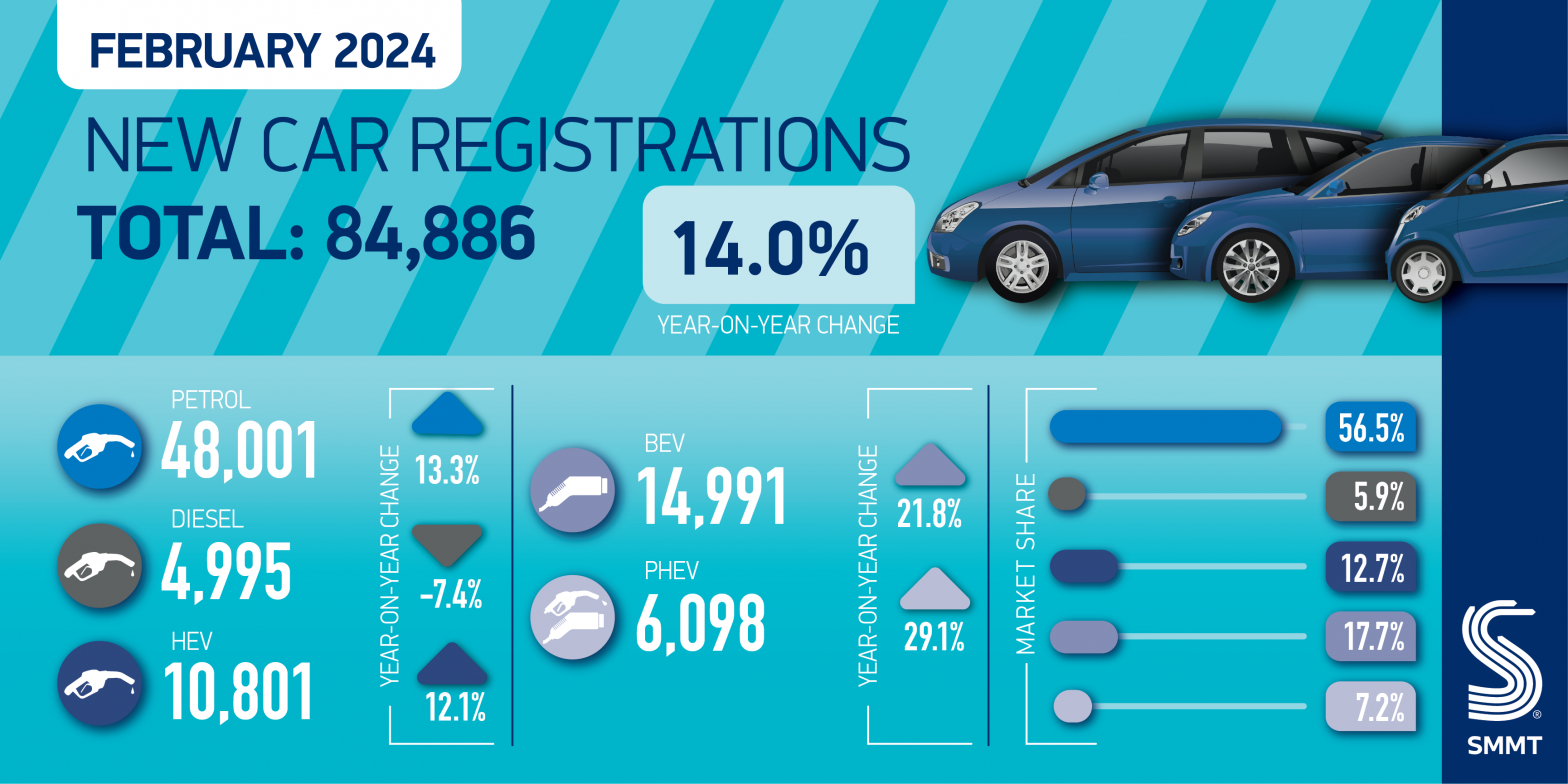

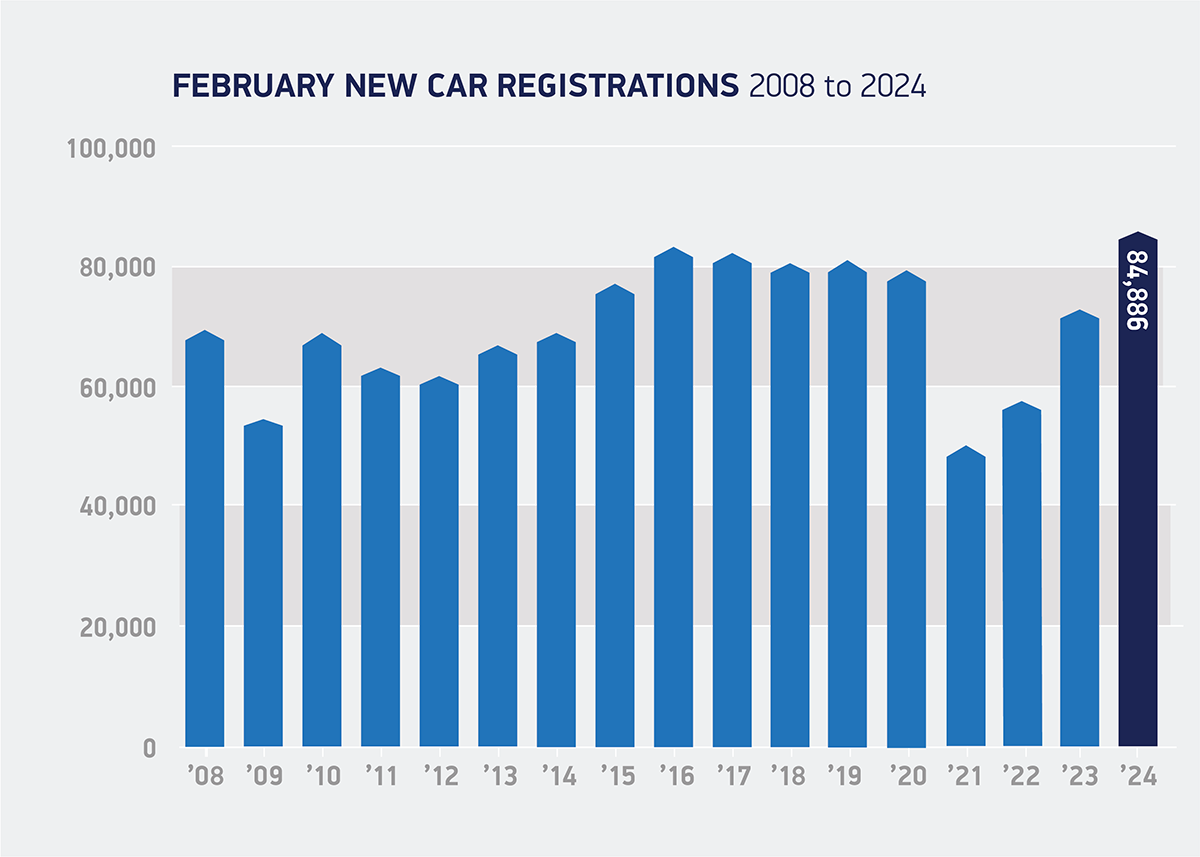

- New car registrations rise 14.0% to 84,886 units – best performance for the month since 2004.

- Battery electric vehicle share grows during traditionally low-volume, pre-new number plate month.

- Industry calls for fairer EV taxation as fleets continue to drive growth, while private EV uptake declines.

