Overview of Richard Pzena (Trades, Portfolio)’s Recent Stock Transaction

On December 31, 2023, Pzena Investment Management, LLC, led by value investing stalwart Richard Pzena (Trades, Portfolio), made a notable adjustment to its holdings in Lear Corp (NYSE:LEA). The firm reduced its stake by 211,254 shares, which represented a 3.24% decrease from its previous holding. This transaction had a -0.13% impact on the portfolio, with the shares being traded at a price of $141.21. Following the trade, Pzena Investment Management held a total of 6,304,116 shares in Lear Corp, accounting for 3.83% of the portfolio and 10.80% of the company’s shares.

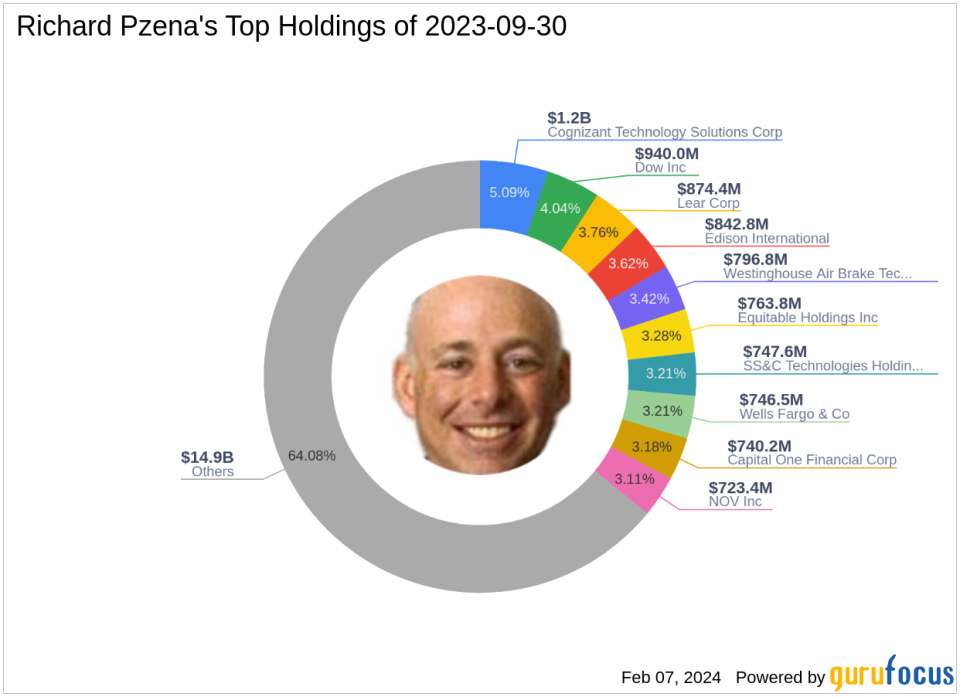

Profile of Richard Pzena (Trades, Portfolio)

Richard Pzena (Trades, Portfolio) is the founder and Co-Chief Investment Officer of Pzena Investment Management, LLC, established in 1995. With a BS summa cum laude from the Wharton School and an MBA from the University of Pennsylvania, Pzena’s investment philosophy emphasizes purchasing shares in quality businesses at low prices, often during times of market distress. The firm’s approach is to determine whether the factors causing a stock’s price drop are temporary or permanent, aiming to capitalize on the former scenario. Pzena Investment Management oversees an equity portfolio valued at $23.28 billion, with top holdings in diverse sectors such as Financial Services and Technology.

