SHANGHAI/BEIJING Sept 14 (Reuters) – Beijing on Thursday blasted the launch of a probe by the European Commission into China’s electric vehicle (EV) subsidies as protectionist and warned it would damage economic and trade relations, as shares in Chinese EV makers slipped.

European Commission President Ursula von der Leyen announced the investigation on Wednesday, accusing China of flooding global markets with electric cars that had artificially low prices because of huge state subsidies.

The probe, which could result in punitive tariffs, has prompted analyst warnings of retaliatory action from Beijing as well as pushback from Chinese industry executives who say the sector’s competitive advantage was not due to subsidies.

The investigation “is a naked protectionist act that will seriously disrupt and distort the global automotive industry and supply chain, including the EU, and will have a negative impact on China-EU economic and trade relations,” China’s Ministry of Commerce said in a statement.

“China will pay close attention to the EU’s protectionist tendencies and follow-up actions, and firmly safeguard the legitimate rights and interests of Chinese companies,” it added.

Eurasian Group analysts warned that should Brussels ultimately levy duties against subsidized Chinese EVs, Beijing would likely impose countermeasures to hurt European industries.

Other analysts said the probe could slow capacity expansion by China’s battery suppliers, although the move should not pose a big risk for Chinese EV makers because they could turn to other growing markets like Southeast Asia.

Still, it could hurt perceptions of Chinese EV makers as they expand abroad, Bernstein analysts said in a client note.

The manufacturers have been accelerating export efforts as slowing consumer demand in China exacerbates production overcapacity.

Hong Kong-listed shares of Chinese EV makers pared initial losses, with market leader BYD closing down 1.2%. Smaller rivals Geely Auto (0175.HK) and Nio (9866.HK) fell 0.5% and 0.9%, respectively. Xpeng (9868.HK) reversed losses to rise 0.4%.

Shanghai-listed shares of state-owned car giant SAIC (600104.SS), whose MG brand is the best-selling China-made brand in Europe, fell as much as 3.4% before closing down 0.3%.

Nio and Geely declined to comment on the EU probe, while BYD, Xpeng and SAIC did not respond to requests for comment.

The Shenzhen-listed shares of battery maker CATL (300750.SZ) fell 0.8%. CATL did not respond immediately to a request for comment.

Shares in European carmakers were also among the biggest fallers on the euro zone stock index (.STOXXE50) in early trading. BMW (BMWG.DE), Volkswagen (VOWG_p.DE), Mercedes (MBGn.DE) and Stellantis (STLAM.MI) were down between 1.1% and 2.2% at 0720 GMT.

STRAINED RELATIONS

The anti-subsidy probe, initiated unusually by the European Commission and not from any industry complaint, comes amid broader diplomatic strains between the EU and China.

Relations have become tense due to Beijing’s ties with Moscow after Russian forces swept into Ukraine, and the EU’s push to rely less on the world’s second-largest economy, which is also its No.1 trading partner.

The EV probe will set the agenda and tone for bilateral talks ahead of the annual China-EU Summit, set to take place before year-end, with a focus returning to EU demands for wider access to the Chinese market and a rebalance of a trade relationship that Brussels describes as “imbalanced”.

Cui Dongshu, the secretary general of the China Passenger Car Association, said on his personal WeChat account on Thursday that he was personally “strongly against” the review and urged the EU to take an objective view of the industry’s development and not “arbitrarily use” economic or trade tools.

The price of China-made cars exported to Europe is generally almost double the price they sell for in China, he added.

Underscoring challenges facing established European automakers as they battle growing competition from China, Volkswagen (VOWG_p.DE) is looking at cutting staff at its all-electric plant in eastern Germany due to lower than expected demand for EVs, the dpa news agency reported on Wednesday.

GROWING MARKET SHARE

EU officials believe Chinese EVs are undercutting the prices of local models by about 20% in the European market, piling pressure on European automakers to produce lower-cost EVs.

The European Commission said China’s share of EVs sold in Europe had risen to 8% and could reach 15% in 2025.

