BorgWarner Inc. BWA reported adjusted earnings of 98 cents per share for third-quarter 2023, up from 80 cents recorded in the prior-year quarter. The bottom line also outpaced the Zacks Consensus Estimate of 91 cents per share.

The automotive equipment supplier reported net sales of $3,622 million, missing the Zacks Consensus Estimate of $3,720 million. The top line, however, increased by 12% year over year.

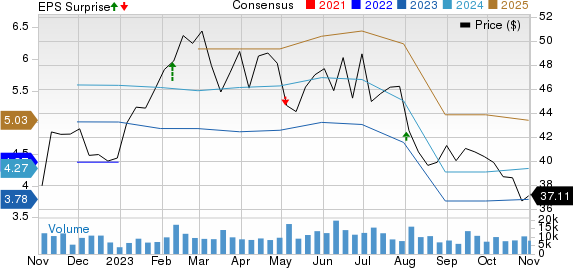

BorgWarner Inc. Price, Consensus and EPS Surprise

BorgWarner Inc. price-consensus-eps-surprise-chart | BorgWarner Inc. Quote

Segmental Performance

Air Management: Net sales totaled $1,945 million in the reported quarter compared with $1,843 million in the year-ago period. Sales, however, missed our estimate of $2,055.6 million. Adjusted operating income of $294 million rose from $291 million recorded in the year-ago quarter and topped our estimate of $293.2 million.

Drivetrain & Battery Systems: Net sales totaled $1,145 million in the reported quarter compared with $954 million in the year-ago period and surpassed our projection of $1,144.6 million. Adjusted operating income of $147 million increased from $103 million recorded in the year-ago quarter and topped our estimate of $131.2 million.

e-Propulsion: Sales from the segment were $571 million, up from $489 million a year ago but lagging our estimate of $645.8 million. The segment incurred an adjusted operating loss of $20 million, narrower than $33 million in the corresponding period of 2022 and our estimate of a loss of $27.5 million.

Financial Position

As of Sep 30, BorgWarner had $949 million in cash/cash equivalents/restricted cash compared with $1,083 million as of Dec 31, 2022. As of Sep 30, long-term debt was $3,665 million, down from $4,140 million recorded on Dec 31, 2022.

Net cash provided in operating activities from continuing operations was $221 million in the quarter under review. Capital expenditures and free cash flow totaled $185 million and $36 million, respectively.

Updated 2023 Guidance

For full-year 2023, the company anticipates net sales within $14.1-$14.3 billion, down from prior guidance of $14.2-$14.6 billion but indicating a year-over-year increase in organic sales of 12-14%.

Adjusted operating margin is expected in the band of 8.1-8.2%, down from the prior range of 9.2-9.6%. Adjusted earnings are estimated to be within $3.60-$3.80 per share compared with the previously guided range of $3.50-$3.85 per share. Operating cash is expected to be in the range of $1,200-$1,250 million. Free cash flow is projected in the band of $400-$450 million, down from the previously guided range of $400-$500 million.

The company expects its 2023 eProduct sales to be in the range of $2.0-$2.1 billion, up from approximately $1.5 billion in 2022.

Zacks Rank & Key Picks

BWA currently carries a Zacks Rank #3 (Hold).

Some top-ranked players in the auto space are Toyota Motor TM, Honda Motor Co., Ltd. HMC and Volvo VLVLY, each sporting Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TM’s 2023 sales and earnings implies year-over-year growth of 10.6% and 27.6%, respectively. The EPS estimates for 2023 and 2024 have increased by 4 cents and 21 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for HMC’s 2023 sales and earnings suggests year-over-year improvements of 7.7% and 29.4%, respectively. The EPS estimate for 2023 has moved up by a penny in the past 30 days. The EPS estimate for 2024 increased by a penny in the past seven days.

The Zacks Consensus Estimate for VLVLY’s 2023 sales and earnings indicates year-over-year rises of 4.6% and 64.4%, respectively. The EPS estimates for 2023 and 2024 have increased by 16 cents and 12 cents, respectively, in the past seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

AB Volvo (VLVLY) : Free Stock Analysis Report