Oct 20 (Reuters) – China said on Friday it will require export permits for some graphite products to protect national security in its latest action to control supplies of critical minerals.

China is the world’s top producer and exporter of graphite, a material used in nearly all electric vehicle batteries.

The requirement, in response to challenges over its global manufacturing dominance, follows an announcement in July of similar export restrictions on gallium and germanium products used in computer chips and other components.

Widely seen as retaliation for U.S. curbs on sales of technologies to China, the graphite restrictions have heightened concern in the West that China might limit exports of other materials, including rare earths, whose production it dominates.

Tom Kavanagh, head of battery metals at Argus, said other critical minerals China dominates include forms of refined cobalt, nickel and manganese used in EV batteries.

“It is conceivable that they will use this to their advantage as the rest of the world tries to increase their battery output,” he said.

In 2010, China restricted exports of rare earths to Japan following a territorial dispute, sending prices soaring and Japan scrambling to find alternative sources. Beijing said the curbs were based on environmental concerns.

Below are some facts about rare earths, about China’s dominance of the sector, and what countries are doing to ease their dependence on Chinese production.

WHAT ARE RARE EARTHS AND HOW ARE THEY USED?

Rare earths are a group of 17 elements used in products from lasers and military equipment to magnets found in electric vehicles, wind turbines, and consumer electronics such as iPhones.

The 17 are: lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, lutetium, scandium, yttrium.

HOW DOMINANT IS CHINA IN THE RARE EARTHS SUPPLY CHAIN?

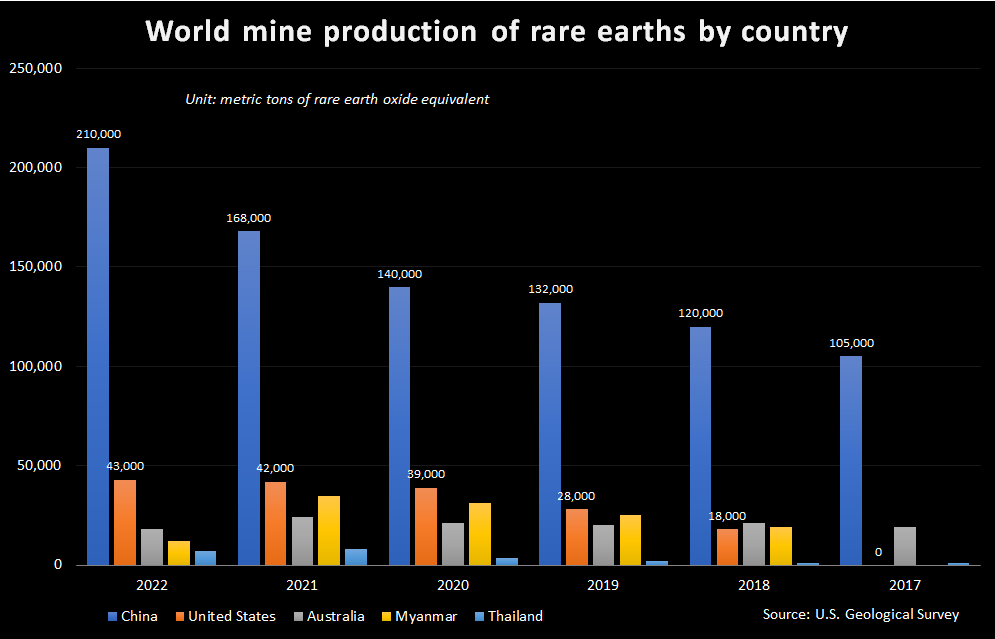

Mining: China accounted for 70% of world mine production of rare earths in 2022, followed by the United States, Australia, Myanmar and Thailand, United States Geological Survey (USGS) data shows.

Processing: China is home to at least 85% of the world’s capacity to process rare earth ores into materials that manufacturers can use, according to research firm Adamas Intelligence in 2019.

Exports: Chinese exports of rare earths declined in September from the previous month, but they rose by 6.6% during the first nine months of the year to 40,371.8 metric tonnes, Chinese customs data showed.

China exported 48,728 tonnes of rare earths in 2022, down 0.4% year-on-year.

The United States sources most of its rare earth imports from China, but that dependence has eased to 74% between 2018 and 2021, from 80% during 2014 to 2017.

WHICH COUNTRIES HAVE THE MOST RARE EARTHS RESERVES?

China is estimated to have 44 million tonnes of rare earth oxide (ROE) equivalent in reserves, or 34% of the world total, USGS data showed.

Vietnam, Russia and Brazil are estimated to have just over 20 million tonnes each, while India has 6.9 million, Australia has 4.2 million and the United States has 2.3 million tonnes.

WHAT HAPPENED IN 2010?

In 2010, China withheld exports of rare earths to Japan during a row over disputed islands. Beijing then curbed global exports of rare earths, saying it was trying to curtail pollution and preserve resources.

Japan, the European Union and the United States successfully challenged China’s action in a case at the World Trade Organization.

The episode led Japan, which had relied on China for virtually all of its rare earths, to find alternative suppliers to ease its reliance on China. It invested in Australian producer Lynas (LYC.AX) and had reduced the share of its imports of rare earths from China to 58% by 2018.

WHY IS IT HARD FOR OTHER COUNTRIES TO RAMP UP PRODUCTION?

Rare earths are relatively abundant but occur in low concentrations and are usually found mixed together with one another, or with radioactive elements such as uranium and thorium.

The chemical properties of rare earths make them difficult to separate from surrounding materials, and processing generates toxic waste.

Lax environmental standards enabled China to build its dominance in rare earths in recent decades as Western producers left the industry.

WHAT ARE OTHER COUNTRIES DOING TO REDUCE RELIANCE ON CHINA?

Western countries have ramped up support to boost domestic production of critical minerals including rare earths.

Australia, Canada, the European Union and the United States have set out policies and support packages for their critical minerals sectors.

U.S.-based MP Materials (MP.N) mines rare earth oxides at the Mountain Pass mine in California, but ships them to China for processing into neodymium and other rare earth metals, as the United States has no final processing facilities.

Electric vehicle maker Tesla (TSLA.O) is moving away from rare earths in future models to mitigate environmental and supply risks, as the rare earth industry struggles to meet demand.

CHINA QUOTA

China has increased its rare earth mining quota for this year to a record high of 240,000 tonnes, government data showed last month.

The quota system, usually issued in two batches a year, was put in place in response to China’s longstanding problems with illegal mining.

The full-year mining output quota for 2023, including 120,000 tonnes issued in March, represents a 14% rise over 2022.

Reporting by Mai Nguyen in Hanoi and Eric Onstad in London; Additional reporting by Melanie Burton in Melbourne and Dominique Patton in Beijing;

Editing by Tony Munroe, Veronica Brown and Barbara Lewis

Our Standards: The Thomson Reuters Trust Principles.