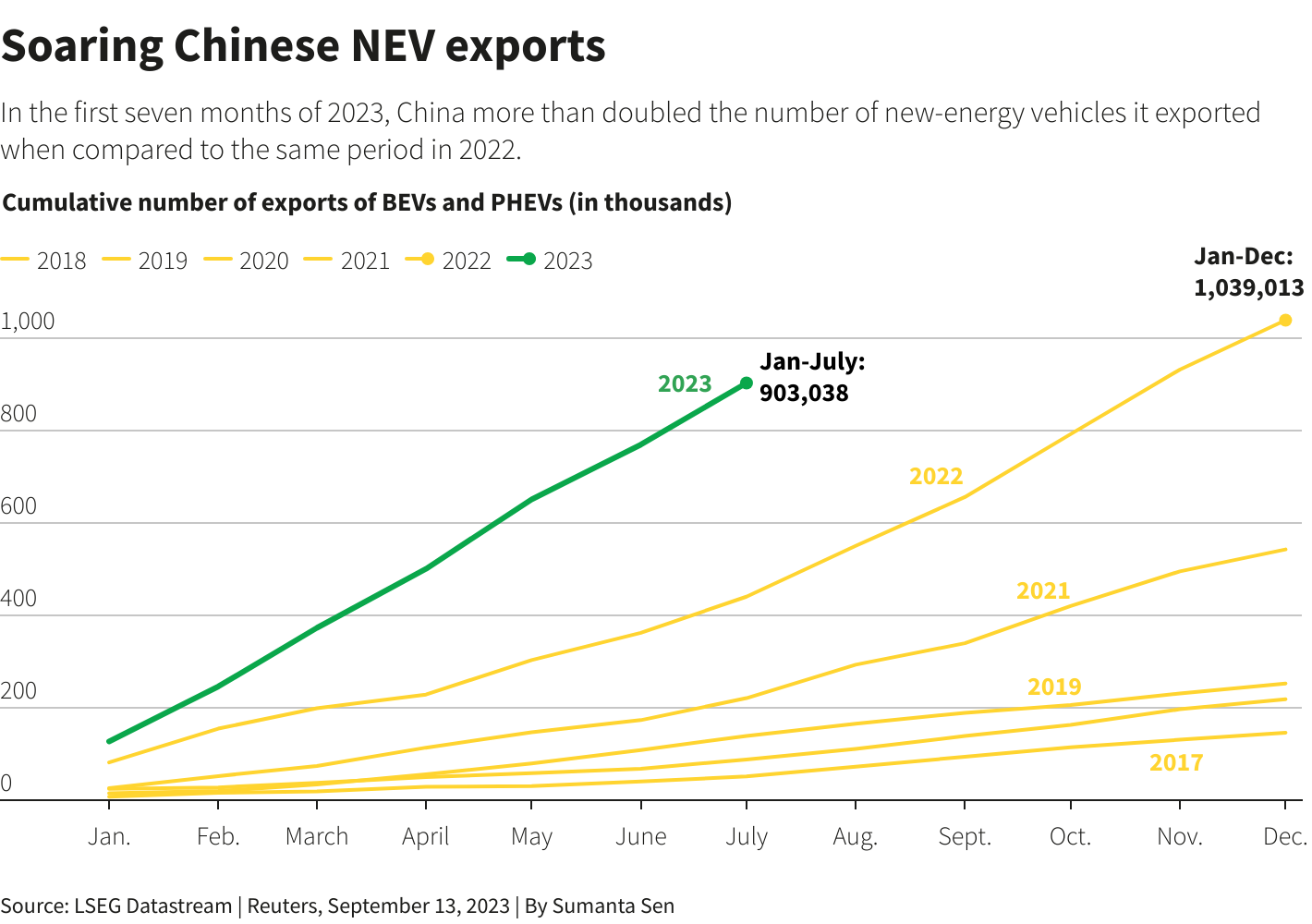

In 2022, 35% of all exported electric cars originated from China, 10 percentage points higher than the previous year, according to U.S. think-tank the Center for Strategic and Internal Studies (CSIS).

Most of the vehicles, and the batteries they are powered by, were destined for Europe where 16% of batteries and vehicles sold were made in China in 2022, it said.

The single largest exporter from China is U.S. giant Tesla (TSLA.O), CSIS data showed. It accounted for 40.25% of EV exports from China between January and April 2023.

Reporting by Donny Kwok in Hong Kong, Brenda Goh in Shanghai and Ryan Woo in Beijing, Writing by Anne Marie Roantree; Editing by Tom Hogue, Jamie Freed and Mark Potter

Our Standards: The Thomson Reuters Trust Principles.