Republic Services, Inc. RSG is scheduled to release its third-quarter 2023 results on Oct 26 after market close.

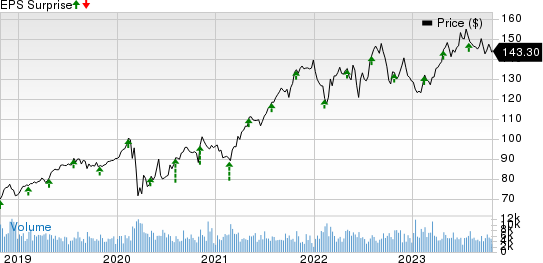

RSG has an impressive earnings surprise history, having surpassed the Zacks Consensus Estimate in all four trailing quarters. The average surprise is 9.32%.

Q3 Expectations

The Zacks Consensus Estimate for the top line is currently pegged at $3.79 billion, up 5.2% from the year-ago actual figure. The expected growth is likely to have been driven by improved segmental performance.

Republic Services, Inc. Price and EPS Surprise

Republic Services, Inc. price-eps-surprise | Republic Services, Inc. Quote

The consensus estimate for earnings per share is pegged at $1.42, up 6% from the year-ago actual figure. The increase can be attributed to proper pricing to earn appropriate returns.

Segmental Expectations

Our estimate for third-quarter 2023 revenues from the Collection segment is currently pegged at $2.57 billion, up 6.1% from the third-quarter 2022 reported figure. The increase can be attributed to the likely benefit from the deployment of RISE tablets.

Our estimate for Landfill revenues is currently pegged at $423.1 million, up 2.6% from the year-ago reported figure. The growth can be due to the expected increase in special waste revenues. Our estimate for Transfer revenues is currently pegged at $193.3 million, up 2.1% from the year-ago figure, and Environmental solutions revenues are currently pegged at $424.5 million, -indicating a 6.9% increase from the year-ago reported figure. Appropriate pricing is likely to have resulted in such growth.

Our estimate for adjusted EBITDA for the third quarter is pegged at $1.13 billion, indicating 7.1% growth from the year-ago figure. EBITDA margin is expected to be 29.8%, up 60 basis points from the year-ago margin.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for RSG this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

RSG has an Earnings ESP of -0.35% and a Zacks Rank of 3.

Stocks to Consider

Here are a few stocks from the broader Business Servicessector, which according to our model, have the right combination of elements to beat on earnings this season.

Aptiv APTV currently has a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company’s revenues are expected to increase 7.7% from the year-ago figure, while the bottom line is expected to decline 7% from the prior-year figure. APTV has beaten the Zacks Consensus Estimate in all previous four quarters, with an average surprise of 13.4%. APTV has an Earnings ESP of +1.91%. The company is scheduled to release its third-quarter earnings on Nov 2.

Gartner IT holds a Zacks Rank of 3 and has beat the Zacks Consensus Mark in all four quarters, with an average surprise of 32.6%. The company’s revenues are expected to increase 4.5% from the year-ago figure, while the bottom line is expected to decline 22.8% from the prior-year figure. IT has an Earnings ESP of +4.30%. The company is scheduled to release its third-quarter earnings on Nov 1.

Verisk Analytics VRSK: The company’s revenues are expected to decline 11.1% from the year-ago figure, while the bottom line is expected to match the prior-year figure. VRSK has beaten the Zacks Consensus Estimate in three of the previous four quarters and matched on one instance, with an average surprise of 9.9%. The company has an Earnings ESP of +2.41% and a Zacks Rank of 3. VRSK is expected to release its third-quarter earnings on Nov 1.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Republic Services, Inc. (RSG) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report