General Motors GM is slated to release fourth-quarter 2023 results on Jan 30, before market open. The Zacks Consensus Estimate for the quarter’s earnings and revenues is pegged at $1.09 per share and $43.34 billion, respectively.

The Zacks Consensus Estimate for General Motors’ fourth-quarter earnings per share has been revised upward by 3 cents in the past seven days. The bottom-line projection indicates a year-over-year decline of 48.58%. The top-line estimate suggests a year-over-year decrease of 6.42%.

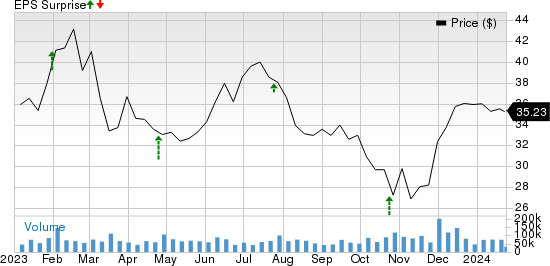

In the last reported quarter, GM topped earnings estimates on higher-than-expected profits from the GM North America (“GMNA”), GM International (“GMI”) and GM Financial segments. Over the trailing four quarters, the company topped the Zacks Consensus Estimate on all occasions, with the average being 23.82%. This is depicted in the graph below:

General Motors Company Price and EPS Surprise

General Motors Company price-eps-surprise | General Motors Company Quote

Factors at Play

General Motors’ fourth-quarter sales in the United States rose 0.3% year over year to 625,176 units. Sales from the Buick brand grew 57% year over year. Total Silverado sales increased to 143,390 units from 141,912 units sold during the year-ago period, whereas Sierra’s total sales rose 9.8% year over year.

Meanwhile, sales in the world’s largest auto market declined on a year-over-year basis. In China, General Motors sold 568,850 vehicles during the fourth quarter of 2023, down 1% year over year. The company saw its sales fall across the Chevrolet (27.44%), Buick (25.91%) and Cadillac (4.98%) brands, while sales across Wuling & Baojun rose 8.08% and 84.81%, respectively.

Our projection for operating income from the GMNA segment is pegged at $2.66 billion, indicating a decline of 8% year over year. General Motors expects the lost production from the United Auto Workers strike (which started on Sep 15, 2023 and lasted for six weeks) to have a significant impact in the fourth quarter, with an incremental $600 million reduction in EBIT.

Our projection for operating income from the GMI segment (excluding GM China joint venture) is pegged at $309.7 million, indicating a rise of 13.9% year over year. We expect the operating margin to expand by 0.9 percentage points from the year-ago quarter to 7.2%.

Our estimate for the sales from the GM Financial unit is pegged at $3.21 billion, suggesting a rise of 7.9% year over year. Our estimate for sales from GM’s autonomous driving unit, Cruise, is pegged at $25 million, suggesting no changes from the year-ago quarter’s levels.

Building on the success of its $2 billion cost-reduction plan announced in early 2023, General Motors will further cut $1 billion in fixed costs over the 2023 to 2024 timeframe. Cost reduction is likely to have a positive impact on GM’s fourth-quarter margins.

Earnings Whispers

Our proven model predicts an earnings beat for General Motors this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is the case here.

Earnings ESP: It has an Earnings ESP of +3.47%. This is because the Most Accurate Estimate of $1.12 per share is pegged 3 cents higher than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: General Motors currently carries a Zacks Rank #2.

Other Stocks With the Favorable Combination

Here are a few other players from the auto space that, according to our model, also have the right combination of elements to post an earnings beat this time around.

Lear Corporation LEA will release fourth-quarter 2023 results on Feb 6. The company has an Earnings ESP of +1.36% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Lear’s to-be-reported quarter’s earnings and revenues is pegged at $3.08 per share and $5.64 billion, respectively. LEA surpassed earnings estimates on each occasion, the average surprise being 9.10%.

Ford Motor Company F will release fourth-quarter 2023 results on Feb 6. The company has an Earnings ESP of +4.93% and a Zacks Rank #3.

The Zacks Consensus Estimate for Ford’s to-be-reported quarter’s earnings and revenues is pegged at 12 cents per share and $36.39 billion, respectively. F surpassed earnings estimates on two out of the trailing four quarters and missed twice, the average surprise being 20.30%.

BorgWarner Inc. BWA will release fourth-quarter 2023 results on Feb 8. The company has an Earnings ESP of +2.44% and a Zacks Rank #3.

The Zacks Consensus Estimate for BorgWarner’s to-be-reported quarter’s earnings and revenues is pegged at 91 cents per share and $3.59 billion, respectively. BWA surpassed earnings estimates on three out of the trailing four quarters and missed once, the average surprise being 10.93%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report