[1/3]Workers select and pack items during Cyber Monday at the Amazon fulfilment center in Robbinsville Township in New Jersey, U.S., November 28, 2022. REUTERS/Eduardo Munoz Acquire Licensing Rights

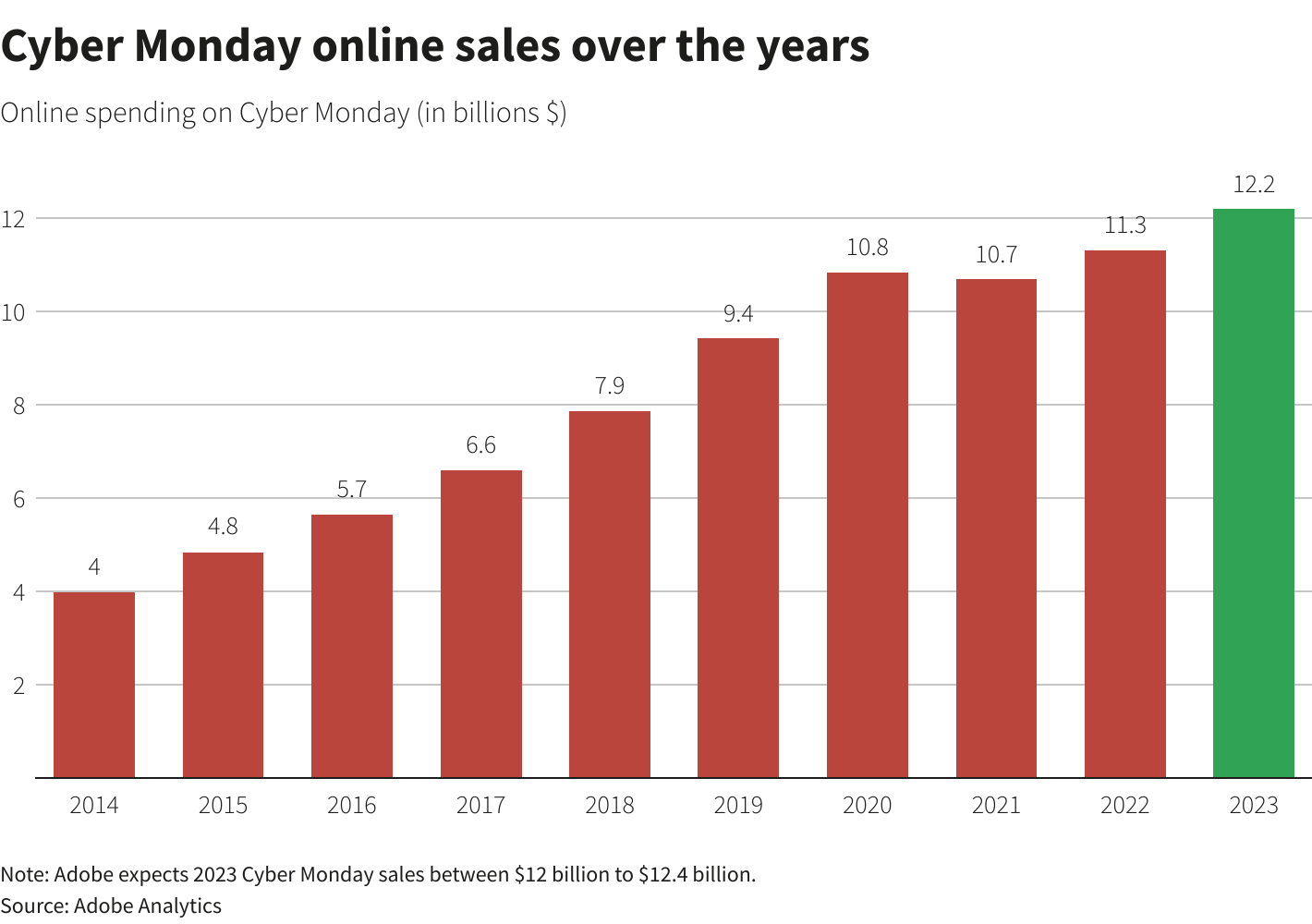

Nov 27 (Reuters) – With U.S. shoppers expected to spend as much as $12.4 billion on heavily-discounted cosmetics, electronics, toys, clothing and other products on Cyber Monday, investors took note of strong online traffic and pointed to Amazon (AMZN.O), Walmart (WMT.N) and Apple as possible winners for the day.

Retailers hit the send button on push notifications, text messages and video streaming ads to reach shoppers on mobile phones.

Amazon began marketing Cyber Monday Deals as early as Saturday, including up to 46% off some Instant Pot kitchen appliances, 37% off certain Vitamix blenders, and 35% on Amazon devices including a 55-inch Amazon Fire TV.

Walmart, eager to capture market share, slashed prices on Sunday night, joining the trend of retailers’ early discounts on major shopping days.

Apple offered Apple Gift Cards of up to $200 with eligible purchases.

“It’s a little early to see how this all plays out,” said Jim Worden, chief investment officer of Wealth Consulting Group, which holds shares of Amazon. “There’s still good spending” online. “While the prices of TVs and some electronics have come down a lot, I don’t know how much the average consumer is going to nibble on these,” he said.

“The biggest discounts are still ahead, and shoppers are all too aware of that,” retail consultant Carol Spieckerman said at mid-day on Monday, pointing to lackluster store traffic on Black Friday, the day after Thanksgiving.

Reuters Graphics

Reuters Graphics

Last-minute shoppers on Monday could spend $4 billion between 6 p.m. and 11 p.m. ET alone, said Vivek Pandya, lead analyst at Adobe Digital Insights, which tracks data through Adobe’s Experience Cloud service for e-commerce platforms. “Consumers are going to be concerned about discounts weakening after that,” he added.

“One of the biggest things that we would be looking at is if the discounts throughout the day started to deepen,” said Brian Mulberry, client portfolio manager at Zacks Investment Management, which owns Amazon and Walmart shares. “That would tell you that demand might be slacking off at some point…. But with 12 hours to go” until midnight “that doesn’t seem to be happening.”

Mulberry added that Amazon and Apple are “looking very strong again and not having to discount things as much,” which indicated possible healthy consumer demand for their merchandise on Cyber Monday.

“Walmart has built a lot of infrastructure over the last couple of years to compete with Amazon on Cyber Monday,” he said. “And for consumers, placing more orders for more stuff is now easier at Walmart than it has been before.”

Area chart with data from Insider Intelligence shows retail e-commerce sales in the U.S. from Thanksgiving to Cyber Monday every year from 2017 to 2022 and a forecast for 2023.

Area chart with data from Insider Intelligence shows retail e-commerce sales in the U.S. from Thanksgiving to Cyber Monday every year from 2017 to 2022 and a forecast for 2023.

Reporting by Arriana McLymore, Deborah Sophia, Aishwarya Venogupal and Ananya Mariam Rajeash. Editing by David Gregorio and Nick Zieminski

Our Standards: The Thomson Reuters Trust Principles.