PACCAR PCAR will release fourth-quarter 2023 results tomorrow, before market open. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings per share and revenues is pegged at $2.20 and $8.18 billion, respectively.

For the fourth quarter of 2023, the consensus estimate for PACCAR’s earnings per share has increased by 3 cents in the past seven days. Its bottom-line estimates imply growth of 25% from the year-ago reported number. The Zacks Consensus Estimate for its quarterly revenues suggests a year-over-year increase of 6%.

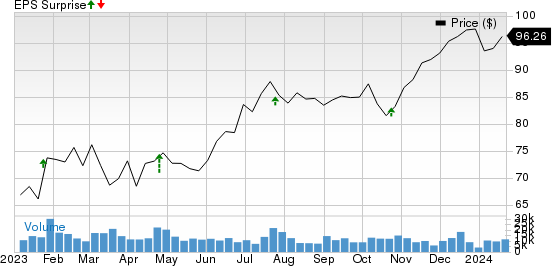

Over the trailing four quarters, PACCAR surpassed earnings estimates on all occasions, the average surprise being 15.99%. This is depicted in the graph below:

PACCAR Inc. Price and EPS Surprise

PACCAR Inc. price-eps-surprise | PACCAR Inc. Quote

Earnings Whispers

Our proven model predicts an earnings beat for the trucking giant this season as well, as it has the right combination of the two key ingredients. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: PACCAR has an Earnings ESP of +2.67%. This is because the Most Accurate Estimate is pegged 6 cents higher than the Zacks Consensus Estimate.

Zacks Rank: It currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors at Play

Robust demand from its Class 8 heavy-duty trucks is likely to have aided PACCAR’s trucking revenues in the to-be-reported quarter. Leading brands, namely Kenworth, DAF and Peterbilt, are likely to have driven deliveries. We forecast fourth-quarter 2023 deliveries to be 50,869 units, up from 50,100 units in the third quarter of 2023 but down 1.4% on a year-over-year basis.

Our estimate for Truck segment revenues is $6.4 billion, indicating a rise of 2.2% year over year. The pretax profit estimate for the segment is $824 million, up from $624 million reported in the year-ago period.

The demand for aftermarket parts is on the rise, spurred by high truck utilization and increased average fleet age. Encouragingly, our projection for fourth-quarter revenues from the Parts segment is pegged at $1.6 billion, indicating a rise of 9% year over year. The estimate for pretax profit of the segment, pegged at $396 million, also suggests an increase from $379.5 million. An expanding network of parts distribution centers, dealer locations and independent TRP stores, along with managed dealer inventory and innovative e-commerce systems, is likely to have buoyed the Parts segment.

We anticipate gross margins from Trucks, Parts and Others to come in at 18.9%, implying an improvement from 15.9% recorded in the year-ago period.

We expect revenues from the Financial Services segment to be around $491 million, implying more than 24% growth year over year.

Other Stocks With Favorable Combination

Let’s take a look at a few other players from the auto space, which, according to our model, have the right combination of elements to post an earnings beat for the quarter to be reported:

General Motors GM will release fourth-quarter 2023 results on Jan 30. The company has an Earnings ESP of +3.47% and a Zacks Rank #1.

The Zacks Consensus Estimate for General Motors’ to-be-reported quarter’s earnings and revenues is pegged at $1.09 per share and $39.6 billion, respectively. GM surpassed earnings estimates in the trailing four quarters, with the average surprise being 23.82%.

Ford F is set to report fourth-quarter 2023 results on Feb 6. The company has an Earnings ESP of +4.93% and a Zacks Rank #3.

The Zacks Consensus Estimate for Ford’s to-be-reported quarter’s earnings and automotive revenues is pegged at 12 cents per share and $36.4 billion, respectively. F surpassed earnings estimates in two of the trailing four quarters for as many misses, with the average surprise being 20.3%.

BorgWarner BWA is set to report fourth-quarter 2023 results on Feb 8. The company has an Earnings ESP of +0.88% and a Zacks Rank #3.

The Zacks Consensus Estimate for BorgWarner’s to-be-reported quarter’s earnings and automotive revenues is pegged at 90 cents per share and $3.6 billion, respectively. BWA surpassed earnings estimates in three of the trailing four quarters and missed in the other, with the average surprise being 10.4%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report