Rising environmental concerns are driving a global shift toward sustainable energy, with electric vehicles (EVs) taking center stage. This surge in EV sales is poised to drive significant growth in the Zacks Automotive – Foreign industry as cities and nations worldwide push for green energy transitions and deadlines to phase out fossil fuel vehicles. Notably, India, China, Japan and Europe experienced year-over-year growth in vehicle sales in 2023. The momentum is expected to continue in 2024, albeit at a possibly slower pace. The attractive valuation of the industry, trading at a discount compared to the S&P 500 and broader automotive sector, further bolsters its appeal. Prominent industry players such as BYD Co Ltd. BYDDY, BMW AG BMWYY and Honda HMC present compelling investment opportunities.

Industry Overview

Companies in the Zacks Automotive – Foreign industry are involved in designing, manufacturing and selling vehicles, components as well as production systems. The foreign automotive industry is highly dependent on business cycles and economic conditions. China, Japan, Germany and India are some of the key foreign automotive manufacturing countries. The widespread usage of technology is resulting in a fundamental restructuring of the market. Stricter emission and fuel-economy targets, the ramp-up of charging infrastructure as well as supportive government policies are boosting sales of green vehicles. With almost all firms intensifying their electrification game, competition is getting tougher with each passing day. Foreign automakers are now actively engaged in the R&D of electric and autonomous vehicles, fuel efficiency and low-emission technologies.

Things to Consider

EU Car Market Navigating Challenges Amid Growth Prospects: The European car market displays a cautiously optimistic outlook for 2024. New car registrations in the European Union (EU) rose 13.9% in 2023, reaching 10.5 million units. Although sales are anticipated to continue their upward trajectory this year, the pace of growth is projected to moderate compared to the previous year. According to GlobalData, sedan and SUV sales in Western Europe are forecast to rise 5.5% in 2024. S&P Global Mobility predicts a 2.9% year-over-year increase in auto sales in the Western and Central European markets. Despite the expected growth, factors that may contribute to a slower pace include the looming risks of economic recession, tighter credit conditions, the gradual release of pent-up demand, persistent high car prices and the gradual reduction of electric vehicle (EV) subsidies. So, looking ahead, while the European car market is poised for further expansion, the momentum is likely to be tempered by various economic and industry-specific challenges.

India’s Continued Car Market Growth: In 2023, India maintained its position as the world’s third-largest automotive market, staying ahead of Japan for the second consecutive year. India’s growing population, economic growth, and rising motorization have propelled its passenger vehicle industry to secure the third position globally in volumes, trailing only China and the United States. India’s burgeoning middle class, increasing disposable incomes, improved road infrastructure and accessible financing are escalating demand for automobiles. Amid robust demand and supply chain enhancements, India’s passenger vehicle market achieved a significant milestone in 2023 by surpassing 4 million units for the first time. The SUV segment dominated with a 48.7% share in 2023 and is projected to maintain strength, potentially increasing to 52-53% this year. Industry executives anticipate growth in the domestic car market in 2024, albeit subdued to single digit growth rate.

China’s EV-Driven Auto Market Momentum: In 2023, China’s vehicle sales rose 12% year on year to reach 30.1 million units, per the China Association of Automobile Manufacturers. In 2024, the market is expected to maintain momentum, buoyed by pent-up demand and a gradual restoration of consumer confidence, which is yet to fully return to pre-pandemic levels. S&P Mobility forecasts a 4.2% increase in demand for the year. Specifically, the EV sector in China is experiencing robust activity. The affordability of new energy vehicles (NEVs) in China is anticipated to improve further in 2024, with local battery cell prices already witnessing significant declines throughout 2023. Combined with the extension of NEV tax exemptions into 2024-2025, the penetration of NEVs as a percentage of passenger vehicles is projected to rise to 44% in 2024, up from 36% in 2023.

