Although it has plunged more than 36% since the start of the year, Nio (NIO 2.71%) stock is poised to hit the brakes on its downward path and drive back up — just not as much as he previously thought.

While Tim Hsiao, an analyst at Morgan Stanley, had previously thought that Nio stock would touch $13 a share, he cut his price target on Monday, thinking now that the stock is headed to $10. Let’s take a look at the basis of Hsiao’s outlook on Nio stock and why he could be right.

Speed bumps will slow Nio down for the next two years

Most investors interested in Nio are looking to power their portfolios with an electric vehicle (EV) maker that offers significant growth potential. However, according to Hsiao, the company has a rocky road ahead that could last as long as two years. The analyst reduced expectations for Nio’s shipments in 2024 and 2025, and he foresees Nio incurring a steeper loss than what was reported in 2023 because the company is working through a restructuring. Furthermore, Hsiao doesn’t expect Nio to achieve profitability until 2026.

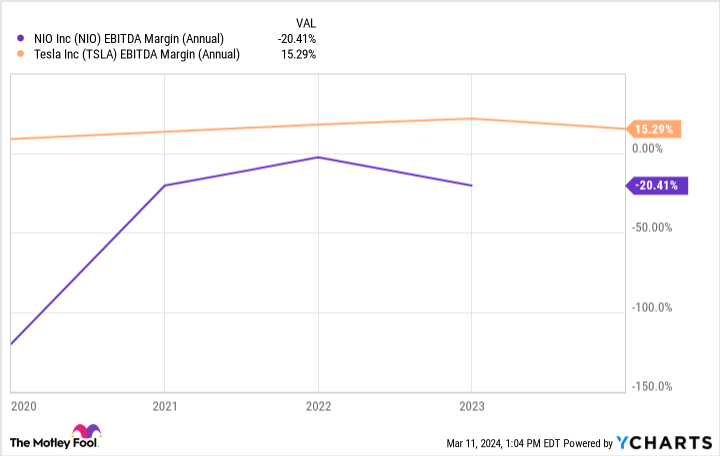

Often characterized as the Tesla (TSLA 0.32%) of China, Nio has long inspired hopes of providing investors with the same types of returns that Tesla has provided shareholders. Whereas Tesla has achieved profitability — and sustained it — Nio has failed to do the same, even on an earnings before interest, taxes, depreciation, and amortization (EBITDA) basis.

NIO EBITDA Margin (Annual) data by YCharts.

In fact, Nio has suffered steeper losses as of late. And it’s struggling to reel in costs toward the top of the income statement as well as the bottom. In 2023, Nio reported a 5.5% gross margin, a contraction from the 10.4% and 18.9% gross margins the company reported in 2022 and 2021, respectively.

Until Nio can expand its gross margin, at the very least, growth investors would be better served to look elsewhere for a promising EV investment.

Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nio and Tesla. The Motley Fool has a disclosure policy.