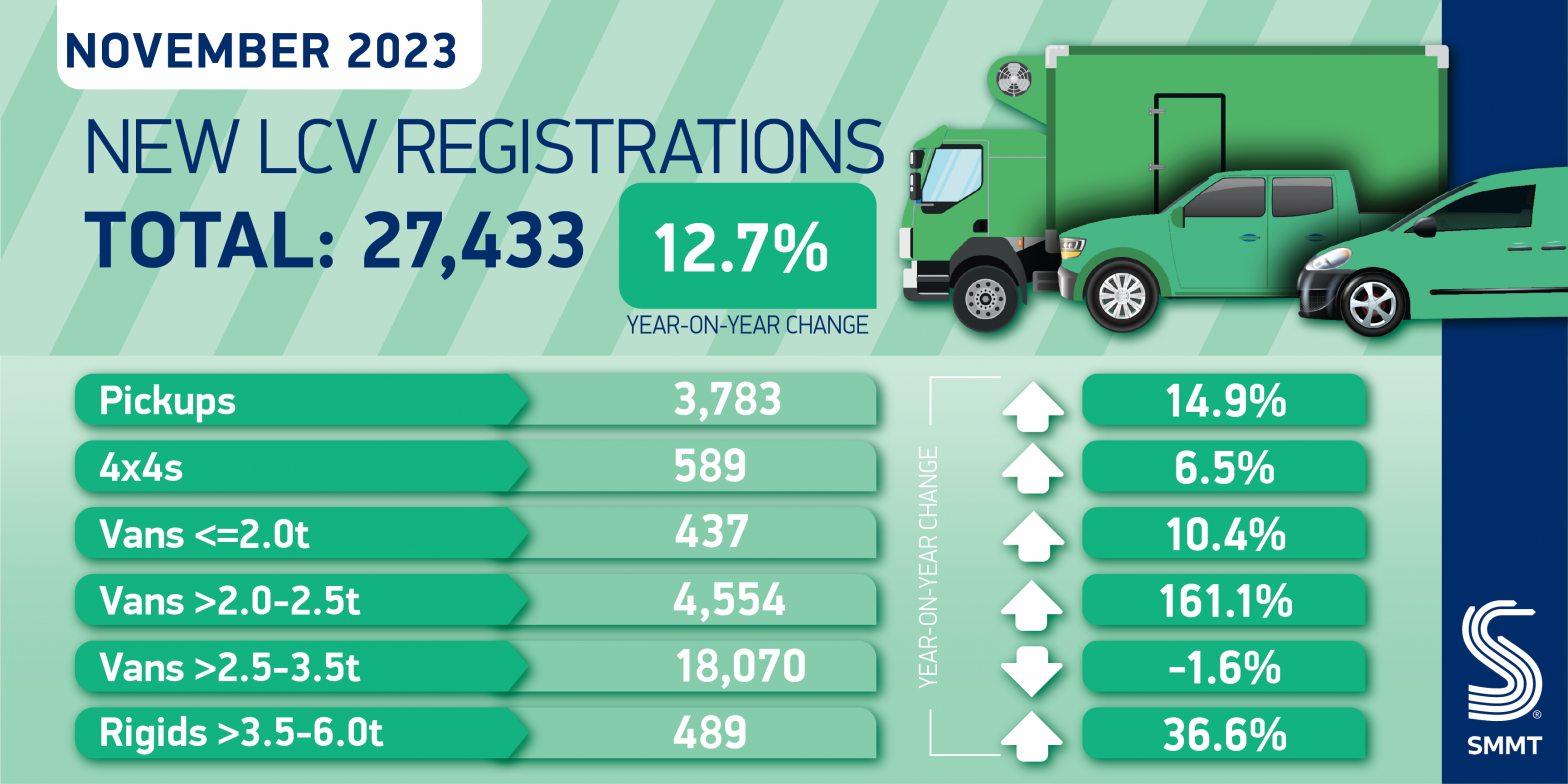

- UK new light commercial vehicle market rises for 11th month in a row, up 12.7% to 27,433 units in November.

- Demand for medium sized vans more than doubles, up 161.1%, but large vans still most popular as operators opt for payload efficiencies.

- Second monthly decline in battery electric van uptake fails to derail YTD gains, but urgent solutions to Rules of Origin tariff threat and van-suitable charging infrastructure crucial to long-term growth.

SEE LCV REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

Britain’s new light commercial vehicle (LCV) market grew by 12.7% in November as 27,433 vans, pickups and 4x4s joined Britain’s fleets, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The performance is 4.6% above pre-pandemic 2019 levels and represents 11 consecutive months of rising demand, totalling 311,754 units – the largest volume for two years as product availability continues to improve.1

The greatest volume growth was delivered via medium-sized vans, more than doubling by 161.1% to 4,554 units, while rising registrations of 4x4s and pickups continued, up 6.5% and 14.9% respectively to 589 units and 3,783 units. New LCV buyers continue to show preference for payload and fuel efficiencies, however, with the largest van models – those weighing greater than 2.5 tonnes to 3.5 tonnes – representing 18,070 units and 65.9% of the market, albeit -1.6% units fewer than in November last year. Small van registrations, meanwhile, grew 10.4% to 437 units.

Battery electric van (BEV) registrations fell for the second month, as 1,631 units were registered – some 343 fewer than in November last year2 – however, the broader trend is positive with BEV registrations up 15.0% since January. 17,289 BEVs have joined UK roads in 2023, accounting for almost one in 18 new vans registered across the year. The recent stall in demand, therefore, underscores the importance of measures that encourage van operators to invest in the benefits that zero emission technology offers, from lower CO2 emissions to increased performance, and potentially lower running costs.

The most pressing priority is swift action to delay tough Rules of Origin requirements that will place tariffs on BEVs traded across the Channel from 1 January – potentially reducing choice and affordability. With four in five (83.6%) BEVs registered this year originating in the EU, and the UK increasing its BEV exports, the new rules pose a clear threat to the transition, just as new regulation mandating the sale of these vehicles comes into effect. Operator confidence must also be safeguarded by accelerating public chargepoint rollout with a national delivery plan that considers the specific needs of larger vans.

Mike Hawes, SMMT Chief Executive, said,

An eleventh month of growth in Britain’s van sector is hugely positive, especially given fleet renewal is key to decarbonisation. It is crucial that operator demand also translates to zero emission van uptake, driving down CO2 emissions to meet Britain’s ambitious environmental targets. These are severely threatened by Rules of Origin requirements due in less than four weeks’ time, so it is essential that a pragmatic solution is found, and fast.

Notes to Editors

1 LCV registrations, November 2019: 26,238 units.

2 BEV registrations, January-November 2022: 15,039 units.