Japan’s Auto Market Recovery Amid EV Transition Hurdles: In 2023, total passenger car sales in Japan reached 3.99 million vehicles, marking a significant 15.6% year-over-year increase. This signals a promising turnaround following four consecutive years of contraction. The easing of the global semiconductor shortage played a pivotal role in Japan’s car sales recovery, with the Honda N-Box retaining its position as the most popular passenger car. Additionally, EV sales surged 50% in 2023. While government subsidies for EVs and charging stations will serve as incentives for buyers, sales growth of zero-emission vehicles is expected to be gradual compared to regions like the United States and Europe, where government regulations actively drive EV adoption to support the automotive industry. Also, stimulating EV sales in Japan is a little challenging due to the dominance of hybrid cars, which effectively meet consumer demand, diverting potential interest away from EVs.

Zacks Industry Rank Indicates Rosy Prospects

The Zacks Automotive – Foreign industry within the broader Zacks Auto-Tires-Trucks sector currently carries a Zacks Industry Rank #63, which places it in the top 25% of around 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates decent near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are optimistic about this group’s earnings growth potential. Since October, the industry’s earnings estimates for 2024 have moved 7.5% north.

Before we present a few stocks that investors can buy, given their solid potential, let’s look at the industry’s recent stock market performance and current valuation.

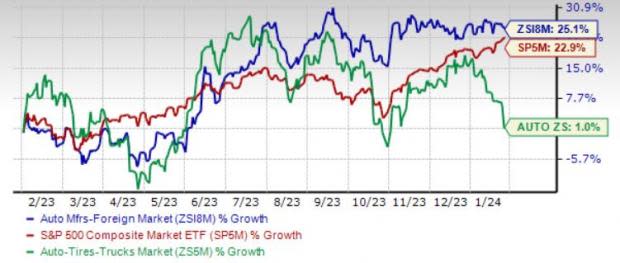

Industry Tops Sector and S&P 500

The Zacks Automotive – Foreign industry has outperformed the Auto, Tires and Truck sector and the Zacks S&P 500 composite over the past year. The industry has rallied 25.1% compared with the sector and S&P 500’s growth of 1% and 22.9%, respectively.

One-Year Price Performance

Industry’s Current Valuation

Since automotive companies are debt-laden, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio.

Based on trailing 12-month enterprise value to EBITDA (EV/EBITDA), the industry is currently trading at 11.27X compared with the S&P 500’s 14.23X and the sector’s 12.66X.

Over the past five years, the industry has traded as high as 12.54X, as low as 5.63X and at a median of 8.54X, as the chart below shows.

EV/EBITDA Ratio (Past Five Years)

3 Stocks to Buy

BYD: China-based BYD is a leading player in automobile research, manufacturing and distribution, alongside secondary rechargeable batteries and mobile phone components. In the fourth quarter of 2023, BYD surpassed Tesla to become the world’s top seller of pure electric vehicles. With a vertically integrated structure spanning mines, battery production and chip manufacturing, BYD holds a competitive advantage.

The company boasts an international footprint across Asia, Europe and Latin America, with significant inroads in markets such as Japan, India, Malaysia, Australia, Singapore, Israel and Europe. Its diverse electric vehicle lineup, featuring models like Seagull, Denza, and Yangwang, has propelled its global acclaim. BYD maintains a steadfast commitment to cost-reduction initiatives across its production processes.

BYD currently sports a Zacks Rank #1 (Buy) and has a VGM Score of A. The consensus mark for 2023 sales and earnings implies year-over-year growth of 27.3% and 35.3%, respectively. The Zacks Consensus Estimate for 2024 earnings per share has been upwardly revised by 30 cents over the past seven days to $3.93 per share.