Lear Corp’s Stock Overview

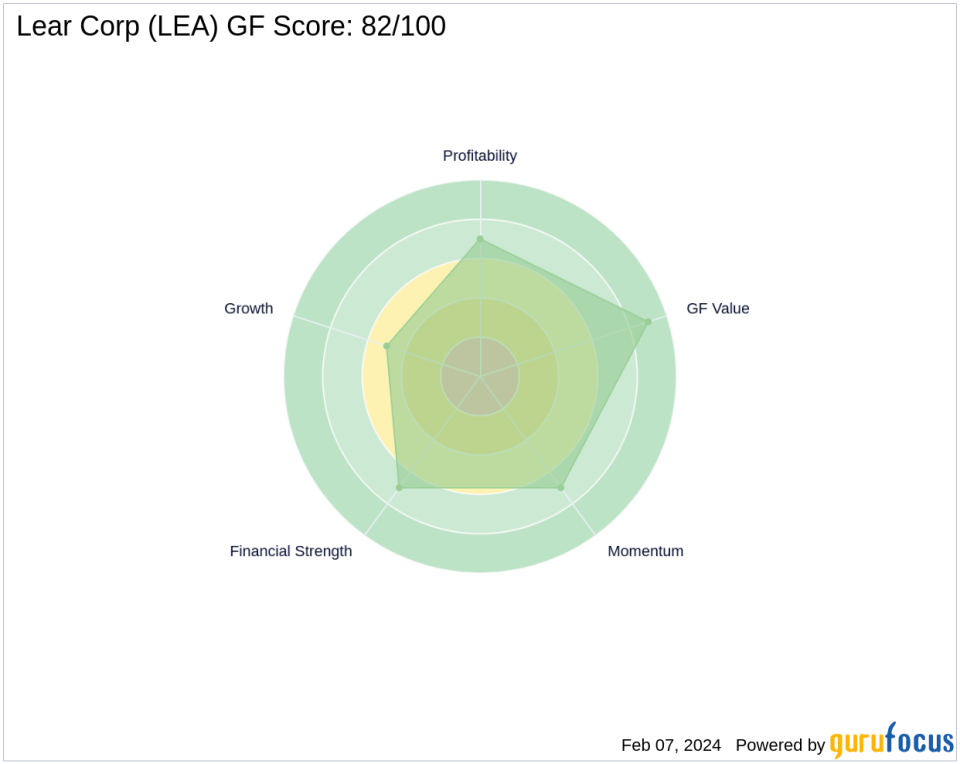

Lear Corp, with its stock symbol LEA, operates in the Vehicles & Parts industry in the USA. Since its IPO on April 6, 1994, the company has grown to a market capitalization of $7.71 billion. Lear specializes in automotive seating and electrical systems, serving major customers like GM and markets predominantly in North America. As of the current date, the stock price stands at $132.35, with a PE ratio of 13.67. Lear Corp is considered modestly undervalued with a GF Value of $171.79 and a price to GF Value ratio of 0.77. The company boasts a GF Score of 82/100, indicating good potential for outperformance.

Analysis of the Trade Impact

The reduction in Lear Corp shares by Pzena Investment Management has slightly decreased the firm’s exposure to the automotive sector. Despite this sell-off, Lear Corp remains a significant holding, reflecting Pzena’s continued confidence in the company’s value proposition. The trade’s share change and position must be viewed in the context of Pzena’s overall portfolio strategy and its alignment with the firm’s value investing principles.

Lear Corp’s Financial Health and Valuation

Lear Corp’s financial health is robust, with a Financial Strength rank of 7/10 and a Profitability Rank also at 7/10. The company’s Growth Rank is 5/10, reflecting moderate growth metrics. Lear’s stock valuation is further supported by a high GF Value Rank of 9/10, suggesting that it is undervalued compared to historical multiples and future business performance estimates.

Market Performance and Guru Holdings

Since its IPO, Lear Corp’s stock has seen a price change of 424.16%. However, year-to-date, the stock has experienced a slight decline of -6.66%, with a -6.27% change since the trade date. Notably, other investment gurus such as HOTCHKIS & WILEY, Joel Greenblatt (Trades, Portfolio), and Ken Fisher (Trades, Portfolio) also hold positions in Lear Corp, indicating a broader interest in the stock among savvy investors.

Sector and Industry Context

Richard Pzena (Trades, Portfolio)’s top sectors include Financial Services and Technology, with Lear Corp fitting into the firm’s diverse portfolio as a key player in the Vehicles & Parts industry. Lear’s competitive position within its industry and its alignment with Pzena’s investment strategy underscore the firm’s decision to maintain a significant stake despite the recent reduction.

Conclusion

The recent trade action by Richard Pzena (Trades, Portfolio)’s firm in Lear Corp reflects a strategic portfolio adjustment rather than a shift in investment philosophy. With Lear Corp’s solid financials, modest undervaluation, and good growth potential, it remains a noteworthy holding in Pzena’s value-driven portfolio. Investors will continue to watch how this position evolves in alignment with market dynamics and Pzena’s long-term investment objectives.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.