%. This indicates that the company has been utilizing its funds more constructively than its peers in the manufacturing electronics industry.

Debt Position

Currently, ETN’s total debt to capital is 33.85%, much better than the sector’s average of 49.63%.

The current ratio at the end of second-quarter 2023 was 1.53. The ratio, being greater than one, reflects the company’s ability to meet future debt obligations without difficulties.

Dividend History

Courtesy of its stable cash flow, Eaton has been increasing shareholders’ value through dividend payments and share repurchases. Currently, its quarterly dividend is 86 cents per share. This resulted in an annualized dividend of $3.44 per share, indicating a 6.2% improvement from the previous year’s level of $3.24. The company’s current dividend yield is 1.51%, better than the Zacks S&P 500 Composite’s average of 1.42%.

Systematic Investments

Eaton has laid out a 10-year plan that includes $3 billion investment in research and development (R&D) programs. In the first half of 2023, Eaton invested $366 million in R&D activities, up 9.9% year over year.

The company has invested more than $8 billion in transformative portfolio management and will be able to focus on the remaining businesses that will allow it to further improve earnings in the long run. Eaton’s capital expenditures totaled $598 million in 2022 compared with $575 million in 2021. It intends to invest nearly $700 million in 2023 to further strengthen its operations.

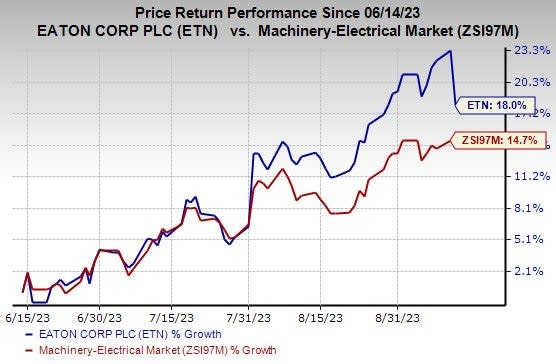

Price Performance

In the past three months, ETN’s shares have rallied 18% compared with the industry’s average growth of 14.7%.

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks from the same sector are EnerSys ENS, Zurn Elkay Water Solutions Co. ZWS and Belden Inc. BDC, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ENS’ long-term earnings growth rate is 14%. It delivered an average earnings surprise of 10.3% in the last four quarters.

ZWS’ long-term earnings growth rate is 15.01%. It delivered an average earnings surprise of 9.4% in the last four quarters.

The Zacks Consensus Estimate for BDC’s 2023 EPS indicates year-over-year growth of 13.4%. The company delivered an average earnings surprise of 8.9% in the last four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

Belden Inc (BDC) : Free Stock Analysis Report

Enersys (ENS) : Free Stock Analysis Report

Zurn Elkay Water Solutions Cor (ZWS) : Free Stock Analysis Report