Kennametal Inc. KMT is gaining from solid product offerings, commercial and operational excellence and a wide geographical presence despite rising costs and expenses and forex woes.

Key Factors Driving KMT

Business Strength: Strength in its aerospace and defense, general engineering, transportation and energy end markets is driving KMT’s Metal Cutting segment. Also, its strategic initiatives, innovation and operational excellence bode well. Infrastructure unit’s revenues are supported by solid momentum in the general engineering end market. In addition, focus on lean operations to drive productivity, share gain initiatives in target end markets and continuing inventory optimization actions bode well for the segment.

Innovation Capabilities: Kennametal is likely to gain from its innovation capabilities in the quarters ahead. Also, mega-trends like hybrid and electric vehicles, digitalization and ESG align well with the company’s technical expertise and market exposure. KMT also aims to drive improved profitability through operational excellence by enhancing manufacturing and business process productivity and optimizing investments in commercial excellence and technology to target the highest return growth initiatives.

Rewards to Shareholders: The company continues to increase shareholders’ value through dividend payments and share buybacks. In fiscal 2023 (ended Jun 30, 2023), the company distributed dividends totaling $65 million to its shareholders. It bought back shares for $49 million in fiscal 2023. In July 2021, the company’s board of directors approved a share buyback worth $200 million. The program is valid for three years and will be funded using the company’s operating cash flow. Since the inception of the program, the company has repurchased 4.7 million shares for $135 million.

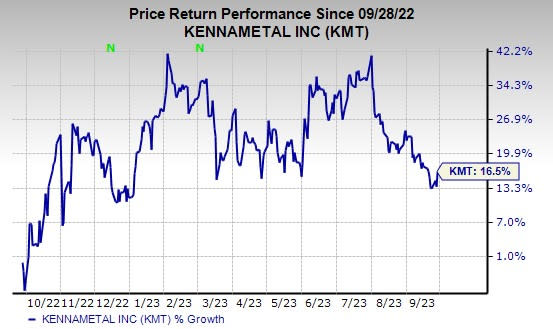

In light of the above-mentioned positives, we believe, investors should retain KMT stock for now, as suggested by its current Zacks Rank #3 (Hold). Shares of the company have increased 16.5% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked companies from the Industrial Products sector are discussed below:

Caterpillar Inc. CAT presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

CAT’s earnings surprise in the last four quarters was 18.5%, on average. In the past 60 days, estimates for Caterpillar’s earnings have increased 10.4% for 2023. The stock has gained 62.6% in the past year.

Ingersoll Rand Inc. IR presently sports a Zacks Rank of 1. IR’s earnings surprise in the last four quarters was 14.9%, on average.

In the past 60 days, estimates for Ingersoll Rand’s earnings have increased 3% for 2023. The stock has gained 43.5% in the past year.

Eaton Corporation plc ETN currently carries a Zacks Rank # 2 (Buy). The company delivered a trailing four-quarter earnings surprise of approximately 3%, on average.

In the past 60 days, estimates for Eaton’s earnings have increased 3.9% for 2023. The stock has soared 60.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Kennametal Inc. (KMT) : Free Stock Analysis Report