SEE CAR REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

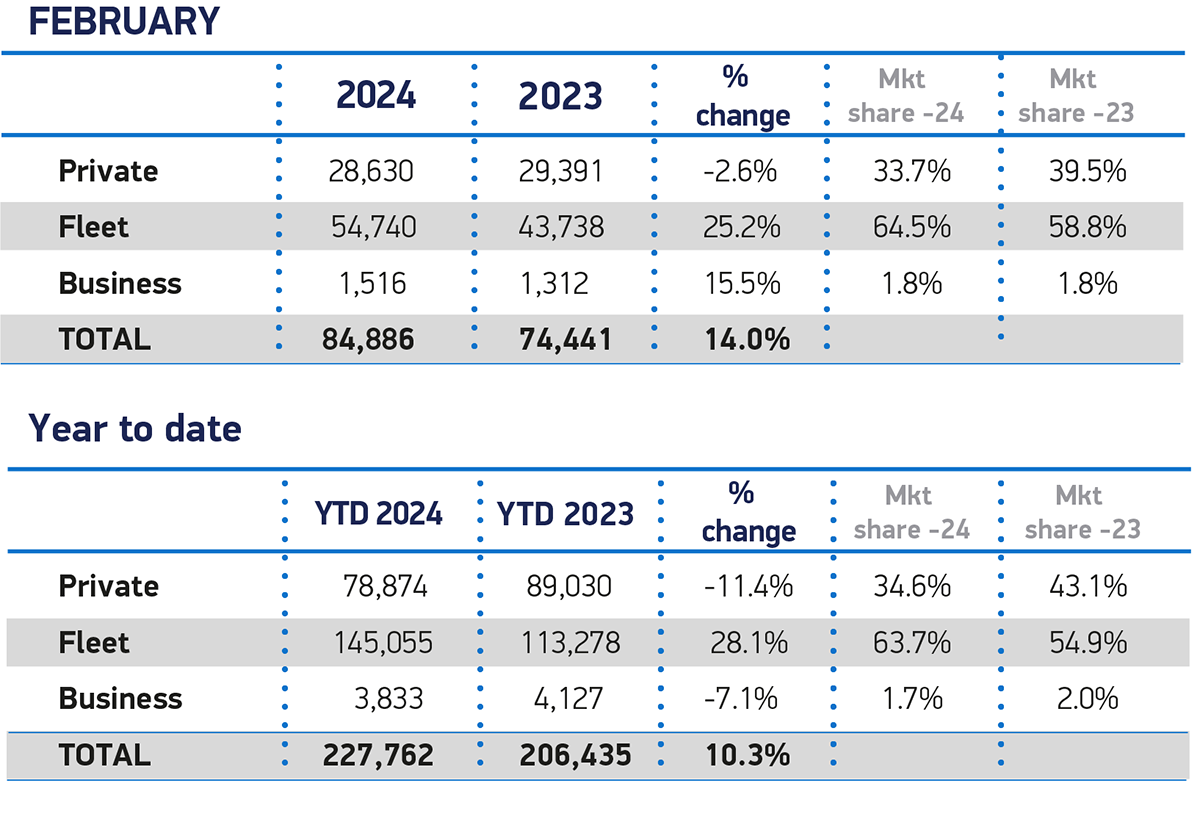

The UK new car market has recorded its best February performance for two decades as registrations rose 14.0% to 84,886 units, according to the latest figures from the Society of Motor Manufacturers and Traders.1

