Today, we shine the spotlight on BorgWarner Inc (NYSE:BWA), a Tier I auto-parts supplier. With a daily gain of 1.87%, a 3-month loss of -3.57%, and an Earnings Per Share (EPS) (EPS) of 4.05, we pose the question: Is BorgWarner fairly valued? In this article, we will dissect BorgWarner’s valuation, providing an in-depth analysis of its financial health, profitability, and growth. Let’s dive in.

A Snapshot of BorgWarner Inc (NYSE:BWA)

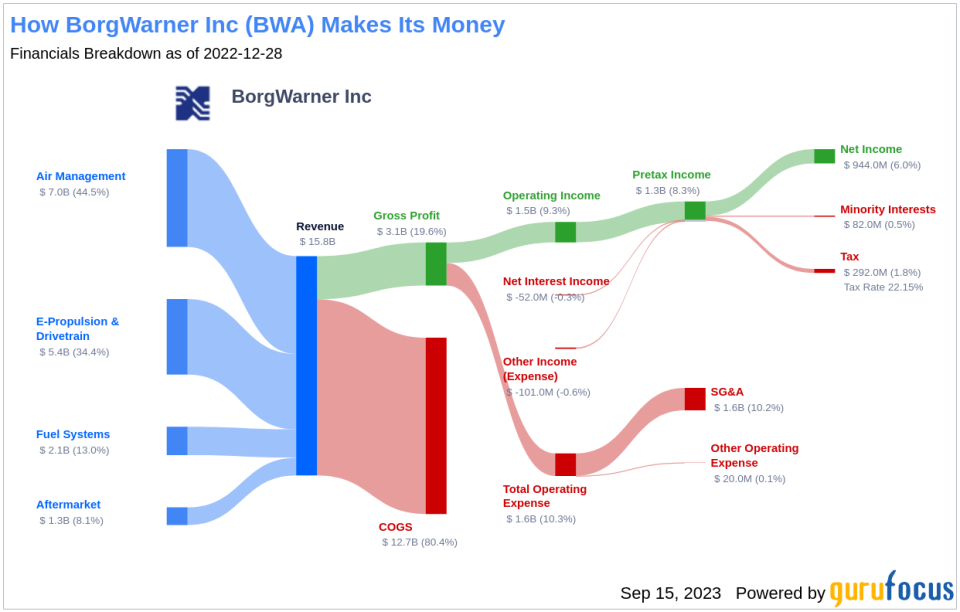

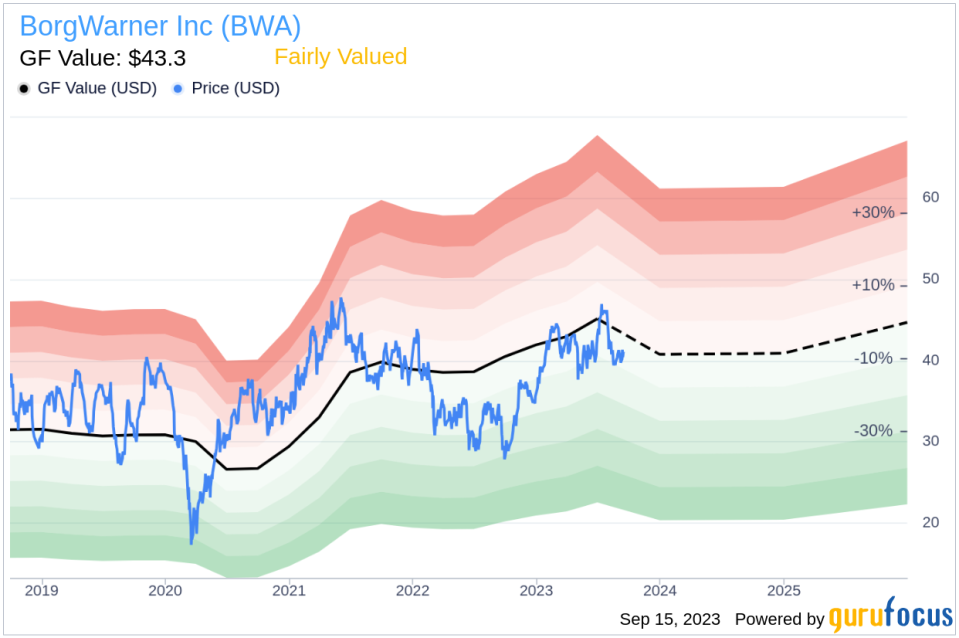

BorgWarner is a key player in the auto-parts sector, boasting three operating segments: air management, drivetrain and battery systems, and e-propulsion. With Ford and Volkswagen as its largest customers, BorgWarner has a global footprint, with Europe, Asia, and North America each accounting for about a third of its 2022 revenue. The company’s current stock price stands at $41.1, with a market cap of $9.70 billion. When compared to the GF Value of $43.3, an estimation of fair value, the stock appears to be fairly valued. But is this truly the case? Let’s delve deeper into BorgWarner’s financials.

