[1/2]The cab to a Ford all-electric F-150 Lightning truck prototype is seen on an automated guided vehicle (AGV) at the Rouge Electric Vehicle Center in Dearborn, Michigan, U.S. September 16, 2021. REUTERS/Rebecca Cook/File Photo Acquire Licensing Rights

Sept 27 (Reuters) – Ford Motor’s (F.N) decision to hit the brakes on a planned $3.5 billion battery plant in Michigan highlights a challenge for Tesla’s growing crowd of rivals in the U.S. market: Tesla is pushing most of them into unprofitable, low-volume niches.

Global automakers are launching scores of new electric vehicles in the United States, and pouring billions of dollars into new EV and battery plants. But few of them besides Tesla’s Model Y and Model 3 are selling at high enough volumes to support a full-scale assembly plant, according to a Reuters analysis of U.S. EV sales data for the first six months of 2023.

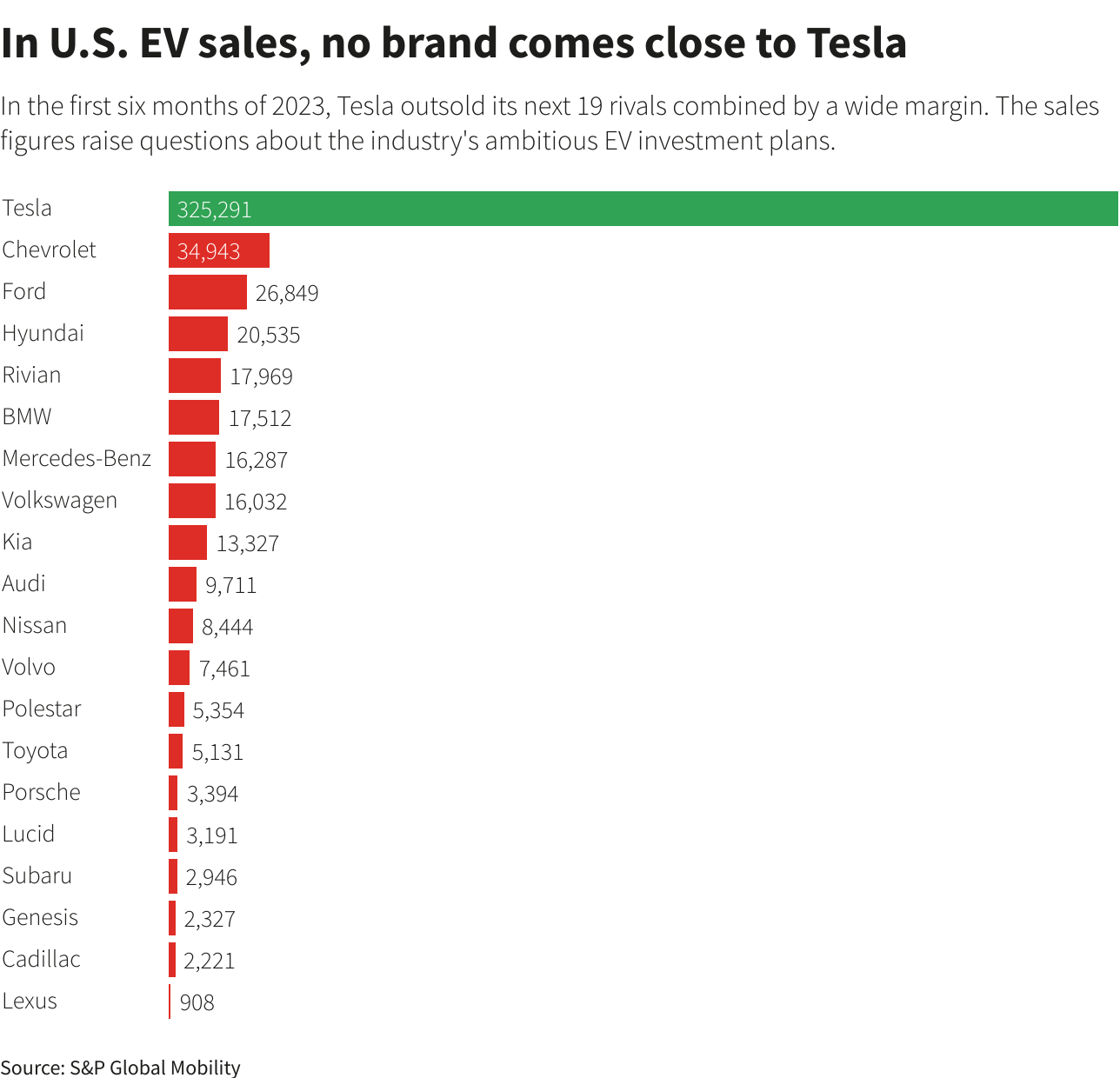

On a brand-by-brand basis, Tesla outsold its next 19 competitors by 10 to one or more during the first half, according to S&P Global Mobility data.

Tesla sold 325,291 vehicles in the United States from January to June. General Motors’ (GM.N) Chevrolet brand, with its aging Bolt EV, was a distant second at 34,943, trailed by Ford, Hyundai (005380.KS) and Rivian(RIVN.O).

On a nameplate basis, all four of Tesla’s models placed in the top 12, with the Model Y and Model 3 ranked numbers one and two, with first-half sales of 200,000 and 160,000, respectively.

In comparison, the Bolt sold 35,000 and Ford’s Mustang Mach E chalked up 13,600 — nowhere near enough volume to fill a typical assembly plant, which needs to operate at 80% of capacity or more to be profitable.

Electrified vehicle sales, including plug-in hybrids and fuel cell vehicles, captured 8.9% of the U.S. market during the first half of 2023, up 2.6 percentage points from a year earlier, according to data compiled by the Alliance for Automotive Innovation, an industry trade group.

But that market share was divided up among 103 different models, according to the Alliance’s latest quarterly report on the EV market.

Ford’s decision to pause work on a $3.5 billion electric vehicle battery plant in Michigan comes as some analysts question whether the U.S. EV market will grow fast enough to support all the new battery and assembly operations launched or under construction.

In July, Ford forecast a full-year loss of $4.5 billion on its EV unit – 50% higher than projected earlier this year – and said it was slowing its EV production ramp up.

The U.S. automaker, like several rivals, has committed billions to build additonal EV and battery plants in the U.S.

In a media presentation on Tuesday, Cox Automotive noted that Tesla has surrendered some share of U.S. EV sales this year as more entrants hit the market, but still commands nearly two-thirds of all EV sales. No other brand has more than 10%.

Cox estimated that EV sales will rise to 8% of total U.S. vehicle sales in the third quarter from about 6.5% a year ago.

Some of that growth likely has been driven by falling prices, a trend driven by Tesla which is using its superior profit margins to cut prices and expand sales. Cox said average EV retail prices fell to $53,376 in July 2023, from a high of nearly $70,000 a year ago.

Reporting by Joe White and Paul Lienert in Detroit; Editing by David Gregorio

Our Standards: The Thomson Reuters Trust Principles.