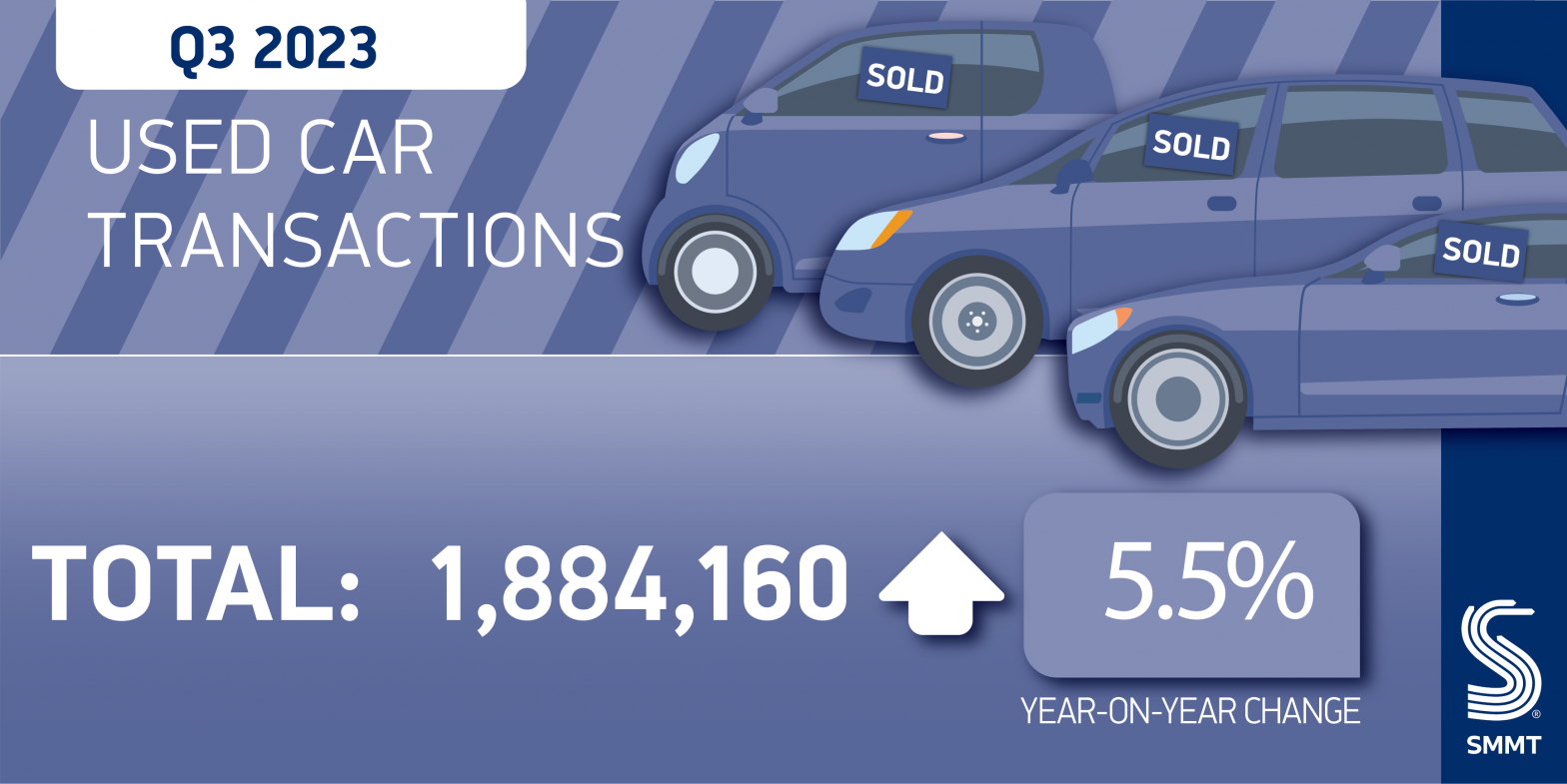

- UK used car market grows 5.5% in Q3 2023, with almost 1.9 million units changing hands.

- Battery electric vehicle (BEVs) sales soar by 99.9%, recording record 1.8% market share.

- Market up 4.6% year to date, an increase on 2022, but still -9.3% behind pre-pandemic levels.

Download the used car sales report for Q3 2023

The UK’s used car market grew by 5.5% during the third quarter, with 1,884,160 units changing hands, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The increase marks the third successive – and best quarterly – growth of the year, with 98,713 additional transactions compared with the same period in 2022,1 following a robust increase in supply as the new car market recovers.

Volumes in each month of the quarter rose, with the strongest gain in September, up 6.3%, which helped the market deliver the best Q3 performance since 2021. Reflecting an increase in supply, demand for battery electric vehicles (BEVs) doubled in the quarter, reaching a record market share as volumes rose by 99.9% to 34,021 units. The boost now means BEVs represent 1.8% of the used market, up from 1.0% last year. Plug-in hybrids (PHEVs), and hybrids (HEVs) also grew, up 34.6%, and 46.4% respectively – resulting in combined plug-ins increasing by 70.9% to comprise 2.8% of the market. Volumes for petrol and diesel cars, meanwhile, grew by 4.0% to 1,065,448 and 2.3% to 704,204 units respectively.

Superminis remained the most popular vehicle type, rising by 5.8% to 607,484 units and accounting for 32.3% of transactions. Rounding off the top three vehicle types were lower medium and dual purpose cars, both rising by 7.1% to make up 26.8% and 14.9% of the market. Combined, the three segments account for almost three quarters (73.9%) of all cars sold in Q3. At the other end of the scale, sports and luxury saloons were the only segments to see declines, falling -1.8% and -2.5% respectively.

Black remained the most popular used car colour for the 11th consecutive quarter, equating to more than a fifth (21.3%) of sales. The top five remain the same as Q3 2022, with grey taking second place and seeing above average gains – growing 9.8% to increase market share to 17.1%. Blue held strong in third place, silver – which once firmly held pole position – was fourth and white placed in fifth.

As a result, the overall market is up 4.6% to 5,563,576 units year to date, an increase of 244,094 units on 2022, although uptake remains -9.3% off pre-pandemic levels.3

Mike Hawes, SMMT Chief Executive, said,

The used car market continues to grow strongly, with re-energised supply unlocking demand for pre-owned electric vehicles – the result being twice as many motorists switching to zero emission motoring in the quarter. Maintaining this momentum requires growth in the new car market, to boost supply to the used sector and cement this success. Equally important is the urgent need for charging infrastructure rollout, so that all drivers can have confidence in being able to charge whenever and wherever they need.

Notes to editors

1 Used car transactions, Q3 2022: 1,785,477 units

2 Used car transactions, Q3 2021: 2,034,463 units

3 Used car transactions, Q3 2019: 2,076,382 units