The Zacks Industrial Products sector put up a resilient show in 2023 despite the persistence of inflationary pressure and aggressive interest rate policy from the Federal Reserve. However, the situation appears to be improving lately as inflation continued to show signs of a steady decline and expectations of multiple rate cuts in 2024 heightened. The industrial sector put up a great fight against the odds as demand remained high.

The easing of supply-chain disruptions amid a healthy demand environment has led to a slow but steady improvement in industrial production of late. Per the latest report published by the Federal Reserve, production at U.S. factories increased 0.2% month over month in November, and manufacturing output rose 0.3%. Also, capacity utilization inched up 0.1% point from the previous month’s level to 78.8% in November.

As momentum in the U.S. economy continued, strength across several end-markets, including mining, aerospace, transportation equipment, appliances and components and electrical equipment are expected to drive the performance of industrial stocks. We believe that stocks like Eaton Corporation plc ETN, Axon Enterprise, Inc. AXON, A. O. Smith Corporation AOS, Kadant Inc. KAI and Alamo Group Inc. ALG are worth adding to your portfolio now.

What’s in Store for Industrial Stocks in 2024?

Despite a sharp decline in inflation, activity in the manufacturing sector has not been impressive over the past few months. Per the Institute for Supply Management’s report, the Manufacturing PMI (Purchasing Manager’s Index) touched 46.7% in November, contracting for the 13th consecutive month. However, the manufacturing sector has been showing signs of gradual improvement.

In November, the New Order Index increased 2.8 percentage points from the previous month’s level. The uptick in new orders, especially for durable goods, in conjunction with the improvement in supply chain, is expected to bolster manufacturing activity in 2024.

Also, in the face of easing inflation and price pressures, the industrial sector is expected to gain as the Federal Reserve hinted at multiple rate hikes in 2024. The central bank is expected to go for at least three 25 basis point rate cuts next year, which will likely drive orders and bolster manufacturing activity.

Lower interest rates will enable people to come out of their cautious spending pattern and allow them to spend more freely. Additionally, the reduction in raw material costs should aid the bottom line of industrial companies. Given this situation, investing in industrial stocks seems to be a prudent choice.

5 Top Industrial Stocks for 2024

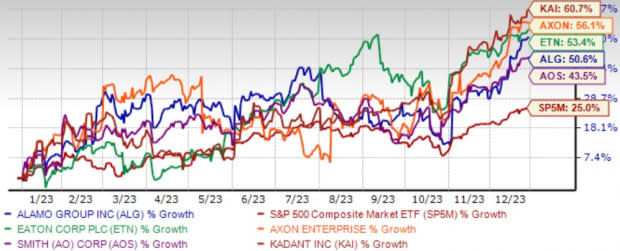

The below-mentioned stocks, having put up solid performances in 2023 so far, make for good investment options. These stocks carry a Zacks Rank #1 (Strong Buy) or #2 (Buy) each and have a market capitalization of more than $1 billion. Stocks with larger market capitalization can better withstand market downturns and hence are considered safer bets. You can see the complete list of today’s Zacks #1 Rank stocks here.

Alamo Group: Based in Seguin, TX, the company is a leader in the design, manufacture, distribution and service of high quality-equipment for infrastructure maintenance, agriculture and other applications. ALG has been witnessing strong customer demand in its end-markets. Strong order levels in both Vegetation Management and Industrial Equipment segments bode well for solid performances in the quarters ahead. Improved supply-chain performance, efforts to improve efficiency and lower costs are likely to boost its margin.

The Zacks Consensus Estimate for ALG’s 2024 earnings growth rate is pegged at 13.6%. The consensus estimate for current-year earnings has improved 5% over the past 60 days. This currently Zacks Rank #1 company has a trailing four-quarter average earnings surprise of 19.8%. Shares of ALG have rallied 50.6% year to date.

Eaton: Dublin, Ireland-based Eaton is a diversified power management company and a global technology leader in electrical components and systems. It has been benefiting from improving end-market conditions, increasing demand from the new AI data center and contributions from its organic assets. The firm is expanding via acquisitions and its rising backlog shows solid demand for its products. Its ongoing research and development activities are allowing it to develop new products for providing efficient power management solutions.

The Zacks Consensus Estimate for Eaton’s 2024 earnings growth rate is pegged at 10.6%. The consensus estimate for current-year earnings has improved 2.4% over the last 60 days. This currently Zacks Rank #2 company delivered a trailing four-quarter average earnings surprise of 4.2%. Shares of ETN have rallied 53.4% in the year-to-date period.

Axon Enterprise: Based in Scottsdale, AZ, Axon Enterprise manufactures weapons for selling to U.S. state and local governments, the U.S. federal government, international government customers and commercial enterprises. Robust sales from virtual reality training services have been driving the company’s TASER segment. The addition of new users and associated devices to the AXON network is aiding the Software & Sensors segment. Strong momentum in Axon Evidence and cloud services, driven by an increase in the aggregate number of users, average revenue per user and software add-ons, bodes well for the company.

The Zacks Consensus Estimate for AXON’s 2024 earnings growth rate is pegged at 7.6%. The consensus estimate for current-year earnings has improved 8.7% over the last 60 days. This currently Zacks Rank #2 company delivered a trailing four-quarter average earnings surprise of 61.1%. Shares of AXON have risen 56.1% year to date.

A. O. Smith: Headquartered in Milwaukee, WI, the company is one of the leading manufacturers of commercial and residential water heating equipment, and water treatment products in the world. With improving supply chains, higher shipments are expected to drive AOS’ growth. Robust demand for residential water heaters and commercial water treatment products is a key catalyst behind this company’s growth.

The Zacks Consensus Estimate for AOS’ 2024 earnings growth rate is pegged at 6.1%. The consensus mark for current-year earnings has improved 1.3% over the last 60 days. This currently Zacks Rank #2 company delivered a trailing four-quarter average earnings surprise of 14%. Shares of AOS have risen 43.5% in the year-to-date period.

Kadant: Headquartered in Westford, MA, the company is a supplier of technologies and engineered systems throughout the world. It is likely to benefit from the solid demand for both aftermarket parts and capital equipment, contribution from organic assets and focus on operational execution.

The Zacks Consensus Estimate for Kadant’s 2024 earnings growth rate is pegged at 3.2%. The consensus estimate for current-year earnings has improved 5.2% over the last 60 days. This currently Zacks Rank #2 company has a trailing four-quarter average earnings surprise of 17.3%. Shares of KAI have risen 60.7% year to date.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Kadant Inc (KAI) : Free Stock Analysis Report

Alamo Group, Inc. (ALG) : Free Stock Analysis Report

Axon Enterprise, Inc (AXON) : Free Stock Analysis Report