The electric vehicle (EV) market, especially in China, is fraught with electrifying prospects and unpredictable speed bumps. Few embody this roller coaster more than NIO Inc (NYSE:NIO). Recently, the EV giant announced the issuance of a $1 billion convertible bond, sending ripples of concern among investors and leading to a drop in its stock price.

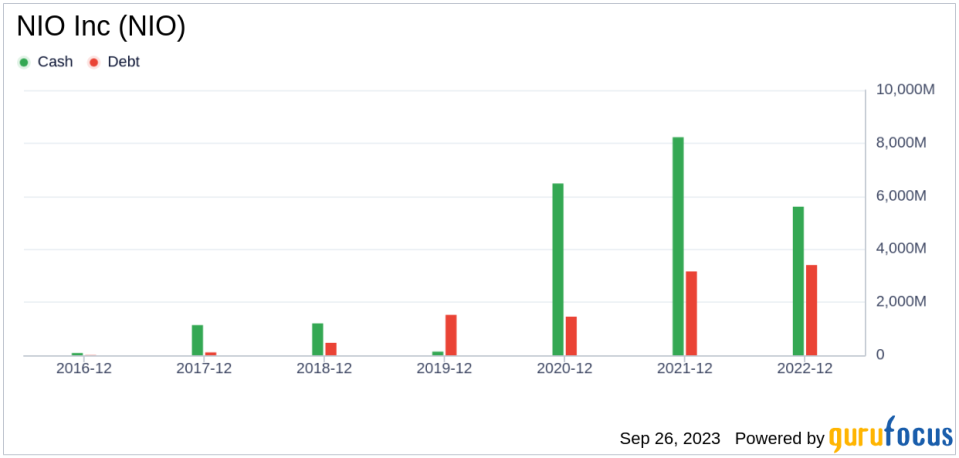

Generally, a debt offering signals a company’s need for cash. Although issuing shares can be dilutive, a debt offering highlights the actual use of cash, leading to increased scrutiny by investors. This hesitance is grounded in the understanding that excessive debt often restrains a company’s ability to generate a cash surplus. High levels of indebtedness can be alarming as they potentially undermine the position of common stockholders, especially in situations of insolvency where they are the last to claim any form of payback from the company.

Growth and Financial Stability

NIO Inc (NYSE:NIO) is unmistakably in a growth phase, continually investing in expanding its product line and infrastructure, including its unique battery-swapping network. However, this growth mode is a double-edged sword. It is contributing to the companys existing issues as substantial capital is funneled into expansion endeavors, exacerbating cash flow concerns and adding to the existing financial obligations.

The persistent need for capital to fuel its growth, leading to additional debt offerings, makes investors cautious. It underlines the critical balance NIO Inc (NYSE:NIO) must maintain to ensure its growth strategies do not inadvertently undermine its financial stability and long-term viability. This prevailing apprehension is influencing investors behavior towards NIO Inc (NYSE:NIO), reflecting concerns regarding the company’s debt strategy and its implications for future financial stability and growth.

Unveiling Investment Opportunities

However, a closer examination of the data hints at a hidden golden opportunity for perceptive investors. Utilizing the comprehensive tools from GuruFocus’ All-in-One Screener, we will delve deeply into the financial dynamics of NIO Inc (NYSE:NIO)’s performance. Embark on this journey with us to unveil the subtle forces shaping NIO Inc (NYSE:NIO)s financial landscape and uncover potential investment opportunities.

Financial Overview and Challenges

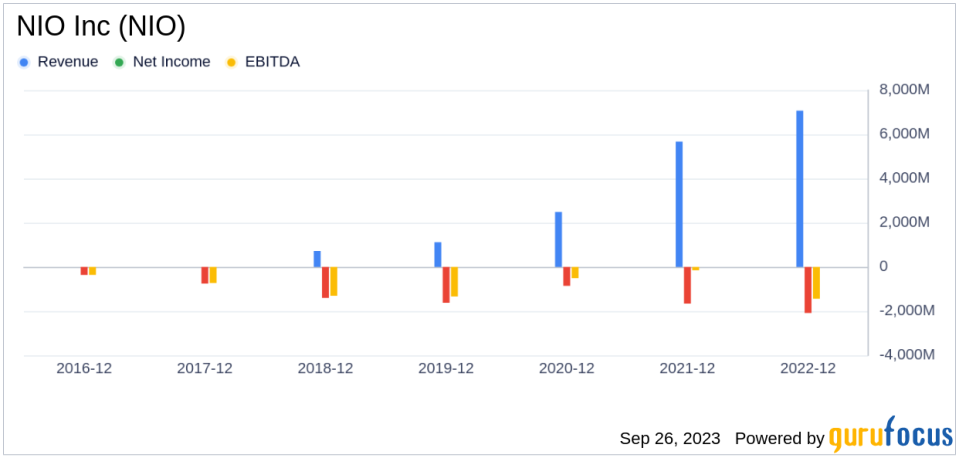

NIO Inc (NYSE:NIO)’s recent financial health has been a mixed bag, echoing the industry’s wider challenges. The Q2 2023 earnings report, released on August 29, revealed a 15% year-over-year revenue decline, amounting to 8.77 billion yuan ($1.21 billion). Despite this, NIO Inc (NYSE:NIO) managed to exceed Wall Street’s diminished expectations, showcasing a resilience that could be a harbinger for recovery.

The subsequent quarters did present setbacks, with declining deliveries and a reported adjusted net loss that more than doubled from the previous year to 5.44 billion yuan ($751 million). Despite these challenges, NIO Inc (NYSE:NIO)’s adherence to innovation and market differentiation, particularly through its network of battery-swapping stations, has managed to keep it afloat.

Future Prospects and Growth

Drawing from the valuable insights obtained through GuruFocus’ All-in-one Screener, NIO Inc (NYSE:NIO) stands out as a remarkable growth story in the Vehicles & Parts industry. Over the last three years, NIO Inc (NYSE:NIO) has witnessed an extraordinary 59% revenue growth rate, leaving it in a superior position against 98% of a substantial pool of 1,206 competitors in the sector.

Looking ahead, analysts forecast a continuation of this promising trajectory for NIO Inc (NYSE:NIO). The company is anticipated to augment its total revenue at an impressive rate of 37% over the next three to five years, a pace that overshadows 97% of 200 firms within the industry.

Investment Takeaway

From an investment standpoint, the question lingers: is it too late to invest in NIO Inc (NYSE:NIO)? The answer lies in a balanced assessment of NIO Inc (NYSE:NIO)’s current challenges and its long-term growth prospects. Despite the considerable hurdles and the ongoing pricing war in China’s EV market, NIO Inc (NYSE:NIO)’s low valuation, coupled with its continued vehicle production and innovative approaches, could present a valuable opportunity for long-term investment.

In conclusion, NIO Inc (NYSE:NIO) stands at a critical junction. While the road ahead is filled with uncertainty and challenges, its strategic initiatives, innovative solutions, and commitment to reinforcing its market position illuminate a path of potential recovery and growth. For prospective investors, a careful and patient approach, focusing on the companys long-term trajectory rather than short-term volatilities, would be prudent in navigating the investment landscape surrounding NIO Inc (NYSE:NIO).

This article first appeared on GuruFocus.