Toyota Motor Corporation TM is slated to release its third-quarter fiscal 2024 results on Feb 6, after the closing bell. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings and revenues is pegged at $3.66 per share and $73.72 billion, respectively.

For the fiscal third quarter, the consensus estimate for TM’s earnings per share has moved up by $1.51 in the past 90 days. Its bottom-line estimate implies a decline of 3.17% from the year-ago reported number.

The Zacks Consensus Estimate for its quarterly revenues suggests a year-over-year rise of 6.59%.

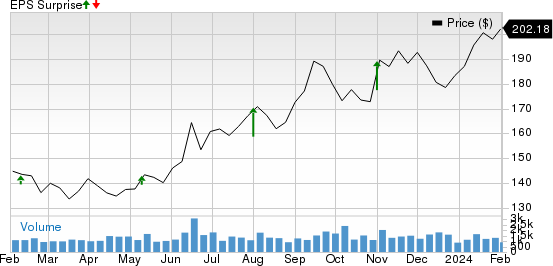

TM surpassed the consensus estimate for earnings on each of the trailing four quarters, the average surprise being 46.86%. This is depicted in the graph below:

Toyota Motor Corporation Price and EPS Surprise

Toyota Motor Corporation price-eps-surprise | Toyota Motor Corporation Quote

Q2 Highlights

In second-quarter fiscal 2024, Toyota posted adjusted quarterly earnings of $6.54 per share, surpassing the Zacks Consensus Estimate of $3.34. This compares to an adjusted earnings of $2.30 per share reported a year ago. Toyota posted revenues of $79.1 billion in the quarter, outpacing the Zacks Consensus Estimate of $72.7 billion and rising from $66.8 billion in the year-ago quarter.

Things to Note

Toyota is deepening its focus on manufacturing electric and fuel-cell vehicles. In the second quarter of fiscal 2024, sales of hybrid electric vehicles contributed to 35.3% of total sales, up from 34.2% recorded in the first quarter of fiscal 2024. The sequential rise in trend is likely to continue in the to-be-reported quarter amid the soaring popularity of environmentally friendly vehicles. For fiscal 2024, Toyota projects consolidated sales of ¥43,000 billion, indicating a rise from the previous forecast of ¥38,000 billion. High demand for electric vehicles and an upbeat forecast are likely to have bolstered Toyota’s fiscal third-quarter result.

In the third quarter of fiscal 2024, the automaker sold 619,661 vehicles in the United States, indicating an uptick of 15.4% year over year. A year-over-year improvement in sales volume is likely to have bolstered Toyota’s results in the to-be-reported quarter.

Discouragingly, during the second quarter of fiscal 2024, operating income in China declined year over year due to fluctuations in foreign exchange rates and an increase in selling expenses. Moreover, the ongoing price competition in China between local manufacturers and foreign original equipment manufacturers would make it difficult for Toyota to maintain its current market share.

In light of rising challenges in China, the automaker has reduced its full-year 2024 sales estimates in Asia to 1,760,000 units from 1,870,000 units forecasted previously. Declining operating income and rising competition in China are likely to have a negative impact on Toyota’s fiscal third-quarter results.

Toyota plans to spend around ¥1.24 trillion in research and development (“R&D”) expenses in fiscal 2024, the same as the amount spent in fiscal 2023. Capex is forecast at ¥1.97 trillion, indicating an increase from ¥1.60 trillion spent in fiscal 2023. High capex and R&D expenses on advanced technologies and alternative fuels for the development of electric and autonomous vehicles bode well for the future. However, the same is likely to have dented the to-be-reported quarter’s margins and cash flows.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Toyota this time around, as it does not have the right combination of the two key ingredients. A positive Earnings ESP combined with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is not the case here.

Earnings ESP: TM has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate is in line with the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: It currently has a Zacks Rank #3.

Stocks With the Favorable Combination

Here are a few players from the auto space, which, per our model, have the correct ingredients to post an earnings beat this time.

Ford Motor Company F will release fourth-quarter 2023 results on Feb 6. The company has an Earnings ESP of +6.55% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for F’s to-be-reported quarter’s earnings and revenues is pegged at 13 cents per share and $37.77 billion, respectively. Ford surpassed earnings estimates in two of the trailing four quarters and missed twice, the average surprise being 20.30%.

Allison Transmission Holdings, Inc. ALSN will release fourth-quarter 2023 results on Feb 13. The company has an Earnings ESP of +3.73% and a Zacks Rank #2.

The Zacks Consensus Estimate for ALSN’s to-be-reported quarter’s earnings and revenues is pegged at $1.42 per share and $753.73 million, respectively. Allison surpassed earnings estimates in each of the trailing four quarters, the average surprise being 17.23%.

BorgWarner Inc. BWA will release fourth-quarter 2023 results on Feb 8. The company has an Earnings ESP of +3.25% and a Zacks Rank #3.

The Zacks Consensus Estimate for BWA’s to-be-reported quarter’s earnings and revenues is pegged at 93 cents per share and $3.61 billion, respectively. BorgWarner surpassed earnings estimates in three of the trailing four quarters and missed once, the average surprise being 10.93%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report