Last week, China Association of Automobile Manufacturers (CAAM) released full-year 2023 vehicle deliveries and production numbers for the world’s biggest market. Per CAAM, full-year deliveries reached 30.16 million units, up 11.6% year over year. Production totaled 30.09 million units, up 12% year over year. The growth trajectory gained momentum in the latter half of the year, driven by economic recovery and the implementation of supportive government policies.

Having held the title of the world’s largest auto market since 2009, China is poised for continued robust growth in the current year. Forecasts suggest that sales could reach 31 million in 2024, including 11.5 million new energy vehicles, a significant increase from the 9.5 million sold in 2023. Moreover, fueled by a surge in exports, China claimed the coveted position of the world’s top auto exporter in the previous year, underlining its increasingly influential role in the global automotive landscape.

On the news front, leading tire maker Goodyear Tire GT announced an array of developments, including a partnership with TDK Corporation for intelligent tire technology, the launch of Goodyear ElectricDrive 2 for EVs, collaboration with TNO to enhance vehicle safety, and integration of tire intelligence with Gatik’s autonomous driving and ZF’s vehicle motion control software.

U.S. legacy automaker Ford F issued a recall for 140,000 units of the Focus and the EcoSport from model years 2016 to 2022 due to a defect in the engine oil pump drive belt tensioner arm.

Italian-American automaker Stellantis STLA is set to reshape auto software with a virtual cockpit. The introduction of the world’s first virtual cockpit platform promises to revolutionize in-vehicle software engineering, accelerate development cycles and enhance the overall driving experience for customers.

Auto equipment manufacturer Gentex GNTX announced a collaboration with Solace Power, a wireless power transfer technology company, to develop, manufacture and commercialize Solace’s wireless power system.

BorgWarner BWA has agreed to form a joint venture with Shaanxi Fast Auto Drive Group. The partnership will combine BWA’s advanced technology, customer-focused approach and a deep expertise in electrification with Fast Group’s specialization in commercial vehicles and strong customer relationships to drive the rapid growth of electrification in China’s commercial vehicle sector.

GT, F, BWA, STLA and GNTX currently carry a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Last Week’s Top Stories

Goodyear Tire announced a partnership with TDK Corporation to expedite the development and adoption of integrated intelligent hardware and software into tires and vehicle ecosystems. With the blend of TDK’s software, sensor and electronic component capabilities and Goodyear’s expertise in tire development, intelligent solutions and industry trends, both companies aim to introduce a robust tire sensing system to the market.

Goodyear also announced the launch of its latest tire in the ElectricDrive family, called The Goodyear ElectricDrive 2. It is an all-season electric vehicle (“EV”) tire with sustainable materials, improved rolling resistance and durable tread life to optimize driver performance.

Meanwhile, Goodyear and TNO have demonstrated new possibilities for improved vehicle safety. Through collaborative research and testing on a physical test vehicle, they showcased that an improved anti-lock brake system can enhance system efficiency and reduce braking distance by nearly 5.75 feet. In other updates, Goodyear and Gatik announced the expansion of tire intelligence technology into an autonomous driving system. Goodyear and ZF also announced the successful integration of tire intelligence technologies with vehicle motion control software.

Ford is recalling around 140,000 units of the Focus and the EcoSport from model years 2016 to 2022 in the United States due to a defect in the engine oil pump drive belt tensioner arm that can damage the engine. Per the National Highway Traffic Safety Administration (“NHTSA”), the recall covers 26,041 units of the Focus manufactured from Mar 24, 2015 to May 4, 2018, and 113,689 units of the EcoSport manufactured from Apr 3, 2017 to Oct 12, 2021.

Per Ford, the engine oil pump drive belt tensioner arm may rupture because the retention caulk joint is not strong enough to withstand engine vibrations. As a result, it could detach from the tensioner backing plate, causing the oil pump drive belt material to degrade and lose teeth. If the pump stops spinning, there will be a loss of oil pressure in the engine, causing major damage. If the engine seizes, the car will lose its power-operated brakes.

