Aptiv PLC APTV remains well poised to gain from technology investments and acquisitions that help it capitalize on developing opportunities in the automotive market.

The Zacks Consensus Estimate for the company’s 2023 earnings of $4.73 indicates growth of 38.7% from that reported a year ago. Earnings are expected to register 24.7% growth in 2024. APTV has a long-term expected earnings per share growth rate of 17.2%.

Factors That Augur Well

Aptiv is exposed to the lucrative connected cars market. With security becoming a key selling point for connected cars, automakers are increasingly seeking related technologies. This is one of the reasons behind the quick advancement of the driver-assistance system market. Demand for personalization, infotainment connectivity and convenience are increasing rapidly. Added features require more wiring inside vehicles.

We believe that with excellent system integration expertise, Aptiv is well-positioned to leverage the growing electrification, connectivity and autonomy trends in the automotive sector.

The company’s “smart architecture” provides a competitive advantage and should help it continue gaining market share. Decreasing environmental impact and increasing fuel economy are the key industry trends, and OEMs have increased their search for better engine management and lower power consumption. Aptiv intends to take advantage of this trend as its “smart architecture” reduces wiring requirements in cars, helping them become fuel-efficient and add features.

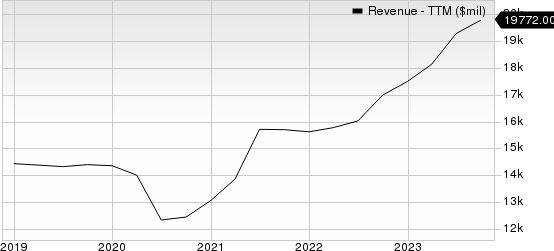

Aptiv PLC Revenue (TTM)

Aptiv PLC revenue-ttm | Aptiv PLC Quote

The 2022 acquisition of Wind River expanded Aptiv’s position in the automotive software solutions market. Another 2022 acquisition, Intercable Automotive Solutions, strengthened the company’s position as a global leader in vehicle architecture systems. Aptiv intends to continue making investments aimed at organic and inorganic growth. Since it acquires a large number of companies on an ongoing basis, the integration of these companies generates cost synergies, which improve the efficiency of the combined company.

A Risk

Aptiv is witnessing an escalation in costs as it continues to invest in organic as well as inorganic growth. Investments generally take a few years to generate revenues. Acquisitions would be immediately accretive, though, at least in some cases.

Zacks Rank and Stocks to Consider

Aptiv currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Investors can consider the following better-ranked stocks:

Rollins ROL currently carries a Zacks Rank #2 (Buy). For the fourth quarter of 2023, the Zacks Consensus Estimate for earnings is pegged at 20 cents, indicating year-over-year growth of 17.7%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ROL has an impressive earnings surprise history, beating the consensus mark in three of the four trailing quarters and matching once, the average surprise being 7.2%.

Maximus MMS also carries a Zacks Rank of 2. The consensus mark for earnings in the first quarter of fiscal 2024 stands at $1.25 per share, indicating 33% year-over-year growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Rollins, Inc. (ROL) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report