Aptiv PLC (NYSE:APTV), a prominent player in the Vehicles & Parts industry, has been exhibiting a mixed performance lately. With a daily gain of 3.42% and a 3-month loss of -2.11%, it presents an intriguing investment opportunity. The company’s Earnings Per Share (EPS) stands at 3.29, which prompts an essential question: Is the stock modestly undervalued? This article aims to provide a comprehensive analysis of Aptiv PLC’s valuation and financial health. Keep reading to explore the financial intricacies of this company.

Company Introduction

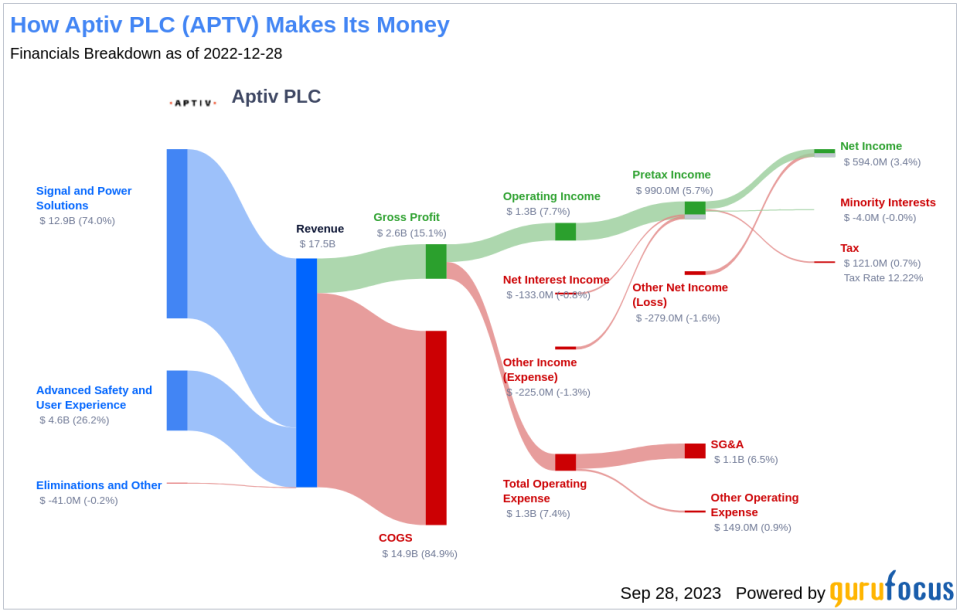

Aptiv PLC (NYSE:APTV) is a leading supplier of components and systems that constitute a vehicle’s electrical system, including wiring assemblies, harnesses, connectors, electrical centers, and hybrid electrical systems. Additionally, it offers body controls, infotainment and connectivity systems, passive and active safety electronics, advanced driver-assist technologies, and displays. The company has a significant customer base, including General Motors and Stellantis, contributing to approximately 9% of 2022 revenue each, followed by Ford and Volkswagen.

