SoFi Technologies, Inc. SOFI is scheduled to report its third-quarter 2023 results on Oct 30, before market open.

The company has an impressive earnings surprise history. It surpassed the Zacks Consensus Estimate in all four trailing quarters, delivering an earnings surprise of 26.6% on average.

Expectations This Time Around

The Zacks Consensus Estimate for SoFi’s revenues in the to-be-reported quarter is pegged at $516.2 million, indicating a 21.8% year-over-year increase. The growth in lending and financial services performance, coupled with the reinforcement of the tech platform, is likely to have contributed to the positive impact on the company’s top line.

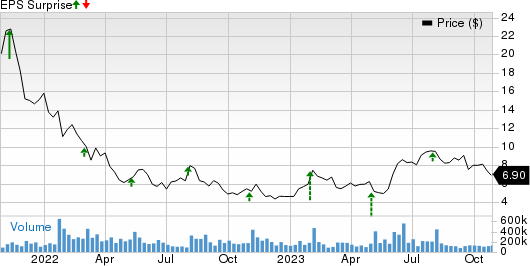

SoFi Technologies, Inc. Price and EPS Surprise

SoFi Technologies, Inc. price-eps-surprise | SoFi Technologies, Inc. Quote

The consensus estimate for the bottom line in the to-be-reported quarter is a loss of 7 cents per share. The company incurred a loss of 9 cents per share in the year-ago quarter. We expect SoFi’s cost-saving efforts to have contributed to the contraction of losses in the quarter.

What Our Model Says

Our proven model predicts an earnings beat for SOFI this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

SOFI has an Earnings ESP of +57.81% and a Zacks Rank of 3.

Other Stocks to Consider

Here are a few stocks from the broader Zacks Business Services sector, which according to our model, also have the right combination of elements to beat on earnings this season:

Aptiv APTV currently has an Earnings ESP of +4.94% and a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company’s revenues are expected to increase 7.7% from the year-ago figure and the bottom line is expected to indicate a 6.3% decline from the prior-year figure.

APTV has beaten the Zacks Consensus Estimate in all four quarters, with an average surprise of 13.4%. APTV is expected to release its third-quarter earnings on Nov 2.

Trane Technologies TT: The company’s revenues and bottom line are expected to indicate growth of 9.4% and 17.2%, respectively, from the year-ago figure.

TT has beaten the Zacks Consensus Estimate in all four quarters, with an average surprise of 7.3%. The company has an Earnings ESP of +0.54% and a Zacks Rank of 2. TT is expected to release its third-quarter earnings on Nov 1.

Verisk Analytics VRSK: The company’s revenues are expected to decline 11.1% from the year-ago figure while the bottom line is expected to match the prior-year figure.

VRSK has beaten the Zacks Consensus Estimate in three of the previous four quarters and matched on one instance, with an average surprise of 9.9%. The company has an Earnings ESP of +2.41% and a Zacks Rank of 3. VRSK is expected to release its third-quarter earnings on Nov 1.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report

Trane Technologies plc (TT) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report

SoFi Technologies, Inc. (SOFI) : Free Stock Analysis Report