The technology services sector has witnessed robust growth since the pandemic, fueled by the rapid adoption of remote work, accelerating the global digital transition. Technological advancements like 5G, blockchain, artificial intelligence (AI), and machine learning (ML) have further driven industry expansion. Additionally, increased concerns about data security have acted as a catalyst for industry growth.

Thomson Reuters Corporation TRI, Marvell Technology, Inc. MRVL, Trane Technologies plc TT, and Aptiv PLC APTV are poised to gain from the prevailing trends of the industry.

About the Industry

The Zacks Technology Services industry encompasses companies involved in producing, developing and designing various software support, data processing, computing hardware and communications equipment. These offerings range from integrated powertrain technologies, advanced analytics, technology solutions, and contract research services to semiconductor packaging and interconnect technologies, collaboration software, specialty printers and data acquisition and analysis systems. This industry caters to consumer and business markets and serves diverse end markets and customer segments. Additionally, some industry players offer advanced analytics, clinical research services, data storage technology and solutions and technology-enabled financial services for consumers and small business owners.

Factors Structuring the Future of Technology Services

Rising Demand Environment: The industry has been gaining traction over the past year, thanks to recent technological advancements and the onset of remote work. Revenues, income and cash flows have been growing in the past year, aiding many industry players to pay out stable dividends.

Cloud Computing Gains Traction: Per a report by Grand View Research, the global cloud computing market was valued at USD 483.98 billion in 2022 and is expected to grow at a CAGR of 14.1% from 2023 to 2030. Factors driving this growth include the cloud’s ability to enhance business performance, increasing demand for hybrid and Omni-cloud systems and pay-as-you-go models. Government efforts to safeguard data and the adoption of hybrid work models post the COVID-19 pandemic are also contributing. However, data security concerns constrain growth, while large enterprises embrace the cloud to reduce costs and manage data efficiently, especially with pay-as-you-go models. Large businesses are rapidly adopting cloud services due to their on-demand availability.

Technological Advancement Take Centre Stage: The global shift towards digitization creates opportunities in various markets, including 5G, blockchain, and artificial intelligence (AI). The United States, a significant player in the IT sector, is positioned for growth due to the widespread adoption of smart technologies and increased investments in security. Companies increasingly adopt AI, ML, blockchain, and data science to gain a competitive advantage. According to Statista, the worldwide artificial intelligence market was worth $142.3 billion in 2022 and is projected to reach $207.9 billion in 2023. It is anticipated to reach a staggering $1.85 trillion by 2030. This indicates a substantial Compound Annual Growth Rate (CAGR) of 41.75% from 2022 to 2030. MLis is anticipated to experience significant growth, increasing from $140 billion to $2 trillion by 2030.

Cybersecurity, talk of the town: The rapid adoption of technology services has brought about some negative consequences. The FBI, for instance, has reported a 300% surge in cybersecurity cases. Nevertheless, the industry benefits from the growing demand for data security and privacy protection solutions. The increasing frequency of cyberattacks and associated security threats is anticipated to sustain the industry’s growth. Per Statista, Revenue is expected to show an annual growth rate (CAGR 2023-2028) of 10.48%, resulting in a market volume of $273.60 billion by 2028. According to Statista, the IT Services market is projected to reach $1,204 billion in 2023, with the market volume expected to reach $1,570 billion. This suggests a compound annual growth rate (CAGR 2023-2027) of 6.86%.

Zacks Industry Rank Indicates Encouraging Prospects

The Zacks Technology Services industry, which is housed within the broader Zacks Business Services sector, currently carries a Zacks Industry Rank #92. This rank places it in the top 37% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates continued outperformance in the near term. Our research shows that the top 50% of Zacks-ranked industries outperform the bottom 50% by a factor of more than two to one.

Before we present a few stocks that you may want to consider for your portfolio, let’s look at the industry’s recent stock market performance and current valuation.

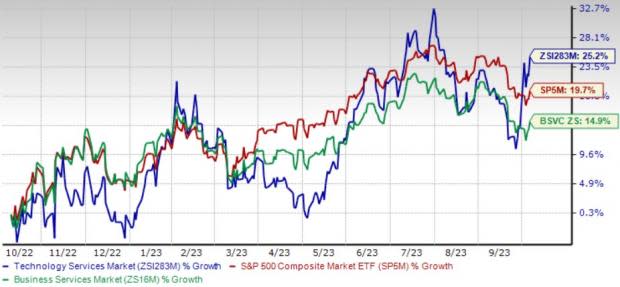

Industry Beats Sector and S&P 500

The Zacks Technology Services industry has outperformed the broader Zacks Business Services sector and the Zacks S&P 500 composite over the past year.

The industry has gained 25.2% over this period compared to a 14.9% gain of the broader sector and a 19.7% increase of the Zacks S&P 500 composite.

One-Year Price Performance

Industry’s Current Valuation

On the basis of EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation and amortization), which is commonly used for valuing Technology Services stocks, the industry is currently trading at 59.56X compared with the S&P 500’s 12.88X and the sector’s 24.2X.

