Long-established in the Industrial Products industry, Eaton Corp PLC (NYSE:ETN) has enjoyed a stellar reputation. It has recently witnessed a daily gain of 0.55%, juxtaposed with a three-month change of 14.76%. However, fresh insights from the GuruFocus Score Rating hint at potential headwinds. Notably, its diminished rankings in financial strength, growth, and valuation suggest that the company might not live up to its historical performance. Join us as we dive deep into these pivotal metrics to unravel the evolving narrative of Eaton Corp PLC.

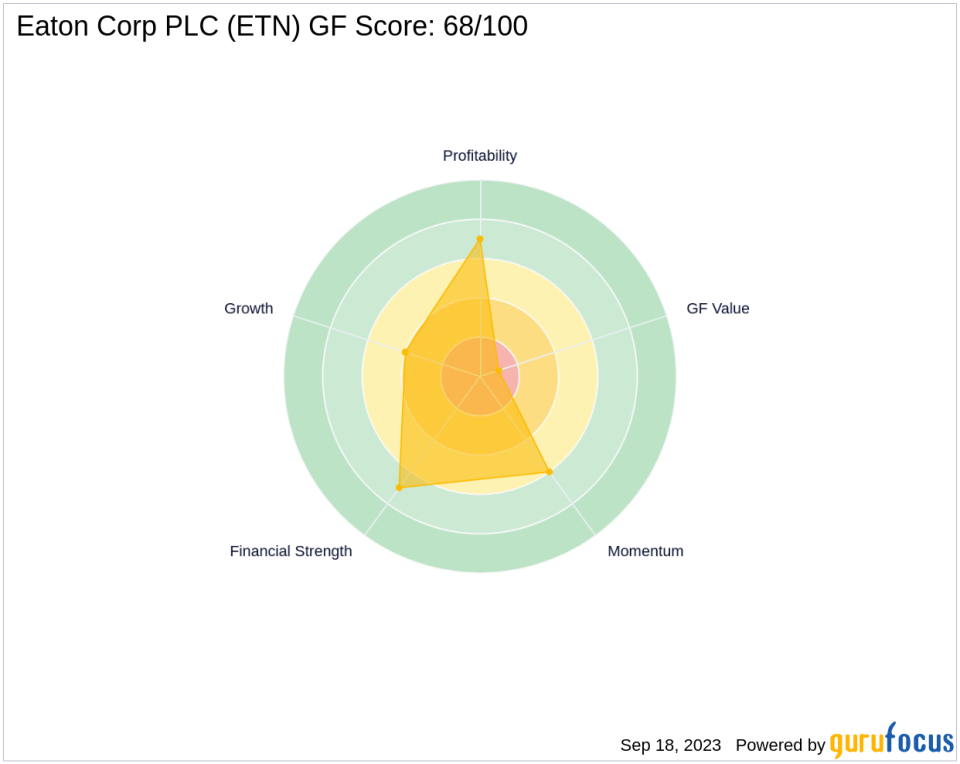

Decoding the GF Score

The GF Score is a stock performance ranking system developed by GuruFocus using five aspects of valuation, which has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021. The stocks with a higher GF Score generally generate higher returns than those with a lower GF Score. Therefore, when picking stocks, investors should invest in companies with high GF Scores. The GF Score ranges from 0 to 100, with 100 as the highest rank.

Based on the above method, GuruFocus assigned Eaton Corp PLC the GF Score of 68 out of 100, which signals poor future outperformance potential.

