NIO Inc (NYSE:NIO) has had a wild ride in recent months. Shares of the Chinese electric vehicle company began their latest rally at the end of May, rising more than 100% by the end of July. But alas, the good times were not to last as the rally ran out of steam in the first week of August. From there, the proverbial wheels came off the stock. NIO Inc (NYSE:NIO) plummeted in spectacular fashion, ending the month down 34% from its Aug. 3 peak. Things have not improved in September, with shares down a further 23% since the start of the month.

NIO Inc (NYSE:NIO)s recent woes are the result of a number of factors, some of which are, unfortunately, out of its direct control. More unfortunate still, these risk factors could well continue to weigh on the EV maker for some time.

Operational risk: Weak sales and margins

On Aug. 1, NIO Inc (NYSE:NIO) published its July delivery numbers. The company reported 20,463 deliveries for the month, up 91% sequentially and up 104% from the same period last year. The market responded positively to the news and it looked like NIO Inc (NYSE:NIO) could extend its rally for some time. Yet, just a few days later, the stock started to go into reverse. The proximate cause of reversal was weak economic data coming out of China. NIO Inc (NYSE:NIO) fell alongside many other Chinese companies following the Aug. 8 report that China’s imports contracted 12.4% in July, considerably worse than the 5% decline that economists had anticipated.

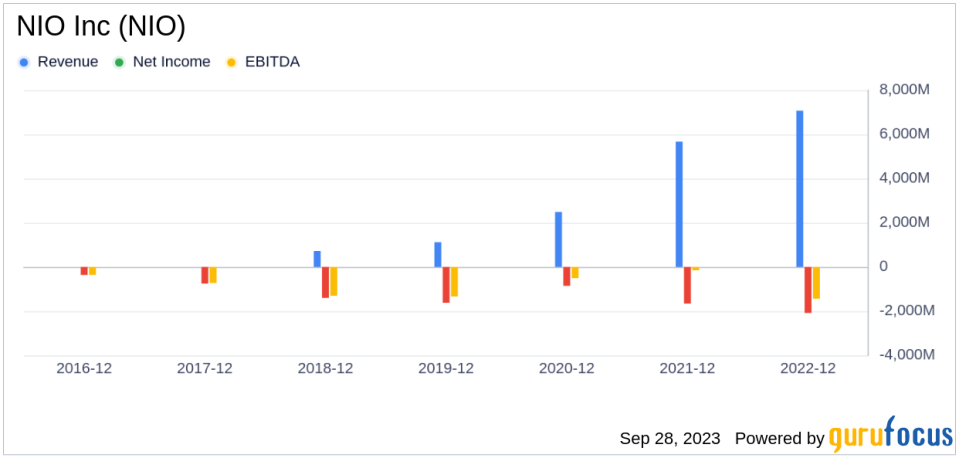

Things really went south for NIO Inc (NYSE:NIO) following the Aug. 29 release of its second quarter earnings report. NIO Inc (NYSE:NIO)s full-quarter delivery numbers fell short of expectations, with sales declining 22% sequentially to $990.9 million. As a result, NIO Inc (NYSE:NIO) fell short of the Wall Street analyst consensus on both top and bottom lines. Making matters worse, NIO Inc (NYSE:NIO)s margins also took a hit. Its vehicle margin was just 6.2% during the quarter, a significant slide from the 16.7% it managed during the same period a year earlier.

NIO Inc (NYSE:NIO)s woes have continued in September. On Sep. 1, the EV maker released its August delivery numbers. The company delivered 19,329 during the month. While that was good enough for an 81% increase year over year, it was still a modest sequential decline.

