The goal of emission-free new car sales in 2025 is threatened by the fact that every third company car user still chooses a new petrol or diesel car. – Reintroduction of the tax discount for electric company cars is the move the Storting must now take, says Erik Andresen of the Bilimportørenes Landsforening (BIL).

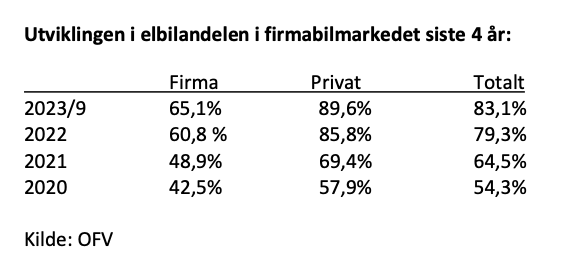

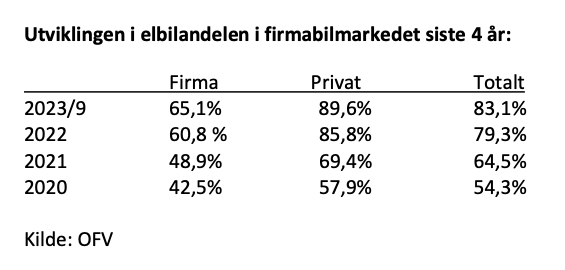

The Storting has decided that only emission-free cars will be sold in Norway after 2025. As of 17.9. electric cars account for 83.1 per cent of total new car sales. But this obscures an important difference. While 89.6 percent of everyone who buys a new car privately chooses an electric drivetrain, the figure in the company car market is completely different. Here, only 65 percent choose all-electric.

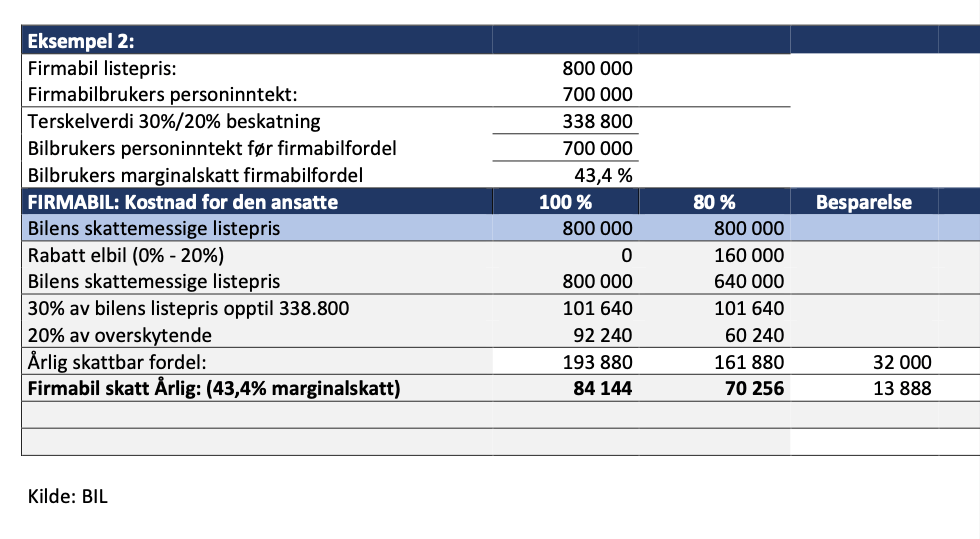

– We will not achieve the goal that all new car sales will be zero emissions in 2025, with this development. And the development is easy to explain. While electric cars are profitable to buy for private individuals, it is significantly less profitable for company car people – because here the employer pays for fuel, tolls and parking. To remedy this, company car taxation on electric cars must be set to 80 percent of the rates for fossil-fuel cars as it has been in the past, says Erik Andresen, director of the Bilimportørenes Landsforening (BIL).

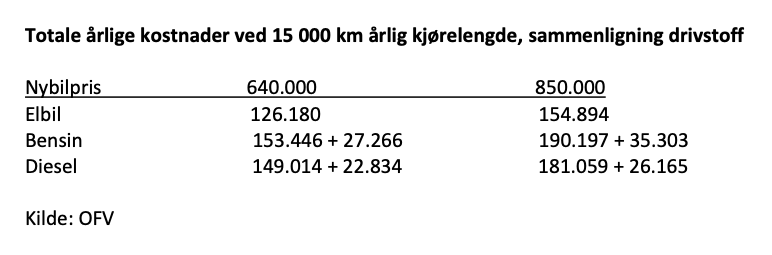

There is no doubt that lower operating costs are an important explanation for the success of electric cars in the Norwegian private market. Electricity is cheaper as a “fuel” than petrol and diesel. In addition, electric cars only pay 50 per cent of the rates in the toll rings, while many municipalities offer a discount on parking. For a private person, there is thus between NOK 20,000 and 35,000 to save in annual operating costs by choosing an electric car.

The same calculation does not apply to company cars. Here, the employer picks up all expenses for fuel, tolls and parking. As a result, company car users have no financial incentives to choose an electric car. They should get that, says Andresen in BIL.

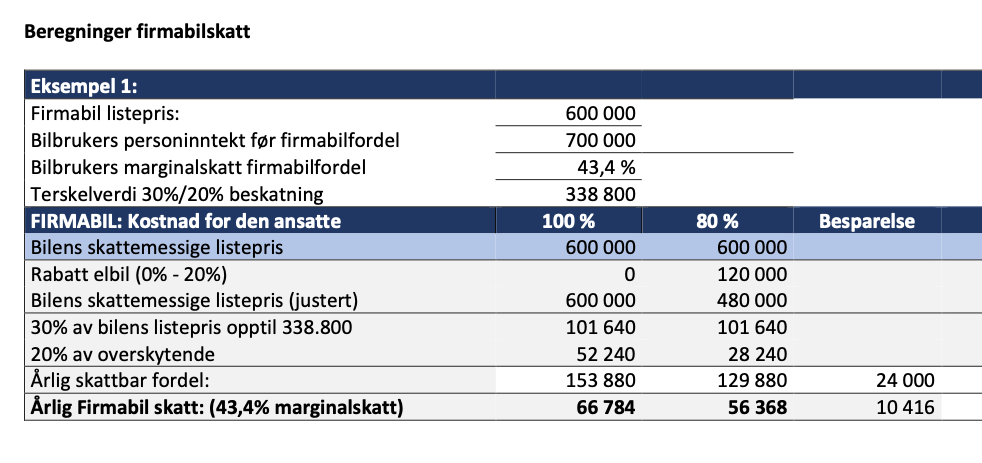

– If an electric company car only has 80 percent of the tax surcharge of a fossil company car, a financial incentive is introduced to choose climate-friendly in this segment as well. Such a discount, which we had until last year, will give 20-35,000 in reduced gross tax and 10-15,000 in reduced net tax. If there is one thing that the Norwegian electric car success has taught us, it is that financial incentives work. I am absolutely certain that this also applies in the company car segment, says Andresen.

He therefore makes a strong call to the Storting to look in particular at the design of company car taxation when they will soon consider the national budget for 2024, which includes the tax and duty system.