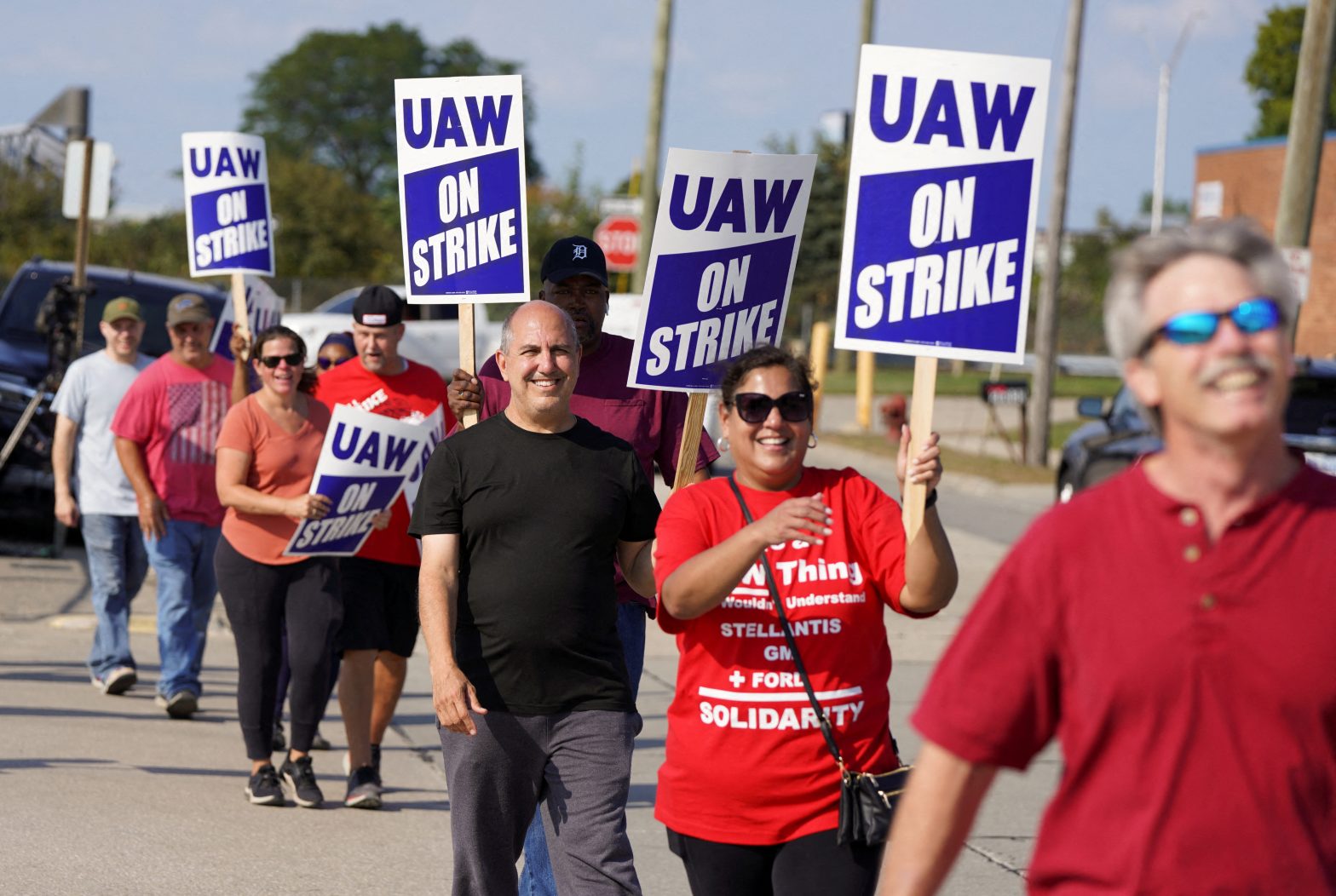

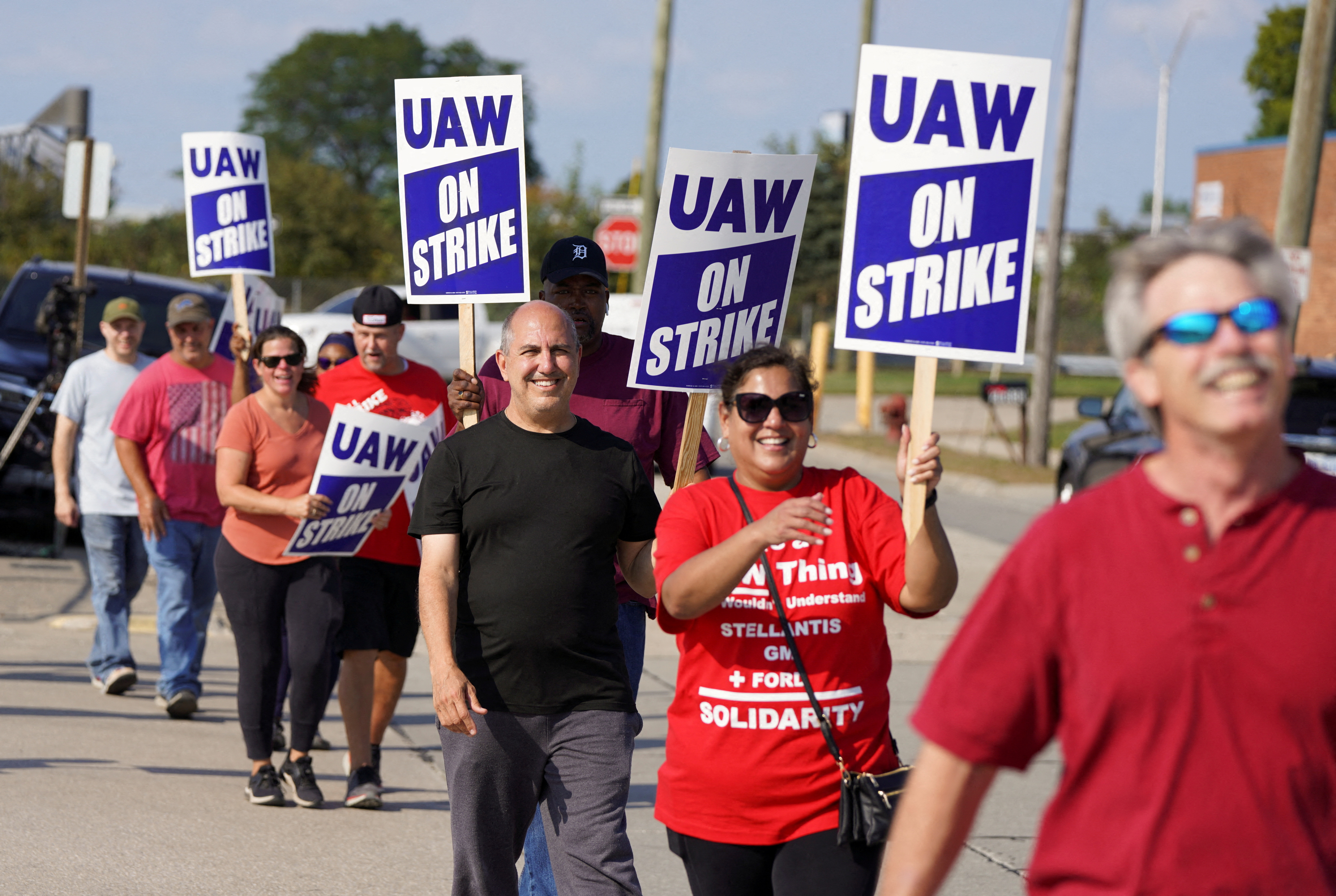

Striking UAW workers picket outside a Stellantis facility in Center Line, Michigan, U.S., September 22, 2023. REUTERS/Dieu-Nalio Chery/File Photo Acquire Licensing Rights

DETROIT, Sept 29 (Reuters) – United Auto Workers union President Shawn Fain is expected to launch walkouts at more Detroit Three auto factories Friday, barring last-minute progress in bargaining that has moved slowly since last week.

UAW members, Wall Street investors, industry executives and the White House are watching to see whether Fain shuts down powertrain factories or plants that assemble the pickup trucks and large SUVs that Ford (F.N), General Motors (GM.N) and Stellantis (STLAM.MI) rely on for most of their North American and global profits.

Fain will make a video address on Friday at 10 a.m. ET (1400 GMT). On Thursday, the union made a

counter-proposal to Stellantis

.

Talks among the UAW and negotiators for the Detroit Three were described as “very active” by one person briefed on the situation.

If Fain triggers walkouts at more plants starting at noon (1600 GMT) on Friday, the UAW is expected to continue work stoppages currently under way until a new contract is ratified, a source familiar with the situation said, speaking on condition of anonymity.

Headed into Friday, about 18,300 UAW members at the Detroit Three were on strike, or about 12% of the 146,000 union members working at the automakers. Strikers have been getting $500 a week from the UAW’s strike fund.

The union has shut one assembly plant at each of the Detroit Three, and 38 parts distribution centers at GM and Stellantis.

The effect of these walkouts has been relatively limited compared to the financial hit from halting assembly lines that build Ford F-series, Chevy Silverados and Ram trucks.

Analysts estimate GM, Ford and Stellantis earn as much as $15,000 per vehicle on each of their respective large pickup truck models.

Strikes at Ford’s Kentucky truck plant and GM’s Flint truck factory would mark a significant escalation. Those factories build heavy-duty pickups that are the most profitable vehicles Ford and GM sell. A walkout at Stellantis Ram truck and Jeep SUV factories in Sterling Heights, Michigan, Warren, Michigan, and Detroit would deal a sharp blow to the French-Italian automaker.

