China’s electric vehicle (EV) maker, NIO, Inc. NIO has performed poorly on the bourses so far this year amid high interest rates and slower economic recovery in China, which impacted deliveries, particularly in the first half of 2023. The company also grappled with low vehicle margins. High operational costs for the development of new products and expansion initiatives increased operating costs. Additionally, the price war started by EV industry leader Tesla TSLA prompted NIO to slash prices across its models, which further weighed on margins. Stiff competition with its local rivals like Li Auto LI and XPeng XPEV added to NIO’s difficulties in navigating this demanding landscape.

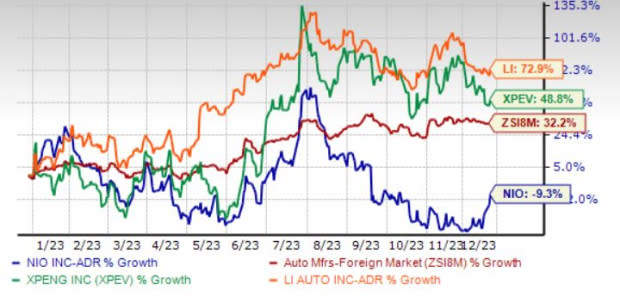

Year to date, shares of NIO have declined 9.3% against the industry’s growth of 32.2%. In comparison, LI and XPEV witnessed a sharp uptick of 72.9% and 48.8%, respectively.

Image Source: Zacks Investment Research

In terms of valuation, NIO’s P/S F12M ratio of 1.23 presently compares favorably with XPEV and LI’s 1.52X and 1.43X, respectively.

Currently priced at around $9/share, NIO is trading at a steep discount to its 52-week high of $16.18/share. So, should you buy the dip in the stock? Well, we think a potential comeback is on the horizon, and you should invest in this Chinese EV stock for profits in 2024.

Resurgent Delivery Momentum: After witnessing sequential declines in delivery volumes in the first and second quarters of 2023, NIO demonstrated strong delivery momentum in the third quarter and the first two months of the fourth quarter. Around 16,000 units were delivered on average in the last two months. For fourth-quarter 2023, NIO projects deliveries in the range of 47,000-49,000 vehicles, suggesting a 17.3-22.3% surge year over year.

The recent upgrade of GDP growth forecasts by the International Monetary Fund for China indicates an encouraging economic landscape. The agency now expects China’s economy to grow by 4.6% in 2024, up from its previous forecast of 4.2% in October. Chinese consumers’ spending is also on the rise, as evidenced by a notable 10.1% increase in national retail sales in November. With increasing economic activity and consumer expenditure, NIO appears positioned to benefit from favorable economic tailwinds in 2024.

Improving Vehicle Margins: NIO’s vehicle margins plunged to as low as 5.1% in the first quarter of 2023 amid intensifying pricing pressure in China’s EV industry. However, the last two quarters have witnessed an uptick in vehicle margins, particularly in the third quarter, thanks to decreased promotions. In the last reported quarter, NIO reported a vehicle margin of 11%, up 4.8 percentage points from the second quarter of 2023. Encouragingly, the company guided a vehicle margin of 15% for the fourth quarter of 2023. NIO anticipates vehicle margin in the band of 15-18% for 2024 and 20-22% for the longer term, driven by enhancements to the cost structure of the NT2 product, achieved through design optimization and improvements in supply chain and production efficiency.

Moreover, early this month, NIO announced that it would acquire two JAC plants for $442 million, marking a crucial shift from contract manufacturing to full-fledged factory management. This strategic move is expected to reduce production costs by approximately 10%, per management. Due to its manufacturing arrangement with JAC, there wasn’t much scope for NIO to streamline manufacturing costs. But that’s about to change now. Gaining full control over the manufacturing process will enable NIO to enhance efficiency and have greater influence in the competitive landscape, establishing a foundation for improved performance and cost-effectiveness.

Robust Battery Swap Network: NIO’s battery swap technology — part of NIO’s battery as a service (BaaS) strategy —provides an edge to the firm over its peers. The company claims that a battery pack can be replaced in its vehicles in about three minutes. On the latest earnings call, NIO notified that it had installed 2,226 power swap stations worldwide. Encouragingly, NIO is expected to increase the total number of battery-swap stations to more than 2,300 by 2023-end.

NIO’s strategic collaboration with Changan Automobile and Geely Holdings Group, allowing access to its battery swap network, signals a pivotal move, akin to Tesla’s successful Supercharger network model. This partnership not only opens new revenue streams through access fees but aligns with industry trends, enhancing NIO’s market influence.

NIO likens the battery swap network to cloud services and infrastructure—commencing with internal service and subsequently opening up to the public. The company plans to bring in partners to acquire the assets of the battery swap network but entrust its operations to NIO. Notably, NIO Power’s charging business is almost breaking even, with 80% of electricity consumed by other brands, underscoring the success and efficiency of NIO’s charging ecosystem.

Additionally, market speculation suggests that NIO may consider spinning off its battery production unit and swapping technology as a distinct entity. Such a move could potentially generate additional liquidity for the parent company.

Mobility Revolution with NOP+: Leveraging the backing of 29 highway battery swap stations, NIO’s PSP system smoothly incorporates NOP+ with cutting-edge battery swap technologies. NOP+ stands as NIO’s driver assistance software akin to Tesla’s FSD. Concurrently, the company is advancing its NAD (NIO Autonomous Driving) software. Having effectively introduced NOP+ to early adopters across 100 cities, exceeding the 60,000 km testing milestone, NIO is well-positioned to accelerate the citywide rollout of NOP+, propelled by an advanced closed-loop data system and inventive hardware embedding strategies.

Funding Boost From Abu Dhabi: NIO recently secured a $2.2 billion investment from Abu Dhabi’s CYVN Holdings, which not only strengthens the EV maker’s financial position but also cements CYVN’s confidence in NIO’s strategic standing in the EV industry. With CYVN’s increased stake of about 20.1%, NIO gains crucial support for its long-term initiatives. This funding provides NIO with a fortified balance sheet, enabling intensified brand positioning, enhanced sales and service capabilities, and substantial investments in core technologies. Moreover, the collaboration with CYVN extends beyond financial backing, fostering strategic and technical collaborations in international markets and positioning NIO for sustained growth amid a transformative automotive landscape.

Buy NIO Now

While NIO is yet to turn a profit and is suffering from weak cash flow, the company seems to be making progress in the right direction. Hence, investing in NIO shares at the current price point might be prudent due to multiple factors. Its robust relationship with China’s government and innovative lineup, featuring models like ES6, ES8, EC6, EL7, ET5, ET7, and EC7, will act as growth drivers. The recent commencement of deliveries for the all-new EC6 underscores its commitment to product innovation. NIO’s strategic focus on core technologies, in-house manufacturing for cost reduction, and an emphasis on product development and service expansion are set to boost prospects.

The upcoming year holds promise, with the full potential of NIO’s second-generation products set to be unleashed, further solidifying its competitive edge. Increasing average selling prices and growing sales signal a positive trajectory. With the worst seemingly behind, NIO is poised for a promising 2024 backed by factors like cash boost, delivery upticks, model launches and an improvement in margins.

NIO currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for NIO’s top and bottom line implies a year-over-year improvement of 52% and 31%, respectively.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report

Li Auto Inc. Sponsored ADR (LI) : Free Stock Analysis Report

XPeng Inc. Sponsored ADR (XPEV) : Free Stock Analysis Report