Genuine Parts Company GPC delivered fourth-quarter 2023 adjusted earnings of $2.26 per share, up 10.2% year over year. The bottom line surpassed the Zacks Consensus Estimate of $2.20 per share. Higher-than-expected profit from the Industrial Parts segment resulted in the outperformance.

The company reported net sales of $5.59 billion, lagging the Zacks Consensus Estimate of $5.63 billion. The top line, however, rose 1.2% year over year. The year-over-year rise in revenues largely resulted from increased comparable sales across the Industrial Parts segment and benefits from acquisitions and a net favorable impact of foreign currency translation.

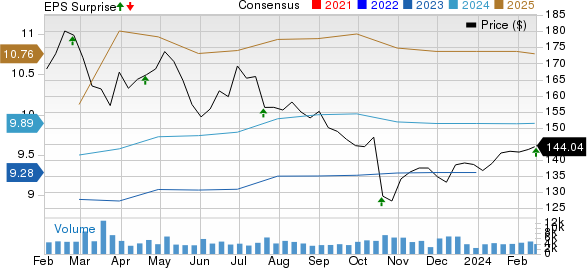

Genuine Parts Company Price, Consensus and EPS Surprise

Genuine Parts Company price-consensus-eps-surprise-chart | Genuine Parts Company Quote

Segmental Performance

The Automotive segment’s net sales totaled $3.46 billion in the reported quarter. The top line rose 0.8% year over year on the back of forex and acquisition benefits but marginally lagged our estimate of $3.49 billion. The segment’s comparable sales fell 2.7% year over year. Operating profit decreased 12.2% to $259 million and missed our forecast of $297 million. Segment profit margin came in at 7.5%, down 110 basis points compared with the year-ago period.

The Industrial Parts segment’s net sales totaled $2.13 billion. The top line rose 1.7% year over year on comparable sales growth and acquisition benefits but lagged our estimate of $2.17 billion. The segment’s comparable sales increased 1.2% in the reported quarter. Operating profit rose 19.3% from the prior-year quarter to $275 million, beating our forecast of $260.3 million. The profit margin of 12.9% expanded 190 basis points year over year in the fourth quarter of 2023.

Financial Performance

Genuine Parts had cash and cash equivalents worth $1.1 billion as of Dec 31, 2023, up from $653.5 million as of Dec 31, 2022. Long-term debt increased to $3.6 billion from $3.08 billion as of Dec 31, 2022. The company exited the fourth quarter with $2.6 billion in total liquidity, comprising $1.5 billion on the revolving credit facility and the remainder as cash/cash equivalents. The company generated free cash flow (FCF) of $190 million in the quarter under review.

2024 Guidance

For 2024, Genuine Parts expects revenues from automotive and industrial sales to witness year-over-year upticks of 2-4% and 3-5%, respectively. Overall sales growth is projected to be 3-5%. The company envisions adjusted earnings of $9.70-$9.90 per share. The operating cash flow is expected to be $1.3-$1.5 billion. The guidance for FCF is pegged between $800 million and $1 billion.

Zacks Rank & Key Picks

GPC currently carries a Zacks Rank #3 (Hold).

Some better-ranked players in the auto space are Modine Manufacturing Company MOD, NIO Inc. NIO and Oshkosh Corporation OSK. MOD sports a Zacks Rank #1 (Strong Buy), and NIO and OSK carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MOD’s 2024 sales and earnings suggests year-over-year growth of 4% and 67.2%, respectively. The earnings per share (EPS) estimates for 2024 and 2025 have improved 22 cents each in the past 30 days.

The Zacks Consensus Estimate for NIO’s 2023 sales implies year-over-year growth of 10.4%. The EPS estimates for 2024 have improved 7 cents in the past 30 days.

The Zacks Consensus Estimate for OSK’s 2024 sales and earnings suggests year-over-year growth of 6.7% and 4%, respectively. The EPS estimates for 2024 and 2025 have improved 16 cents and 29 cents, respectively, in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Genuine Parts Company (GPC) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

Modine Manufacturing Company (MOD) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report