O’Reilly Automotive ORLY is slated to release fourth-quarter 2023 results on Feb 7, after the closing bell. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings per share and revenues is pegged at $9.02 and $3.83 billion, respectively.

For the fourth quarter, the consensus estimate for O’Reilly’s earnings per share has increased 2 cents in the past seven days. Its bottom-line estimates imply 7.77% growth from the year-ago reported numbers.

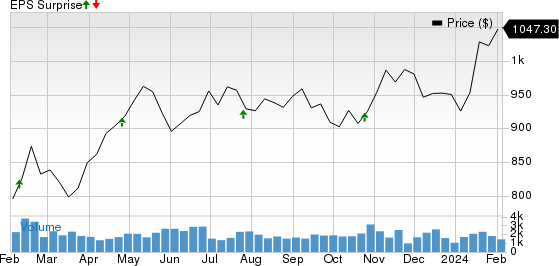

The Zacks Consensus Estimate for ORLY’s quarterly revenues suggests a year-over-year increase of 5.13%. Over the trailing four quarters, the company surpassed earnings estimates on each occasion, the average surprise being 4.31%. This is depicted in the graph below:

O’Reilly Automotive, Inc. Price and EPS Surprise

O’Reilly Automotive, Inc. price-eps-surprise | O’Reilly Automotive, Inc. Quote

Q3 Highlights

In the third quarter of 2023, ORLY’s adjusted earnings per share of $10.72 beat the consensus mark of $10.36 and rose 16.9% year over year. The company reported net sales of $4.20 billion, topping the Zacks Consensus Estimate of $4.07 billion. The top line also rose 10.6% year over year.

Things to Note

O’Reilly is poised to benefit from store openings and distribution centers in profitable regions. In addition to opening stores in new markets, the company has been actively increasing store count in less-populated areas. During the third quarter, the company opened 40 new stores. In total, it targeted 180-190 new stores in 2023.

The increased complexity of auto parts and repairs is driving more people to independent repair shops. Thus, as cars get more technologically advanced, high-quality auto parts are much in demand, which is likely to have bolstered the company’s sales and earnings in the to-be-reported quarter.

Per Automotive News, U.S. light vehicle sales in the fourth quarter of 2023 rose to 3.75 million units, up 8.5% year over year. O’Reilly is expected to have reaped the rewards of an upswing in demand for new vehicles.

Moreover, upbeat projections for full-year 2023 revenues and EPS spark optimism surrounding fourth-quarter results. O’Reilly projects 2023 total revenues in the range of $15.7-$15.8 billion, up from the prior guidance of $15.4-$15.7 billion. The current anticipation is higher than $14.41 billion generated in 2022. EPS is now expected in the range of $37.80-$38.30, up from the previous estimate of $37.05-$37.55. The current projection is higher than $33.44 reported in 2022.

Earnings Whispers

Our proven model predicts an earnings beat for the automotive parts retailer for the quarter to be reported, as it has the right combination of the two key ingredients. A positive Earnings ESP combined with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

Earnings ESP: ORLY has an Earnings ESP of +3.44%. This is because the Most Accurate Estimate is pegged 32 cents higher than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: It currently carries a Zacks Rank #3.

Other Stocks With the Favorable Combination

Here are a few other players from the auto space that, per our model, also have the correct ingredients to post an earnings beat this time.

BorgWarner Inc. BWA will release fourth-quarter 2023 results on Feb 8. The company has an Earnings ESP of +3.25% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for BWA’s to-be-reported quarter’s earnings and revenues is pegged at 93 cents per share and $3.61 billion, respectively. BorgWarner surpassed earnings estimates in three of the trailing four quarters and missed once, the average surprise being 10.93%.

Allison Transmission Holdings, Inc. ALSN will release fourth-quarter 2023 results on Feb 13. The company has an Earnings ESP of +3.73% and a Zacks Rank #2.

The Zacks Consensus Estimate for ALSN’s to-be-reported quarter’s earnings and revenues is pegged at $1.42 per share and $755.14 million, respectively. Allison surpassed earnings estimates in each of the trailing four quarters, the average surprise being 17.23%.

Lucid Group, Inc. LCID will release fourth-quarter 2023 results on Feb 21. The company has an Earnings ESP of +5.36% and a Zacks Rank #3.

The Zacks Consensus Estimate for LCID’s to-be-reported quarter’s loss and revenues is pegged at 28 cents per share and $166.76 million, respectively. Lucid missed earnings estimates in each of the trailing four quarters, the average negative surprise being 7.70%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

O’Reilly Automotive, Inc. (ORLY) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

Lucid Group, Inc. (LCID) : Free Stock Analysis Report