The owners of the impacted vehicle will be notified by mail in February 2024. When the parts are available, the owners will be asked to visit a Ford or Lincoln dealership, where a technician will replace the oil pump drive belt tensioner assembly with an updated and durable part free of cost. The owners who have borne the cost of fixing it before May 2023 will be able to claim a refund.

Stellantis joined forces with BlackBerry QNX and Amazon Web Services (AWS) to introduce the world’s first virtual cockpit platform. This innovation promises to revolutionize in-vehicle software engineering and accelerate the delivery of infotainment technology to customers. The virtual cockpit platform allows Stellantis to create realistic virtual versions of car controls and systems, simulating real-world behavior without the need to alter the main software that operates them. What used to take months to achieve can now be accomplished in as little as 24 hours, thanks to this groundbreaking technology.

At the heart of this innovation lies the QNX Hypervisor, a cloud-based solution developed by BlackBerry QNX. This cutting-edge technology is now available through early access on the AWS Marketplace as part of the QNX Accelerate portfolio of cloud-based tools. This collaboration empowers Stellantis to integrate a virtual cockpit high-performance computing simulation into a cloud environment.

Stellantis recognizes that software is a critical component in delivering clean, safe and affordable mobility, as outlined in its Dare Forward 2030 strategic plan. By embracing a software-driven approach and deploying the QNX Hypervisor in the cloud, Stellantis can accelerate customer feedback sessions and replicate the cockpit experience of various brands and vehicles with minimal effort.

Gentex partnered with Solace to develop, manufacture and commercialize Solace’s wireless power system. The partnership also includes strategic investment by Gentex in Solace. Solace has a knack for building wireless power and data transfer applications across a wide range of industries. It has proprietary technology underpinned by 27 patents and hundreds of trade secrets. It can deliver up to 3 kilowatts of power at distances up to 375mm through various mediums.

With its wide range of skills, Solace has made significant strides in its manufacturability, power transfer reliability and spatial freedom. It has a healthy customer base and plans to leverage Gentex’s manufacturing and product development capabilities to achieve market scale. Solace not only has a crucial role to play in Gentex’s current product portfolio but can also support Gentex’s continued expansion into new markets.

Solace offers customized solutions by addressing design complexity, packaging, range, power dynamics, safety and environmental concerns. By integrating Solace’s technology into its product lines, Gentex can improve product design flexibility. The integration will also eliminate power distribution concerns, reduce cables and connectors and enable unique power and data transfer solutions.

BorgWarner announced a strategic partnership with Shaanxi Fast Auto Drive Group, a prominent Chinese supplier of commercial vehicle parts. This joint venture, set to be established in the first quarter of 2024 pending regulatory approval, aims to bolster BorgWarner’s presence in the burgeoning electric commercial vehicle market in China.

Stefan Demmerle, president and general manager of BorgWarner PowerDrive Systems, emphasized the venture’s focus on developing high-voltage inverters for high-efficiency vehicles, including heavy-duty trucks and off-road vehicles. This collaboration is expected to significantly enhance BorgWarner’s business growth in power electronics for electrified commercial vehicles. The company’s robust engineering footprint in China enables it to expedite product development to commercialize highly efficient inverter technology.

Xuyao Ma, chairman of Fast Group, pointed out that with the automotive industry in China evolving rapidly due to electrification, connectivity, autonomous driving, and shared mobility, the commercial vehicle sector’s transition to new energy sources is accelerating. The joint venture aims to leverage both companies’ strengths to deliver advanced inverter products and propulsion solutions, thereby increasing customer value in the commercial vehicle market.

Price Performance

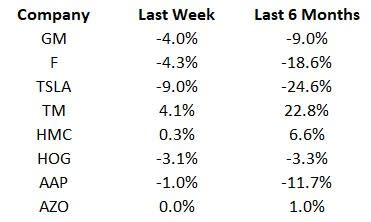

The following table shows the price movement of some of the major auto players over the last week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

Industry watchers will keep a tab on full-year 2023 new car registration data to be released by the European Automobile Manufacturers Association.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

The Goodyear Tire & Rubber Company (GT) : Free Stock Analysis Report

Gentex Corporation (GNTX) : Free Stock Analysis Report

Stellantis N.V. (STLA) : Free Stock Analysis Report