The union could also shut down engine and transmission factories, or metal stamping operations, that supply parts to multiple product lines and plants. Such an approach would quickly result in closure of assembly plants because they would lack parts.

After the last expansion of the coordinated strike, Fain threatened more action at Stellantis’ critical parts plants in his hometown of Kokomo, Indiana, where the automaker has four factories that make engines and transmissions used widely across the company’s product line.

The union could continue a more incremental approach, halting work at factories such as GM’s electric vehicle plants in Detroit-Hamtramck and Spring Hill, Tennessee, or Ford’s F-150 Lightning electric pickup plant in Dearborn, Michigan. However, strikes at these plants would have less impact as the models affected are either money-losers or substantially less profitable than the big pickups.

The UAW has taken a new approach with walkouts to turn up pressure on the automakers. Rather than the hammer blow of a mass walkout, the UAW has used strikes like a ratchet, keeping company executives guessing where the next turn would come.

The union launched its first walkouts on Sept. 15, with simultaneous strikes at one assembly plant at each automaker.

The union on Sept. 22 expanded its strikes against GM and Stellantis, but kept its Ford walkout limited to a single plant due to progress in those talks. It is unclear whether Ford will be targeted in the next round of actions.

The union and the companies remain far apart on key economic issues. Fain has stuck with a demand for 40% pay hikes over a four-year contract, a position supported by President Joe Biden during a visit to Detroit on Tuesday. The companies have countered with offers of about 20%.

The UAW also is pushing automakers to eliminate the two-tier wage system, under which new hires can earn far less than veterans.

Reporting by David Shepardson and Joseph White

Editing by Nick Zieminski

Our Standards: The Thomson Reuters Trust Principles.