Understanding Eaton Corp PLC’s Business

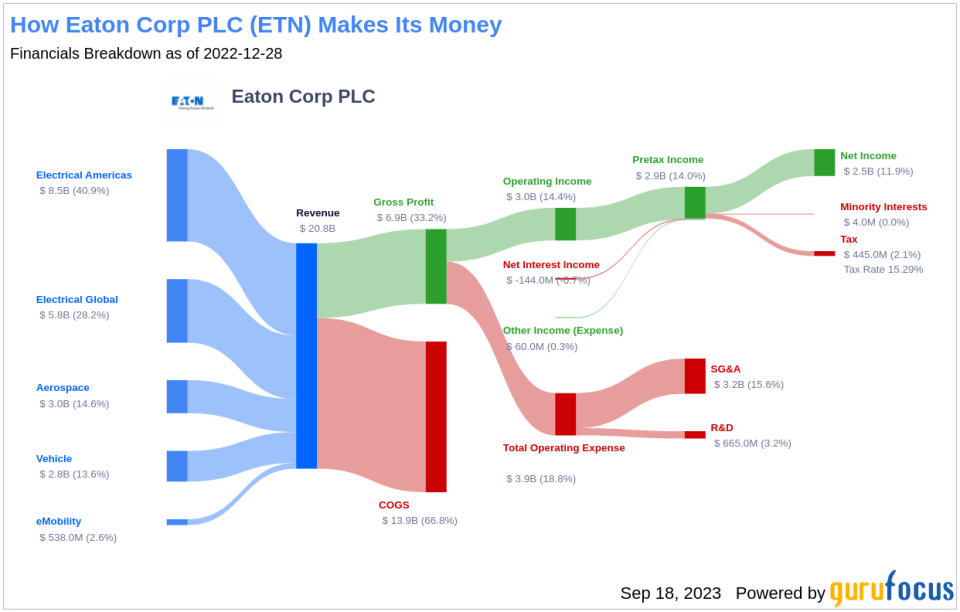

Eaton Corp PLC, with a market cap of $87.31 billion and sales of $22.05 billion, has been a diversified power management company for over 100 years. The company operates through various segments, including electrical Americas, electrical global, aerospace, vehicle, and eMobility. Eaton’s portfolio can broadly be divided into two halves. One part of its portfolio is housed under its industrial sector umbrella, which serves a large variety of end markets like commercial vehicles, general aviation, and trucks. The other portion is Eaton’s electrical sector portfolio, which serves data centers, utilities, and the residential end market, among others. While the company receives favorable tax treatment with its Ireland domicile, most of its operations are in the U.S.

Growth Prospects

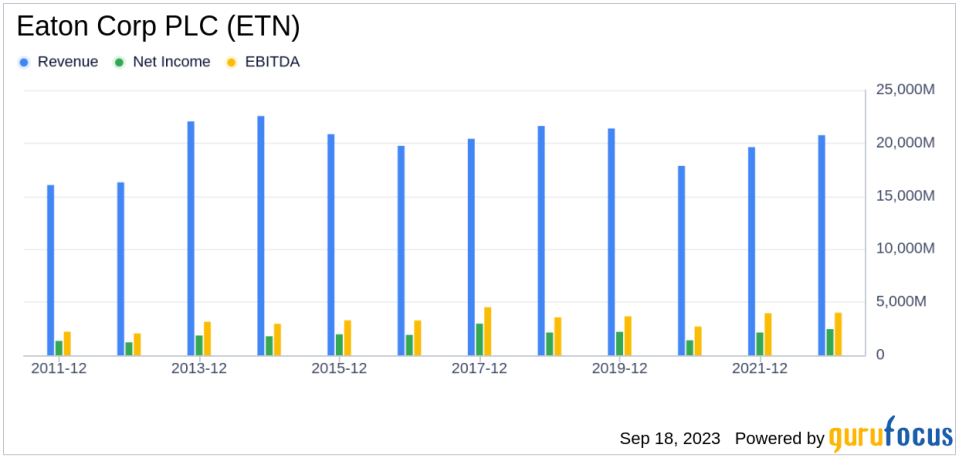

A lack of significant growth is another area where Eaton Corp PLC seems to falter, as evidenced by the company’s low Growth rank. Furthermore, Eaton Corp PLC’s predictability rank is just one star out of five, adding to investor uncertainty regarding revenue and earnings consistency.

Conclusion

Given the company’s financial strength, profitability, and growth metrics, the GuruFocus Score Rating highlights the firm’s unparalleled position for potential underperformance. While Eaton Corp PLC has a strong history, the current metrics suggest that it may struggle to maintain its performance in the future. This analysis underscores the importance of thorough research and careful consideration when investing.

GuruFocus Premium members can find more companies with strong GF Scores using the following screener link: GF Score Screen

This article first appeared on GuruFocus.