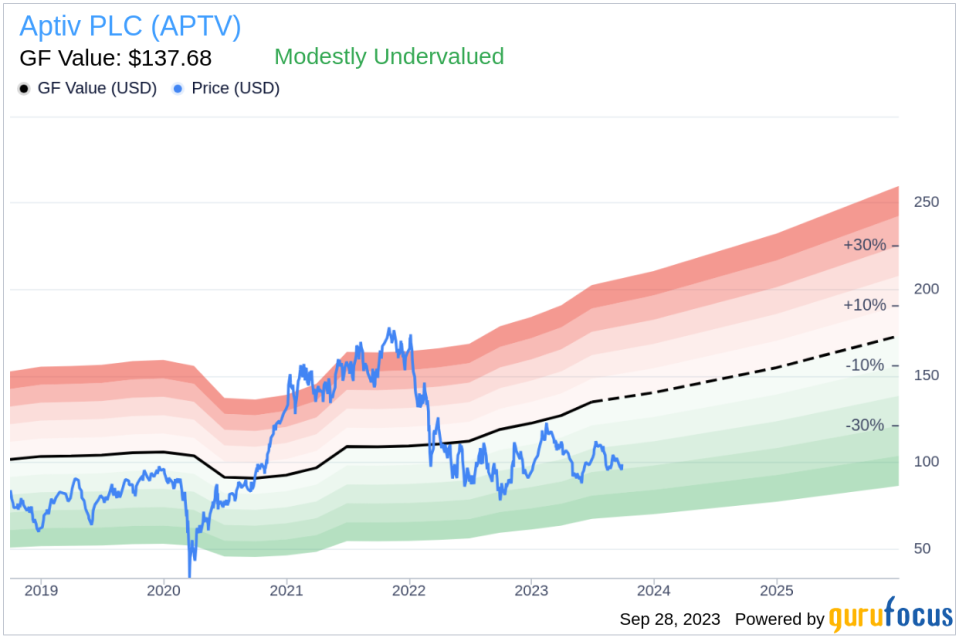

As of September 28, 2023, Aptiv PLC’s stock price stands at $99.14, while its GF Value, an estimation of the fair value, is at $137.68. This discrepancy indicates that the stock might be modestly undervalued.

Understanding GF Value

The GF Value is a unique measure of a stock’s intrinsic value, calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line represents the fair value at which the stock should ideally be traded. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

For Aptiv PLC (NYSE:APTV), the GF Value estimates the stock’s fair value to be around $137.68, suggesting that the stock is modestly undervalued. Therefore, the long-term return of its stock is likely to be higher than its business growth.

Financial Strength

Investing in companies with poor financial strength carries a higher risk of permanent loss of capital. Therefore, it’s crucial to review the financial strength of a company before deciding to buy its stock. Aptiv PLC’s cash-to-debt ratio of 0.19 is worse than 75.77% of companies in the Vehicles & Parts industry, indicating fair financial strength.

Profitability and Growth

Investing in profitable companies carries less risk, especially those with consistent profitability over the long term. Aptiv PLC has been profitable 10 years over the past 10 years, with an operating margin of 9.16%, which is better than 75.02% of companies in the Vehicles & Parts industry. However, Aptiv PLC’s 3-year average revenue growth rate and EBITDA growth rate are worse than 52.82% and 66.73% of companies in the industry, respectively.

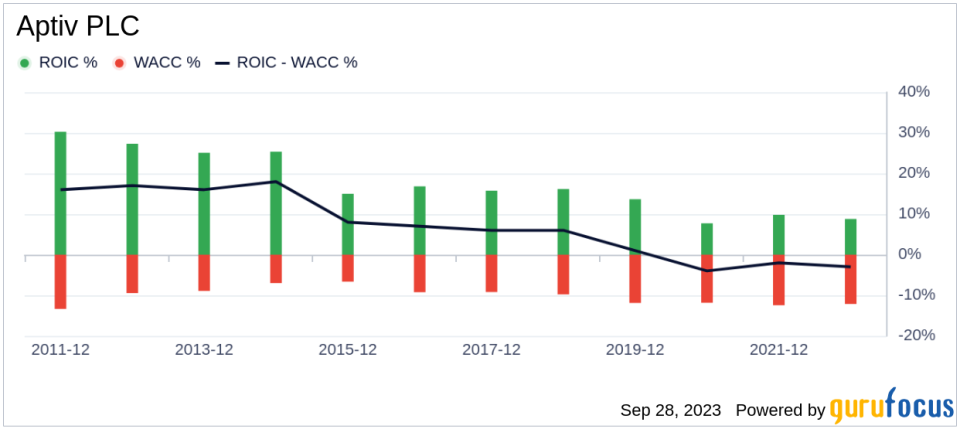

ROIC vs WACC

Comparing a company’s Return on Invested Capital (ROIC) and the Weighted Average Cost of Capital (WACC) provides insights into its profitability. Aptiv PLC’s ROIC is 11, while its WACC is 11.55, indicating a need for improved profitability.

Conclusion

In conclusion, Aptiv PLC (NYSE:APTV) stock appears to be modestly undervalued. The company exhibits fair financial strength and strong profitability, despite its growth ranking worse than 66.73% of companies in the Vehicles & Parts industry. For more insights into Aptiv PLC’s financials, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, visit GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.