Understanding the GF Value

The GF Value is a unique measure of a stock’s intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line provides a representation of the stock’s ideal fair trading value. If the stock price significantly deviates from the GF Value Line, it could indicate overvaluation or undervaluation, thereby influencing its future return.

According to our calculations, BorgWarner (NYSE:BWA) appears to be fairly valued. This conclusion is drawn from the company’s historical trading multiples, past business growth, and analyst estimates of future business performance. As such, the long-term return of BorgWarner’s stock is likely to align with the rate of its business growth.

Assessing BorgWarner’s Financial Strength

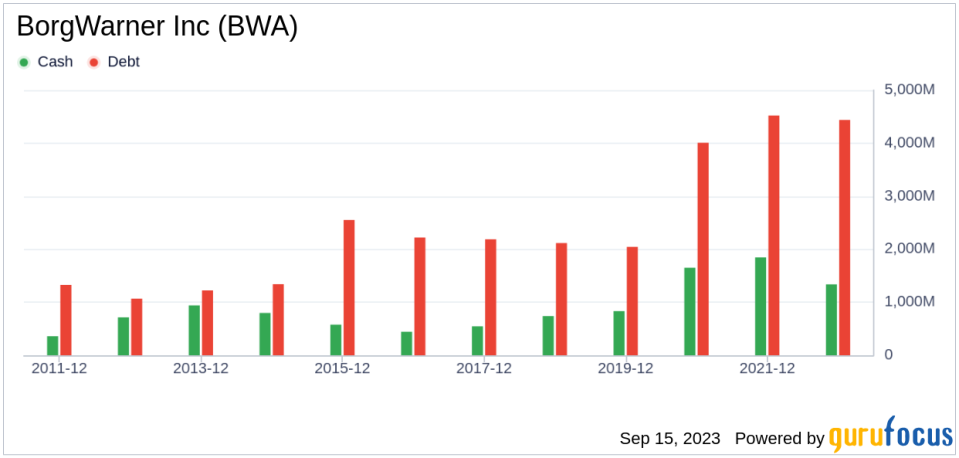

Investing in companies with weak financial strength can lead to a higher risk of permanent capital loss. Therefore, it’s crucial to review a company’s financial health before investing. BorgWarner’s cash-to-debt ratio of 0.19, which is lower than 75.88% of companies in the Vehicles & Parts industry, suggests fair financial strength.

Profitability and Growth

Consistent profitability over the long term reduces investment risk. BorgWarner has been profitable for 10 out of the past 10 years, with an operating margin of 9.57%, ranking better than 76.65% of companies in the industry. However, its 3-year average annual revenue growth rate of 10.7% and EBITDA growth rate of 1.7% rank lower than a majority of its peers.

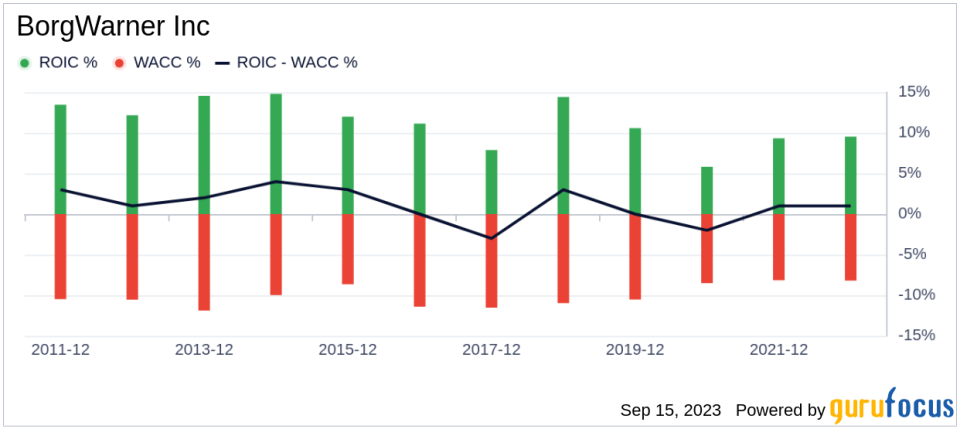

ROIC vs WACC

Comparing a company’s return on invested capital (ROIC) to its weighted average cost of capital (WACC) can provide insights into its profitability. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. BorgWarner’s ROIC of 9.84 outpaces its WACC of 8.44, suggesting value creation.

Conclusion

In conclusion, BorgWarner’s stock appears to be fairly valued. The company exhibits fair financial strength and strong profitability, although its growth ranks lower than a majority of its industry peers. For more insights into BorgWarner, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.