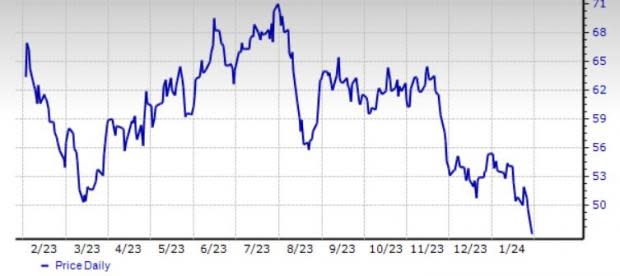

Price: BYDDY

BMW: It is a Germany-based automotive powerhouse that specializes in producing and distributing luxury vehicles and motorcycles. In the previous year, the BMW Group achieved a record-breaking milestone, delivering 2,555,341 BMW, MINI and Rolls-Royce vehicles to customers, marking a 6.5% increase in sales. Stepping boldly into electrification, BMW anticipates EVs to comprise 50% of its global sales by 2030.

The company has ambitious plans to deliver 2 million fully electric vehicles by 2025 and increase this number to 10 million by 2030. With an extensive lineup of 18 fully electric models across all its brands, BMW is poised for significant growth in the BEV segment. Currently, one in every five newly delivered vehicles boasts a fully electric drivetrain, a figure set to rise to one in four by 2025.

BMW aims to deliver more than 500,000 electric vehicles this year, ensuring substantial double-digit growth aligned with the company’s global objectives. The stock currently sports a Zacks Rank #1 and has a VGM Score of A. The Zacks Consensus Estimate for 2023 and 2024 EPS has been upwardly revised by 16 cents and 42 cents, respectively, over the past 60 days.

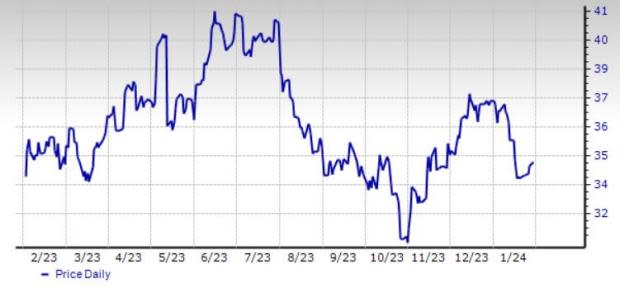

Price: BMWYY

Honda: Based in Japan, it is one of the prominent manufacturers of automobiles and the largest producer of motorcycles in the world. Honda’s 2030 Vision, which emphasizes electrified mobility products, bodes well. Honda targets EVs to account for 20% of its sales in Japan and 40% of its sales in North America and China by the decade’s end. Its joint venture with GAC Group and Dongfeng Motor Group will drive its EV prospects in China.

In August 2023, Honda launched its first personal-use electric motorcycle in Japan, EM1 e. Demonstrating innovation, it showcased the SC e: Concept motorcycle at the Japan Mobility Show 2023. The company plans to introduce 10 models in the next five years in its e:N series. As part of the global restructuring move, Honda has been taking steps to control costs and optimize production capacity.

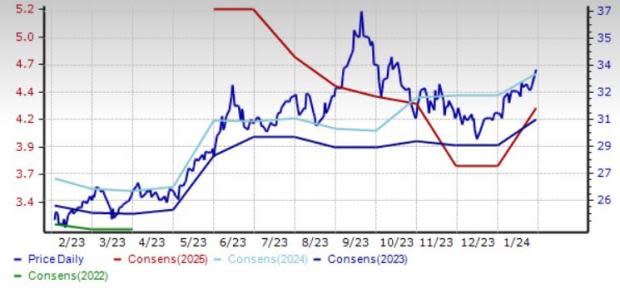

HMC currently sports a Zacks Rank #1 and has a VGM Score of A. The consensus mark for fiscal 2024 and 2025 earnings implies year-over-year growth of 37.3% and 11%, respectively. The Zacks Consensus Estimate for fiscal 2024 and 2025 EPS has been upwardly revised by 7 cents and 3 cents, respectively, in the past seven days.

Price & Consensus: HMC

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

Bayerische Motoren Werke AG Sponsored ADR (BMWYY) : Free Stock Analysis Report