-

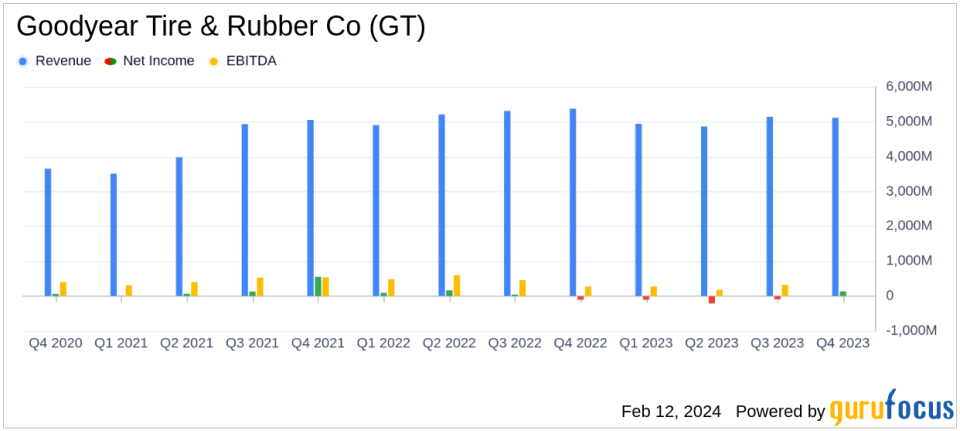

Net Sales: Q4 net sales decreased by 4.8% year-over-year to $5.116 billion.

-

Net Loss: Reported a net loss of $291 million in Q4, compared to a net loss of $104 million in the previous year.

-

Adjusted EPS: Adjusted earnings per share on a diluted basis were $0.47, up from $0.07 a year ago.

-

Tire Units: Tire unit volume totaled 45.4 million units, a decrease of 3.8% from the previous year.

-

Segment Operating Income: Q4 segment operating income increased by 62.3% year-over-year to $383 million.

-

Debt and Cash Flows: Total debt reduced to $7.6 billion, with operating cash flow for Q4 at $1.2 billion.

On February 12, 2024, Goodyear Tire & Rubber Co (NASDAQ:GT) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The company, a leading manufacturer of tires for various types of vehicles, is undergoing a strategic transformation under the “Goodyear Forward” plan, aiming to unlock incremental value and enhance financial flexibility.

Company Overview

Goodyear Tire & Rubber Co manufactures and sells a variety of rubber tires under the Goodyear brand name. The firm’s tires are used for automobiles, trucks, buses, aircraft, motorcycles, mining equipment, farm equipment, and industrial equipment. The company operates its business through three operating segments representing its regional tire businesses: Americas; Europe, the Middle East, and Africa (EMEA); and the Asia Pacific.

Financial Performance and Challenges

The company’s fourth quarter sales decreased by 4.8% compared to the prior year, primarily due to lower replacement volume and third-party chemical sales, partially offset by favorable currency impacts. The net loss widened to $291 million, mainly due to a goodwill impairment charge related to the EMEA segment and higher rationalization charges, despite higher segment operating income. The adjusted net income, however, showed a significant improvement to $135 million, compared to $20 million in the prior year’s quarter.

Goodyear’s tire unit volume in the quarter totaled 45.4 million units, down 3.8% from the prior year, with global replacement volume lower by 6.7%. The company’s segment operating income for Q4 was $383 million, up $147 million from the previous year, driven by net price/mix versus raw materials of $249 million, the highest since Q4 of 2012.

Financial Achievements and Importance

The company’s strategic initiatives, including portfolio optimization and cost reduction efforts, are expected to deliver annualized cost reductions of $1.0 billion by the fourth quarter of 2025. This is crucial for maintaining competitiveness and leadership in the tire industry. The “Goodyear Forward” plan is also expected to benefit segment operating income by approximately $350 million in 2024, highlighting the company’s focus on margin expansion and sustainable cash flow generation.

Analysis and Outlook

Despite the challenges faced in 2023, Goodyear’s strategic actions are setting the stage for future growth and profitability. The company’s focus on optimizing its portfolio and capturing incremental segment operating income through better price/mix in North America is expected to yield positive results. For the first quarter of 2024, Goodyear anticipates a 2% decline in global unit volumes, driven by replacement, but expects raw material costs to be lower than the prior year by approximately $245 million.

The company’s balance sheet shows a reduction in total debt and a strong operating cash flow, indicating improved financial health. As Goodyear continues to execute its “Goodyear Forward” plan, investors may anticipate further margin expansion and debt reduction, positioning the company for long-term shareholder value creation.

For more detailed information and financial tables, please refer to Goodyear’s full 8-K filing.

Explore the complete 8-K earnings release (here) from Goodyear Tire & Rubber Co for further details.

This article first appeared on GuruFocus.