Lear Corp LEA reported third-quarter 2023 adjusted earnings of $2.87 per share, which increased from $2.33 recorded in the year-ago quarter. The bottom line also surpassed the Zacks Consensus Estimate of $2.54 per share. Higher-than-expected revenues from both the Seating and E-Systems segments led to the outperformance. In the reported quarter, revenues increased 10% year over year to $5,781 million. The top line also beat the Zacks Consensus Estimate of $5,507.

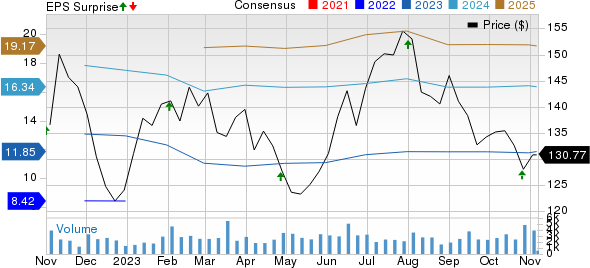

Lear Corporation Price, Consensus and EPS Surprise

Lear Corporation price-consensus-eps-surprise-chart | Lear Corporation Quote

Segment Performance

Sales of the Seating segment totaled $4,284.9 million in the reported quarter, reflecting a 10.2% increase from the year-ago quarter and surpassing our estimate of $4,005 million, thanks to higher-than-expected volumes, strong backlog and acquisition benefits. Adjusted segment earnings came in at $274.9 million, up from $254.8 million recorded in the year-ago quarter. The segment recorded adjusted margins of 6.4% of sales, down from 6.6% in the previous year quarter.

Sales in the E-Systems segment were $1,496.1 million, up 10.5% year over year and ahead of our estimate of $1,370 million on strong volumes and backlog. Adjusted segmental earnings amounted to $78.9 million, up from $53.4 million in the corresponding quarter of 2022. For the E-Systems segment, the adjusted margin was 5.3% of sales, up from 3.9% in the year-ago quarter.

Performance by Region

Sales in the North America region increased 4.2% year over year to $2,381.4 million in the quarter under review and exceeded our projection of $2,245.5 million.

Sales in the Europe and Africa region grew 26.8% year over year to $2,015.4 million in the quarter. The metric also topped our estimate of $1,867.3 million.

Sales in the Asia region totaled $1,142.5 million in the quarter, surpassing our forecast of $1,049 million and almost flat year over year.

Sales in the South America region rose 7.2% year over year to $241.7 million in the quarter, falling short of our prediction of $264 million.

Financial Position

The company had $979.7 million in cash and cash equivalents as of Sep 30, 2023 compared with $1,114.9 million recorded as of Dec 31, 2022. Long-term debt was $2,742.1 million at the quarter end compared with a debt of $2,591.2 million as of 2022-end.

During the quarter under discussion, net cash provided by operating activities totaled $403.8 million, a noticeable improvement from $252.1 million in the corresponding quarter of 2022. In the reported period, its capital expenditure amounted to $153.2 million, up from $140.4 million. The company registered a free cash flow (FCF) of $250.6 million in the quarter under review compared with $111.7 million in the previous-year quarter.

During the quarter, LEA repurchased 521,552 shares of its common stock for a total of $74.9 million. At the end of the quarter, Lear had a remaining share repurchase authorization of nearly $1.1 billion, which will expire on Dec 31, 2024. In the third quarter of 2023, Lear returned $120 million to investors via buybacks and dividends.

2023 Guidance Revised

Lear projects its full-year net sales in the band of $23,100-$23,300 million, up from the prior range of $22,350-$23,050 million and from $20,891 million recorded in 2022. Core operating earnings are now envisioned in the range of $1,085-$1,125 million compared with the previous forecast of $1,010-$1,140 million and marking an uptick from $871 million generated in 2022. Operating cash flow is projected within $1,230-$1,270 million, compared with $1,180-$1,280 million guided earlier. Lear anticipates FCF in the band of $555-$595 million, up from the previous projection of $480-$580 million. Capital spending is now forecast at around $675 million, down from $700 million guided earlier. Adjusted EBITDA is envisioned to be between $1,685 million and $1,725 million, compared with the prior guidance of $1,610-$1,740 million.

Zacks Rank & Key Picks

Lear currently carries a Zacks Rank #3 (Hold).

A few top-ranked players in the auto space include Toyota TM, Honda HMC and Stellantis STLA. While TM and HMC sport a Zacks Rank #1 (Strong Buy) each, STLA carries a Zacks Rank #2 (Buy) currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TM’s fiscal 2024 sales and EPS implies year-over-year growth of 10.5% and 30.9%, respectively. The earnings estimate for fiscal 2024 and 2025 has been revised upward by 45 cents and 40 cents, respectively, in the past seven days.

The Zacks Consensus Estimate for HMC’s fiscal 2024 sales and EPS implies year-over-year growth of 7.7% and 31%, respectively. The earnings estimate for fiscal 2024 and 2025 has been revised upward by 9 cents and 24 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for STLA’s 2023 sales and EPS implies year-over-year growth of 8% and 10.2%, respectively. The earnings estimate for 2023 and 2024 has been revised upward by 27 cents and 13 cents, respectively, in the past seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Stellantis N.V. (STLA) : Free Stock Analysis Report