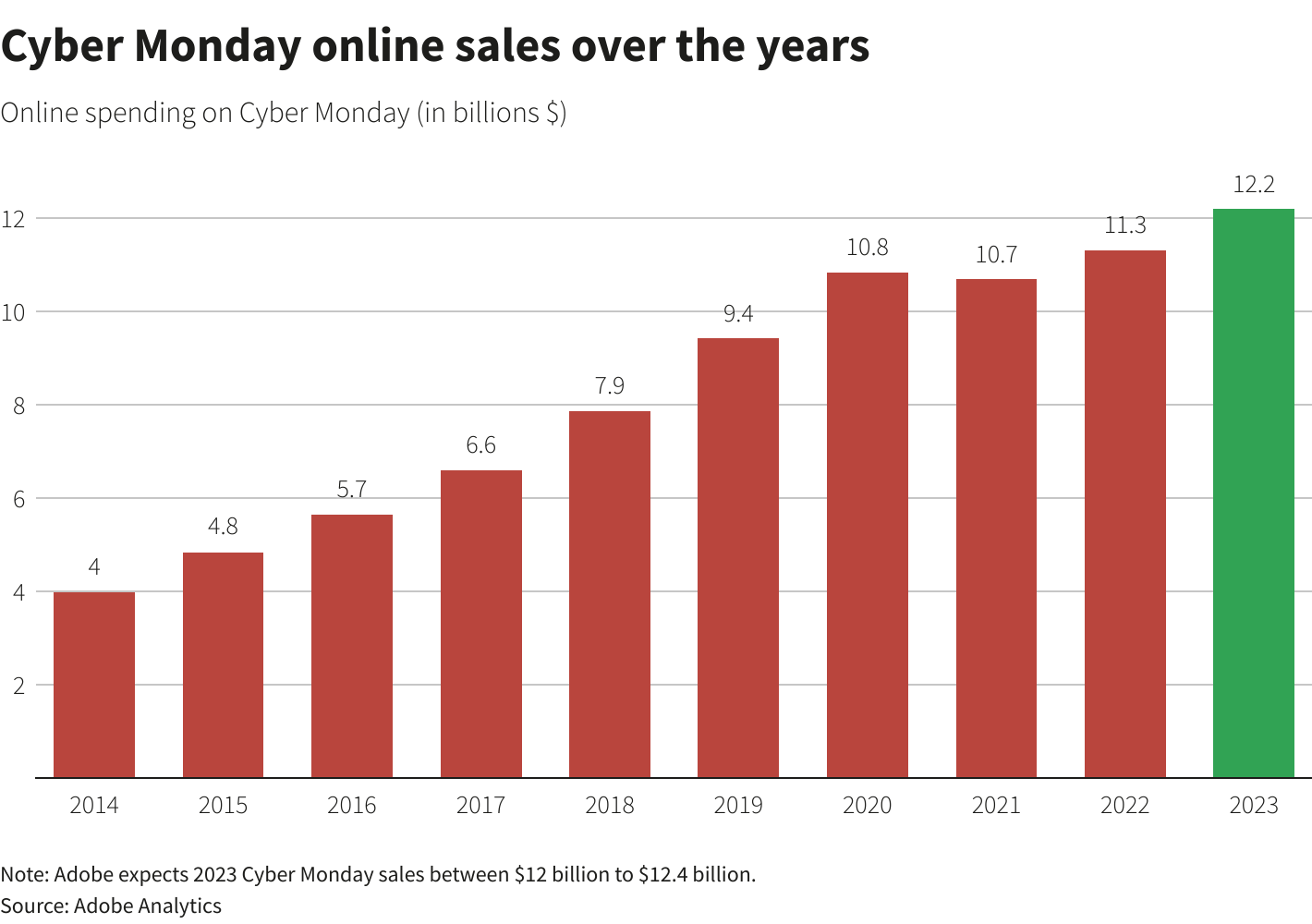

Nov 28 (Reuters) – Spending online on Cyber Monday is set to exceed $12 billion, a record, as bargain hunters snap up deals on items including Barbie dolls, Lego sets, headphones and smart watches, according to preliminary estimates from Adobe Digital Insights.

The estimate projects U.S. shoppers will spend $12 billion-$12.4 billion on Cyber Monday, the biggest U.S. online shopping day.

A significant portion of this spending, around $4 billion, is expected to occur between 6 p.m. and 11 p.m. EST, particularly from last-minute shoppers, it said. At the top end, this would represent an 9.7% increase compared to the $11.3 billion spent on Cyber Monday last year.

Retailers have been coaxing inflation-weary U.S. shoppers to open their wallets on Cyber Monday with push notifications, text messages and video streaming ads touting heavily discounted cosmetics, electronics, toys, clothing and other products.

The push seems to have worked with U.S. shoppers spending $8.3 billion online as of 6 pm EST (2300 GMT), according to Adobe Analytics, which tracks data through Adobe’s Experience Cloud service for e-commerce platforms.

A record amount of price-pinched holiday shoppers are also expected to use buy now, pay later services for Cyber Monday to relieve stress on their wallets, according to the firm.

“Whether the consumer is going to continue at this pace or not, we’ll continue to see them spend. I think this is going to be a much better-than-advertised Christmas,” said Nancy Tengler, CEO of Laffer Tengler Investments in Scottsdale, Arizona.

Shoppers have been hunting for deals since 12 a.m. on Monday with transactions during the first 12 hours of the day exceeding those during the same timeframe in 2022, according to data firm Criteo, which tracks sales from more than 700 brands and retailers in the United States.

[1/3]Workers select and pack items during Cyber Monday at the Amazon fulfilment center in Robbinsville Township in New Jersey, U.S., November 28, 2022. REUTERS/Eduardo Munoz Acquire Licensing Rights

“Consumers are quite resilient and have found ways to buy presents and experiences for their kids and their pets,” said Matthew Katz, Managing Partner at consulting firm SSA & Company.

Still, Walmart (WMT.N)

, Target (TGT.N)

and Home Depot <HD.N> are among firms to raise caution on the strength of the consumer, citing higher interest rates and depleting household savings.

Charles Sizemore, chief investment officer at Sizemore Capital Management, said he expects retailers to have to discount more in the weeks ahead.

This makes him worried about profit margins at a time input and labor costs have not come down and shoppers continue to be picky. “I really think margins are going to be depressed,” during the holiday season, said Sizemore, whose firm holds about $2 million of shares each in Walmart and Target.

Amazon (AMZN.O) began marketing Cyber Monday Deals as early as Saturday, including discounts of up to 46% on some Instant Pot kitchen appliances, 37% off certain Vitamix blenders, and 35% on Amazon devices including a 55-inch Amazon Fire TV.

Walmart, eager to capture market share, slashed prices on Sunday night, joining the trend of retailers’ early discounts on major shopping days. On Monday, Walmart stepped up discounts on some clothing to 60%, up from the 50% it offered on Black Friday.

Reporting by Siddharth Cavale and Arriana McLymore in New York, and Deborah Sophia, Aishwarya Venogupal and Ananya Mariam Rajesh in Bengaluru

Editing by David Gregorio, Nick Zieminski, Matthew Lewis and Lincoln Feast

Our Standards: The Thomson Reuters Trust Principles.