Assessing the Upcoming Dividend and Historical Performance

Magna International Inc(NYSE:MGA) recently announced a dividend of $0.48 per share, payable on 2024-03-08, with the ex-dividend date set for 2024-02-22. As investors look forward to this upcoming payment, the spotlight also shines on the company’s dividend history, yield, and growth rates. Using the data from GuruFocus, let’s look into Magna International Inc’s dividend performance and assess its sustainability.

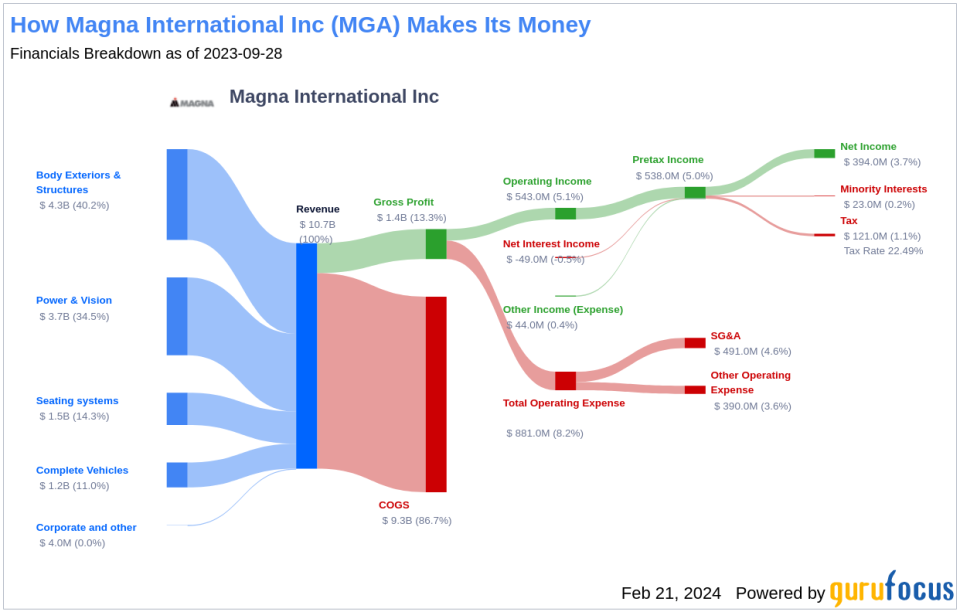

What Does Magna International Inc Do?

Magna International prides itself on a highly entrepreneurial culture and a corporate constitution that outlines distribution of profits to various stakeholders. This automotive supplier’s product groups include exteriors, interiors, seating, roof systems, body and chassis, powertrain, vision and electronic systems, closure systems, electric vehicle systems, tooling and engineering, and contract vehicle assembly. In 2022, roughly 50% of Magna’s revenue came from North America while Europe accounted for approximately 38%.

