The new passenger car market closes December with 81,772 units, 10.6% more than in the same month of 2022

Registrations of light commercial vehicles increase 7.6% in December, with 13,131 sales

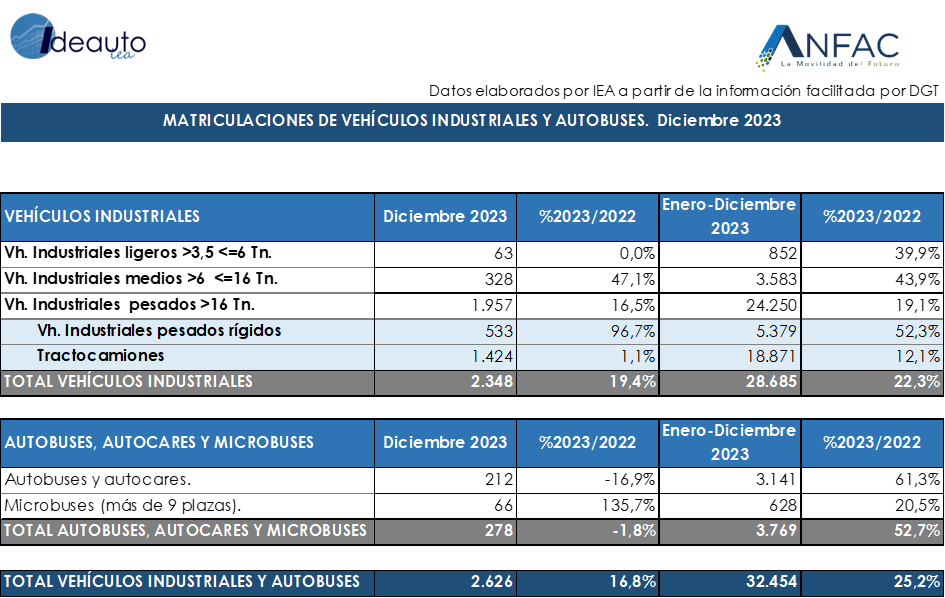

Sales of industrial vehicles, buses, coaches and minibuses grew by 16.8%% in December with 2,626 units

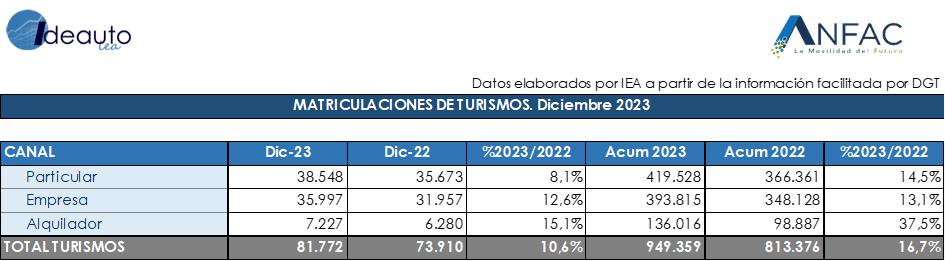

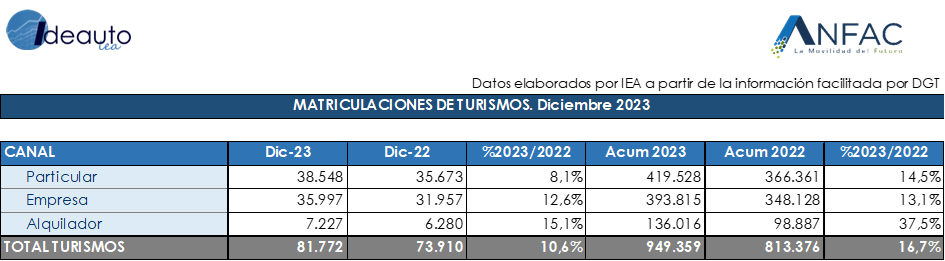

Madrid, January 2, 2024. Sales of passenger cars closed December with an increase of 10.6% to 81,772 units. With this data, 2023 registers an increase of 16.7% to 949,359 units, remaining on the threshold of 950,000 sales and without crossing the psychological barrier of one million deliveries.

The data is positive considering that financing remains high and that inflation has not yet been controlled to the levels it had before the escalation of war conflicts at the international level. All channels show positive data.

The average CO2 emissions of passenger cars sold in December remain at 112.6 grams of CO2 per kilometer traveled, 5.36% lower than the average emissions of new passenger cars sold in the same month of 2022. During 2023, Emissions stand at 117 grams of CO2 per kilometer traveled, 2.87% less than the previous year.

If we break down sales by channel, individual sales grow by 8.1% to 38,548 units while business sales grow by 12.6% to 35,997 units. Last December, it was the rental companies that rose the most in percentage terms, 15.1% with 7,227 purchases.

In the accumulated annual figure, the private channel closes with 419,528 deliveries and an increase of 14.5% and continues to be the channel that has the most weight in the market, although the business channel is not far away after closing with 393,815 units and an annual increase of 13.1%. Rental companies increased their purchases by 37.5% last year to 98,887 units.

