As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term ElringKlinger AG (ETR:ZIL2) shareholders have had that experience, with the share price dropping 38% in three years, versus a market decline of about 0.9%. And the ride hasn’t got any smoother in recent times over the last year, with the price 23% lower in that time. Shareholders have had an even rougher run lately, with the share price down 12% in the last 90 days. But this could be related to the weak market, which is down 6.8% in the same period.

With that in mind, it’s worth seeing if the company’s underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

See our latest analysis for ElringKlinger

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

ElringKlinger became profitable within the last five years. We would usually expect to see the share price rise as a result. So given the share price is down it’s worth checking some other metrics too.

We note that, in three years, revenue has actually grown at a 8.4% annual rate, so that doesn’t seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching ElringKlinger more closely, as sometimes stocks fall unfairly. This could present an opportunity.

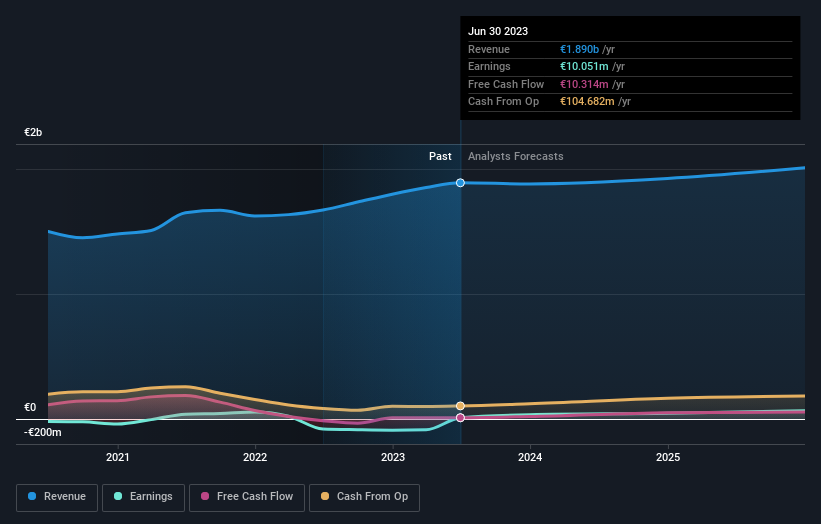

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that ElringKlinger has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think ElringKlinger will earn in the future (free profit forecasts).

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It’s fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, ElringKlinger’s TSR for the last 3 years was -35%, which exceeds the share price return mentioned earlier. And there’s no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

ElringKlinger shareholders are down 22% for the year (even including dividends), but the market itself is up 9.8%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year’s performance caps off a bad run, with the shareholders facing a total loss of 4% per year over five years. We realise that Baron Rothschild has said investors should “buy when there is blood on the streets”, but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 2 warning signs we’ve spotted with ElringKlinger (including 1 which is a bit concerning) .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.