Over the past five years, the industry has traded as high as 26.43X, as low as 9.18X and at the median of 15.98X, as the charts below show.

EV-to-EBITDA

4 Technology Stock Choices

We are presenting four technology stocks expected to reap the benefits of a growing market. Of them, TT and APTV have Zacks Rank #2 (Buy) while TRI and MRVL Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

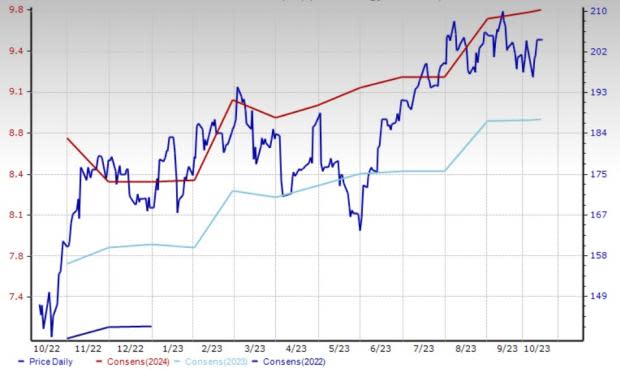

Trane Technologies is a global climate innovator, providing heating, cooling, and air quality solutions. With a commitment to sustainability, Trane Technologies delivers efficient and eco-friendly HVAC systems, enabling customers to create comfortable, sustainable living and working environments while reducing their environmental footprint. Their cutting-edge technologies promote energy efficiency and support a healthier planet for future generations.

The Zacks Consensus Estimate of the company’s revenues is expected to grow 10% for the year 2023 to $17.59 billion. Earnings are expected to record a 20.5% increase, the Zacks Consensus Estimate of which is pegged at $8.87 for fiscal 2024. The Zacks Consensus mark for full-year earnings has been revised favorably by 1.1% in the last 60 days.

Price & Consensus: TT

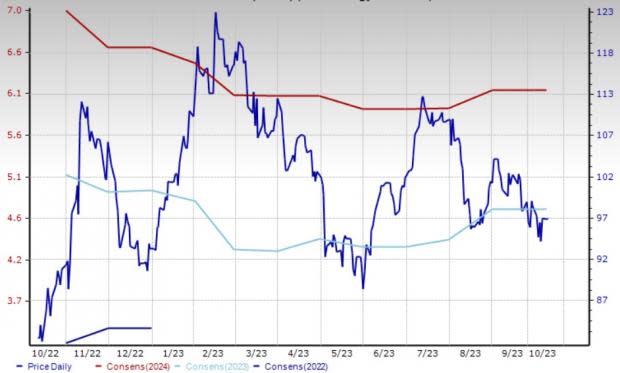

Aptiv is a global technology company specializing in advanced mobility solutions. With expertise in vehicle electrification, connected vehicle platforms, and autonomous driving technologies, Aptiv is at the forefront of shaping the future of transportation. They provide innovative solutions that enhance the automotive industry’s safety, efficiency and connectivity, catering to a world increasingly reliant on intelligent, sustainable mobility solutions.

The Zacks Consensus Estimate of the company’s revenues is expected to grow 14.8% for 2023 to $20.07 billion. Earnings are expected to record a 39% increase, the Zacks Consensus Estimate of which is pegged at $4.74 for fiscal 2024. The Zacks Consensus mark for full-year earnings has been revised favorably by 2.8% in the last 60 days.

Price & Consensus: APTV

Thomson Reuters Corp is a global media conglomerate offering trusted information and services to professionals worldwide. Focusing on finance, law, tax, and accounting, it leverages innovative technology to empower global professionals with vital insights, bolstering decision-making. Renowned for its accuracy and dependability, Thomson Reuters is a foremost provider of timely information across industries.

The Zacks Consensus Estimate of the company’s revenues is expected to grow 3% for 2023 to $6.83 billion. Earnings are expected to record 25.6% increase, the Zacks Consensus Estimate of which is pegged at $3.34 for 2023. The Zacks Consensus mark for 2023 earnings has been kept constant for the last 60 days.

Price & Consensus: TRI

Marvell Technologies is a prominent global semiconductor company specializing in data infrastructure and storage solutions. With a commitment to innovation, Marvell is vital in advancing networking, cloud computing, and storage technologies. Their cutting-edge solutions power various applications, from data centers and enterprise networks to automotive and consumer electronics, enabling efficient and high-performance connectivity in the digital age.

The Zacks Consensus Estimate of the company’s revenues is expected to decline 6.7% for fiscal 2024 to $5.52 billion. Earnings are expected to record a 27.8% decline, the Zacks Consensus Estimate of which is pegged at $1.53 for fiscal 2024. The Zacks Consensus mark for full-year earnings has been revised favorably by 1.3% in the last 60 days.

Price & Consensus: MRVL

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Thomson Reuters Corp (TRI) : Free Stock Analysis Report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

Trane Technologies plc (TT) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report