After a seven-week strike, the United Auto Workers (UAW) union and the three major U.S. automakers — General Motors, Ford, and Stellantis — reached agreements last week, marking the conclusion of a historic simultaneous strike against Detroit’s Big Three. Key features of the agreements include a 25% wage increase to remain in effect until April 2028. The elimination of tiered compensation, enhanced cost-of-living adjustments (COLA) and increased 401(k) retirement contributions are among the provisions, along with the reintroduction of a three-year salary progression, addressing worker concerns.

The strike’s economic toll has been substantial, with estimates suggesting losses exceeding $9.3 billion in the U.S. auto industry. Workers collectively lost approximately $579 million in wages, manufacturers suffered losses of around $2.68 billion, suppliers took a hit of $1.6 billion, and dealers and customers combined lost $1.26 billion. These losses underscore the strike’s broad-reaching repercussions, impacting not just workers and automakers but the entire automotive supply chain and the wider U.S. economy.

Meanwhile, a host of companies reported quarterly results last week, including two S&P 500 sector components, Cummins CMI and BorgWarner BWA. Both these companies managed to pull off earnings beat. Used car e-retailer Carvana CVNA and auto equipment provider Magna International MGA also surpassed earnings estimates. Japan’s auto biggie Toyota TM also made it to the headlines with a $8 billion investment for battery production in North Carolina. Toyota’s commitment reaffirms its strategy toward vehicle electrification, with the North Carolina site set to become a significant hub for lithium-ion battery production in North America.

Last Week’s Top Stories

Cummins reported third-quarter 2023 earnings of $4.73 per share, which reflects an improvement from the prior-year quarter’s earnings of $3.21 per share. The bottom line also topped the Zacks Consensus Estimate of $4.63 per share, thanks to higher-than-expected revenues across all segments. Cummins’ revenues totaled $8,431 million, up from $7,333 million recorded in the year-ago quarter. The top line also beat the Zacks Consensus Estimate of $8,135 million.

Cummins’ cash and cash equivalents were $2,387 million as of Sep 30, 2023, up from $2,020 million on Dec 31, 2022. Long-term debt totaled $4,950 million, up from $4,498 million on Dec 31, 2022. For full-year 2023, Cummins expects revenues to grow 18-20% on a yearly basis, up from the prior guided range of 15-20%, thanks to robust demand across markets, particularly North America. EBITDA is now forecast to be in the range of 15.2-15.4% of sales, narrower than the previous estimated range of 15-15.7%. Cummins continues to stick to its plan of returning nearly 50% of its operating cash flow to shareholders in the form of dividends and share repurchases.

BorgWarner reported adjusted earnings of 98 cents per share for third-quarter 2023, up from 80 cents recorded in the prior-year quarter. The bottom line also outpaced the Zacks Consensus Estimate of 91 cents per share. Net sales of $3,622 million missed the Zacks Consensus Estimate of $3,720 million but increased by 12% year over year. As of Sep 30, BorgWarner had $949 million in cash/cash equivalents/restricted cash compared with $1,083 million as of Dec 31, 2022. As of Sep 30, long-term debt was $3,665 million, down from $4,140 million recorded on Dec 31, 2022.

For full-year 2023, the company anticipates net sales within $14.1-$14.3 billion, down from the prior guidance of $14.2-$14.6 billion but indicating a year-over-year increase in organic sales of 12-14%. Adjusted operating margin is expected in the band of 8.1-8.2%, down from the prior range of 9.2-9.6%. Adjusted earnings are estimated to be within $3.60-$3.80 per share compared with the previously guided range of $3.50-$3.85 per share. Operating cash is expected to be in the range of $1,200-$1,250 million. Free cash flow is projected in the band of $400-$450 million, down from the previously guided range of $400-$500 million. The company expects its 2023 eProduct sales to be in the range of $2.0-$2.1 billion, up from approximately $1.5 billion in 2022.

Toyota announced an expansion of its North Carolina battery manufacturing operations with an investment of nearly $8 billion. It is expected to create about 3,000 new jobs. This boost increases Toyota’s total investment in this initiative to around $13.9 billion and the projected job creation to more than 5,000. The investment will enhance the capacity for producing batteries for battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), with a planned total of 10 production lines aiming for more than 30GWh of annual production by 2030.

The site, which was first announced in 2021 with a $1.29 billion investment, is set to become Toyota’s North American nucleus for lithium-ion battery production. The site’s expansion to seven million square feet underscores Toyota’s commitment to electrification. Globally, Toyota has been a forerunner in the electrified vehicle market, with more than 24.6 million units on the road. By 2025, the company aims to offer an electrified variant for every model in the Toyota and Lexus lineup, signaling a comprehensive shift toward sustainable mobility.

Carvana delivered earnings per share of $3.60 in third-quarter 2023, in contrast to a loss of $2.67 incurred in the year-ago quarter and the Zacks Consensus Estimate of a loss of 85 cents per share. Revenues of $2,773 million topped the Zacks Consensus Estimate of $2,742 million but fell 18% year over year. Total gross profit per unit (GPU) was $5,952, reflecting a jump of 70.1% year over year. Carvana achieved an adjusted EBITDA of $148 million in the third quarter of 2023.

The company had cash and cash equivalents of $544 million as of Sep 30, 2023 compared with $434 million on Dec 31, 2022. Long-term debt amounted to $5,305 million as of Sep 30, 2023 compared with $6,574 million recorded on Dec 31, 2022. CVNA expects to generate positive adjusted EBITDA for the third straight quarter in the October-December period. It expects total non-GAAP GPU to exceed $5,000 in the fourth quarter of 2023. It anticipates fourth-quarter retail units to decline due to industry and seasonal patterns.

Magna reported third-quarter 2023 adjusted earnings of $1.46 per share, up 33% on a year-over-year basis. The bottom line also surpassed the Zacks Consensus Estimate of $1.37 a share. In the reported quarter, net sales increased 15% from the prior-year quarter to $10,688 million, surpassing the Zacks Consensus Estimate of $10,358 million. Magna had $1,022 million in cash and cash equivalents as of Sep 30, 2023, down from $1,234 million as of Dec 31, 2022. Long-term debt, as of Sep 30, 2023, was $4,135 million, up from $2,847 million as of Dec 31, 2022. In the reported quarter, cash provided by operating activities totaled $797 million, up from the year-ago figure of $238 million.

Magna expects full-year 2023 revenues in the band of $42.1-$43.1 billion compared with the previous guidance of $41.9-$43.5 billion. Adjusted EBIT margin is forecast in the range of 5.1-5.4%, up from the previous guidance of 4.9-5.3%. Capex is estimated to be $2.5 billion, the same as the previous guidance.

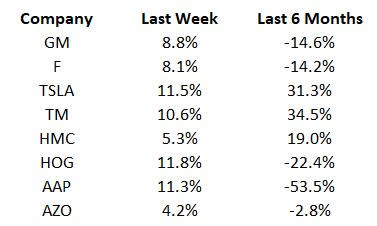

Price Performance

The following table shows the price movement of some of the major auto players over the last week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

Industry watchers will track China vehicle sales data for October 2023, which will be released by the China Association of Automobile Manufacturers soon.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

Cummins Inc. (CMI) : Free Stock Analysis Report

Magna International Inc. (MGA) : Free Stock Analysis Report

Carvana Co. (CVNA) : Free Stock Analysis Report