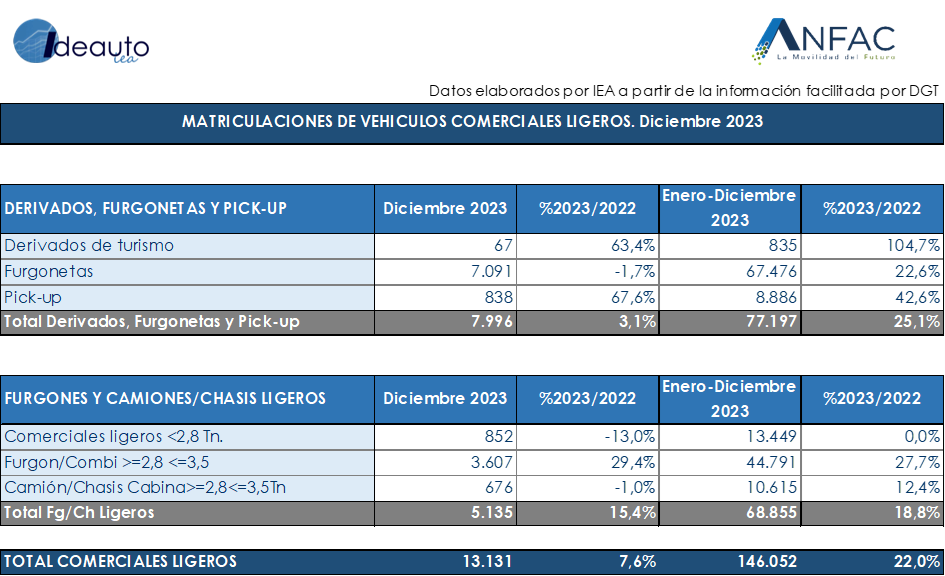

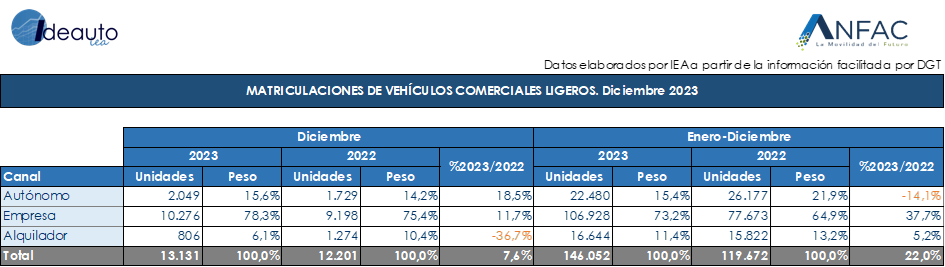

LIGHT COMMERCIAL VEHICLES

Registrations of light commercial vehicles achieved a notable growth of 7.6%, with 13,131 units. In the accumulated annual figure, there have been 146,052 units, an increase of 22% compared to 2022. The business channel, with 10,272 units, is the driving force of sales and rose 11.7% in December. It is also the dominant channel in the year with 106,928 deliveries and an increase of 37.7%. For its part, sales to the self-employed closed 2023 with 26,177 deliveries and a drop of 14.1%.

INDUSTRIAL AND BUSES

In November, registrations of commercial vehicles, buses, coaches and minibuses closed December with an increase of 16.8% and 2,626 units. In the accumulated of the year, 32,454 units were delivered, which represents a growth of 25.2% compared to 2022. By type of vehicle, industrial vehicles added 28,685 new registrations in 2023949,000, increasing 22.3% compared to 2022. In Regarding buses, coaches and minibuses, they registered 380 sales, with a strong growth of 113.5%.

Félix García, director of communication and marketing at ANFAC, explained that “we close 2023 with growth compared to last year with a market of more than 949,000 new registrations. It is a positive aspect to highlight, but it does not have to lead us to conformity. In 2024, Spain must overcome the barrier of one million passenger cars sold. To achieve this, we must continue promoting measures that encourage citizens to be able to advance in the decarbonization commitments, through the renewal of the fleet and the progressive entry of zero and low emission vehicles. The citizen must know that now is the time to buy a new car. And even more so if it is electric or plug-in hybrid. The MOVES Plan still has funds, in addition to the deduction of up to 15% in personal income tax for the purchase of these vehicles. In 2024, we must not only make progress in the recovery of the market, but also in the definitive push towards the electrified vehicle with new measures that really generate a change in trend.”

Raúl Morales, communication director of FACONAUTO, indicated that » «The balance we can make of the year 2023 in the automotive sector is that it has been better than expected, but clearly insufficient as it is still far from the pre-pandemic figures. This means that our sector is recovering much slower than other productive sectors such as, for example, tourism. The supply of vehicles has improved, there are already vehicles on the market, which has generated added demand. However, the economic context – with the increase in interest rates and the price of money – has demobilized many families who were not able to change their vehicle last year. As a sector, we cannot be happy with the result of last year’s registrations, because we have not made progress in the decarbonization of mobility. On the one hand, electrified vehicles have only accounted for 12% of total registrations, very far from the European average, which is around 20%. On the other hand, the average age of the vehicle fleet has continued to worsen. The year 2024 must be the year of decarbonization of the fleet, by promoting measures that encourage the registration of electric vehicles and removing older cars from circulation that penalize the current decarbonization process.”

Ganvam’s communications director, Tania Puche, highlighted that “registrations close in line with the forecasts, registering a significant rebound compared to 2022, but still with more than 300,000 fewer units than we saw before the pandemic. Hence, 2024 must be a year in which the market makes significant progress towards recovery so as not to compromise the competitiveness of the sector. In this sense, promoting the rejuvenation of the park to accelerate the pace of decarbonization becomes a priority objective for this course that we have just launched, especially when the share of registrations of electrified passenger cars in Spain is far from the 20% recorded by the average. European. Thus, one of the main measures that must be undertaken is to replace Moves III with a much more agile and effective demand incentive plan that includes support for used vehicles and allows the aid to be collected at the time of purchase.”