Financial risk: Cash burn and dilution

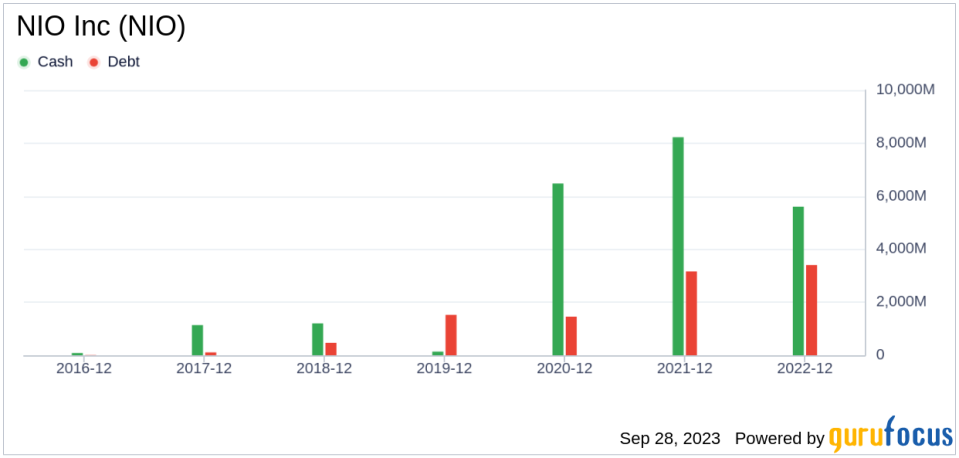

Weak delivery numbers are not the only issue plaguing NIO Inc (NYSE:NIO) at present. The company also faces omnipresent investor anxiety over its capital needs. These fears were stoked up once again on Sep. 18 when NIO Inc (NYSE:NIO) announced a $1 billion convertible note offering. News of the fresh capital raise sent NIO Inc (NYSE:NIO)s stock tumbling.

Making matters worse, rumors began to spread that further fundraising efforts were imminent, with some whispers suggesting a $3 billion equity offering would soon be in the offing. NIO Inc (NYSE:NIO) has sought to squash these rumors. On Sep. 25, the company published a vehement denial:

The Company has been made aware of certain media speculations claiming that the Company is considering raising certain capital from investors, which have been widely circulated today. In light of the unusual market activity in the Company’s American depositary shares today, the Company would like to clarify that the Company currently has no reportable capital raising activity, other than the recent convertible notes offering that was completed on September 25, 2023.

NIO Inc (NYSE:NIO)s denial helped to reassure the market somewhat, allowing it to recover some of its intraday decline. However, while NIO Inc (NYSE:NIO) may not be planning to tap capital markets again so soon, there is little doubt that it will have to do so eventually. After all, growth in a capital-intensive industry such as automotive manufacturing is very expensive. Given its continued unprofitability, NIO Inc (NYSE:NIO) obviously cannot fund its growth investments with cash flows from operations. Thus, it must remain reliant on external investment. While investors may be hopeful about future profitability, getting there will take time. In the meantime, investors will continue to be haunted by the ever-present risk of dilution.

Final thoughts: A long and risky road

NIO Inc (NYSE:NIO) faces numerous risk factors that could undermine its ability to deliver on its long-term promises. Economist and investor James Foord summed it up well in a Sep. 27 research note:

NIO Inc (NYSE:NIO) is a rollercoaster stock. It moves like one and induces absolute dizziness in those who follow it. If you don’t hold tight, it might shake you offClearly, investing in NIO Inc (NYSE:NIO) comes with risks, and one of them is share dilution since the company is still not profitable. But the biggest risk these days doesn’t even come from the company itself, but the broader macro outlook in China.

NIO Inc (NYSE:NIO) has taken a beating in recent months, but that does not necessarily mean it is cheap. With a market capitalization of nearly $15 billion, the EV maker is still priced for growth. With so much growth already priced in already, the potential gains could be thin even if the company manages to execute according to plan. However, there are plenty of things that could go wrong that are simply beyond NIO Inc (NYSE:NIO)s control. Mounting signs of economic weakness in China is a serious red flag that investors cannot ignore.

In my assessment, NIO Inc (NYSE:NIO) remains a risky bet. It may be beaten down, but it is still far from a bargain.

This article first appeared on GuruFocus.