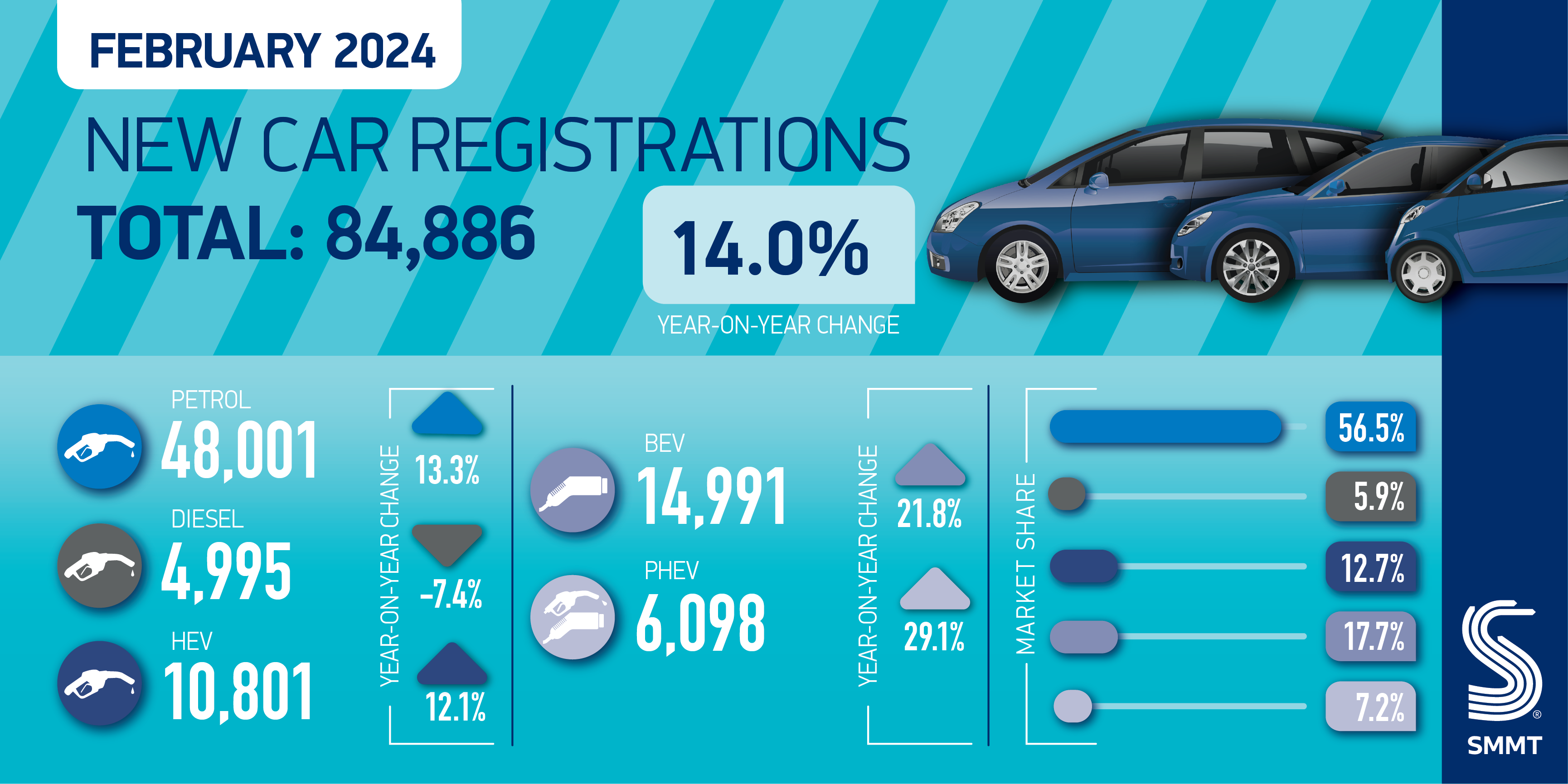

It was the 19th month of consecutive growth, which has primarily been driven by fleets investing in the latest vehicles. Indeed, fleets and businesses were responsible for the entirety of February’s increase, with registrations up 25.2% and 15.5% respectively. Private uptake continued to struggle, with a -2.6% decline to record a 33.7% market share. February is traditionally volatile as the lowest volume month of the year, with buyers often electing to wait until March and the new number plate.

Electrified vehicles recorded robust growth, with hybrid electric vehicles (HEVs) rising 12.1%, but taking a marginally smaller year-on-year market share of 12.7%. Plug-in hybrids (PHEVs) recorded the largest proportional growth for the month, rising 29.1% to reach 7.2% of the market. Battery electric vehicle uptake similarly outpaced the rest of the market, rising 21.8% to account for 17.7% of registrations, an improvement on last year’s 16.5%.

While February’s growth is positive and demonstrative of ongoing robust demand for the latest vehicles, the long-term picture will become clearer in March, the busiest market month. While BEV market share and volumes continue to grow during the first year of mandated targets for manufacturers, the increase in uptake is entirely sustained by fleets, thanks to compelling fiscal incentives. Private buyers account for fewer than one in five (18.2%) new BEVs registered in 2024 so far.

A faster, fairer market transition depends on more private buyers switching but the lack of significant incentives is holding back many. Tomorrow’s Budget is an opportunity for the Chancellor to stimulate demand by halving VAT on new EVs for three years, amending proposed Vehicle Excise Duty (VED) changes, and reducing VAT on public charging in line with home charging.

While consumers do not pay VAT on other emission reduction technologies such as heat pumps and solar panels, private EV buyers pay the full 20% levied on all cars, whether they be electric, petrol or diesel. Halving VAT on new EV purchases would save the average buyer around £4,000 off the upfront purchase price – yet cost the Treasury less than the Plug-in Car Grant that was scrapped in 2022.2

Similarly, upcoming changes to Vehicle Excise Duty next year would see the majority of BEV buyers effectively penalised £1,950 for going electric due to the ‘expensive car’ supplement.3 Furthermore, those unable to charge a BEV at home currently pay a ‘pavement penalty’ of 20% VAT on public charging – quadruple the rate paid by those with the opportunity to charge at home.

Mike Hawes, SMMT Chief Executive, said:

The new car market’s ability to deliver growth continues with its best February for 20 years and this week’s Budget is an opportunity to ensure that growth is greener. Tackling the triple tax barrier as the market embarks on its busiest month of the year would boost EV demand, cutting carbon emissions and energising the economy. It will deliver a faster and fairer zero emission transition, putting Britain’s EV ambition back in the fast lane.

Notes to editors

1 February 2004 registrations: 91,460

2 Based on SMMT analysis and an average JATO BEV purchase price of £47,471 (1H 2023)

3 BEV exemption from Vehicle Excise Duty Expensive Car Supplement (applied to vehicles with list price of or exceeding £40,000) ends in 1 April 2025. Supplement rate is currently £390pa on top of standard VED rate, payable from second to sixth year inclusive after first vehicle registration