Nio (NIO 4.61%) stock made big gains in Monday’s trading. The Chinese electric vehicle (EV) company’s share price closed out the daily session up 4.6%, according to data from S&P Global Market Intelligence.

Nio published a press release before the market opened today announcing that it was on track to receive a new round of investment funding from CYVN Holdings — an Abu Dhabi-based holding company. Per the agreement, CYVN will invest $2.2 billion in Nio and receive 294 million shares of stock at a price of $7.50 per share.

Is Nio stock a buy right now?

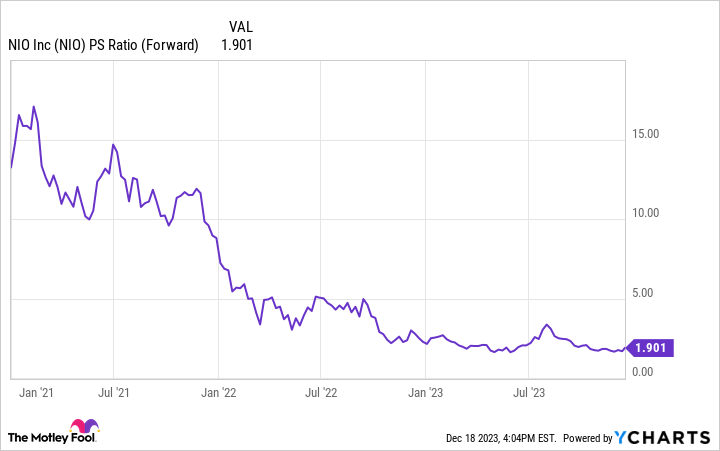

Despite the big pop today, Nio stock is still down significantly across 2023’s trading. The company’s share price has fallen roughly 14% year to date. Even more striking, the EV stock trades down approximately 87% from the lifetime high that it reached in February 2021.

NIO PS Ratio (Forward) data by YCharts.

Nio stock now trades at roughly 1.9 times this year’s expected sales — a level that could potentially be considered quite cheap because the business has continued to grow its sales at an encouraging rate despite an unfavorable macroeconomic backdrop. But the injection of new capital from CYVN could also be viewed as a reminder that the company has been making much slower progress when it comes to its bottom line.

While Nio’s revenue jumped 46.6% year over year to reach roughly $2.61 billion in the company’s most recent quarter, gross profit for the period came in at $208.8 million, representing a decrease of approximately 12% year over year. As a result of declining margins, the company’s net loss for the period hit $624.6 million — up 10.8% from the loss posted in last year’s quarter.

The new funding injection from CYVN represents a significant new vote of confidence from an institutional investor. On the other hand, the investment conglomerate’s big purchase of new stock also highlights the fact that Nio’s mounting losses have increased the company’s need for outside funding.

For risk-tolerant investors seeking ways to play China’s large and growing EV market, Nio stock could be a worthwhile portfolio addition. But if you don’t have above-average risk tolerance, it probably makes more sense to remain on the sidelines right now.

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nio. The Motley Fool has a disclosure policy.