A Glimpse at Magna International Inc’s Dividend History

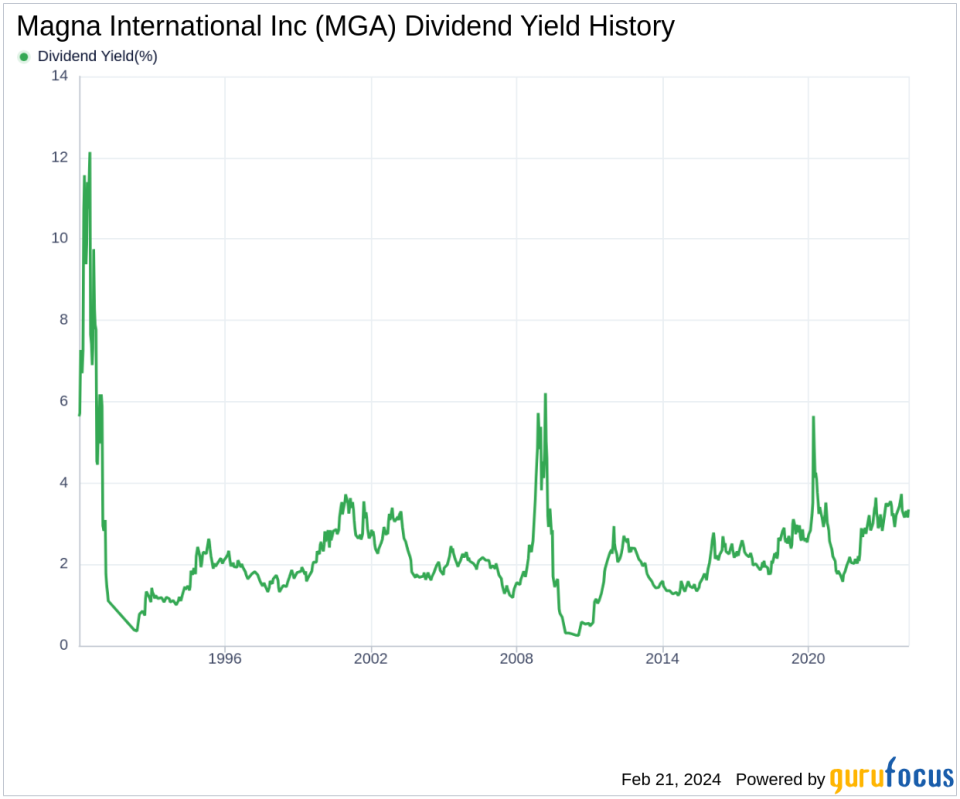

Magna International Inc has maintained a consistent dividend payment record since 1992, with dividends currently distributed on a quarterly basis. Magna International Inc has increased its dividend each year since 2009, earning it the status of a dividend achiever, an accolade reserved for companies with at least 15 consecutive years of dividend increases. Below is a chart showing annual Dividends Per Share to track historical trends.

Breaking Down Magna International Inc’s Dividend Yield and Growth

As of today, Magna International Inc currently has a 12-month trailing dividend yield of 3.40% and a 12-month forward dividend yield of 3.51%, indicating expected dividend increases in the next year. Over the past three years, Magna International Inc’s annual dividend growth rate was 6.40%, which rose to 7.20% per year over a five-year horizon. The past decade has seen an annual dividends per share growth rate of 13.50%. The 5-year yield on cost of Magna International Inc stock is approximately 4.81% as of today.

The Sustainability Question: Payout Ratio and Profitability

Assessing the sustainability of Magna International Inc’s dividend involves examining the dividend payout ratio, which stands at 0.34 as of 2023-12-31. This lower ratio suggests that the company retains a significant portion of its earnings for future growth and stability. The company’s profitability rank is 7 out of 10, indicating good profitability prospects. Magna International Inc has also reported a positive net income each year for the past decade, reinforcing its financial strength.

Growth Metrics: The Future Outlook

Magna International Inc’s growth rank of 7 out of 10 signals a positive growth trajectory. The company’s revenue per share and 3-year revenue growth rate of 12.90% per year outperform approximately 69.74% of global competitors. Additionally, Magna International Inc’s 3-year EPS growth rate of 13.30% per year surpasses approximately 53.86% of global competitors. However, the 5-year EBITDA growth rate of -5.30% is an area for potential improvement.

Concluding Thoughts on Magna International Inc’s Dividend Profile

In conclusion, Magna International Inc demonstrates a strong dividend history with consistent growth and a sustainable payout ratio, underpinned by solid profitability and revenue growth. These factors collectively suggest that Magna International Inc is well-positioned to continue rewarding shareholders with dividends in the future. However, investors should also consider the company’s EBITDA growth rate and overall financial health in their investment decisions. For those seeking dividend-paying stocks, GuruFocus Premium offers the High Dividend Yield Screener as a valuable tool for finding high-yield opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.