Aptiv APTV excels in the connected cars market, leveraging security for consumer appeal. With expertise in system integration and strategic acquisitions, it leads in software solutions and vehicle architecture. The “smart architecture” reduces wiring, aligning with industry trends for fuel efficiency and OEM demands.

Factors in Favor

Aptiv has a strong presence in the thriving connected cars market, where security plays a pivotal role in influencing consumer choices. Automakers are actively pursuing technologies that enhance security, contributing to the rapid growth of the driver-assistance system market. The escalating demand for personalization, infotainment connectivity and convenience is a driving force. However, the integration of additional features necessitates more wiring within vehicles. We are confident that Aptiv’s exceptional system integration capabilities position it favorably to capitalize on the automotive industry’s expanding trends in electrification, connectivity and autonomy.

Aptiv bolstered its presence in the automotive software solutions market through the acquisition of Wind River in 2022. Additionally, the company enhanced its global leadership in vehicle architecture systems with the acquisition of Intercable Automotive Solutions in the same year. Aptiv is committed to ongoing investments for both organic and inorganic growth. Given its frequent acquisitions, the integration of these companies not only contributes to the expansion but also generates cost synergies, thus ultimately enhancing the overall efficiency of the integrated organization.

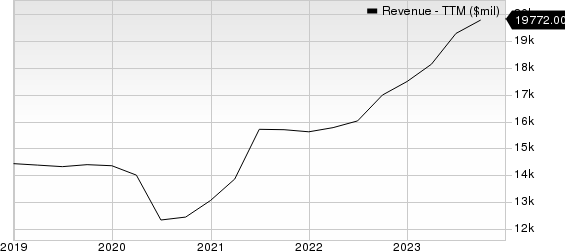

Aptiv PLC Revenue (TTM)

Aptiv PLC revenue-ttm | Aptiv PLC Quote

Aptiv’s “smart architecture” stands as a competitive edge, positioning the company to further capture market share. Amidst industry trends focused on reducing environmental impact and improving fuel economy, OEMs are intensifying their quest for enhanced engine management and lower power consumption. Aptiv is strategically poised to leverage this shift, as its “smart architecture” mitigates the need for extensive wiring in vehicles. This innovation not only contributes to fuel efficiency but also facilitates the integration of additional features in cars.

A Risk

Aptiv’s current ratio (a measure of liquidity) was 1.81 at the end of third-quarter 2023, lower than 2.66 recorded at the end of the year-ago quarter. A decreasing current ratio does not bode well for the company.

APTV currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Here are a few better-ranked stocks from the Business Services sector:

Gartner IT: The Zacks Consensus Estimate for Gartner’s 2023 revenues indicates 7.9% growth from the year-ago reported figure, while earnings are expected to decline 1.9%. The company has beaten the consensus estimate in each of the four quarters, with an average surprise of 34.4%.

IT currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

DocuSign DOCU: The Zacks Consensus Estimate for DocuSign’s 2023 revenues indicates 9.2% growth from the year-ago reported figure, while earnings are expected to grow 41.4%. The company has beaten the consensus estimate in three of the past four quarters and matched on one instance, the average surprise being 5.4%.

DOCU presently flaunts a Zacks Rank of 1.

Broadridge Financial Solutions BR: The Zacks Consensus Estimate for Broadridge’s 2023 revenues indicates 7.7% growth from the year-ago reported figure, while earnings are expected to grow 10.1%. The company has beaten the consensus estimate in three of the past four quarters and matched on one instance, the average surprise being 5.4%.

BR currently has a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report